Four fundamentals for building trust in digital

Whilst trust in financial services has increased by 8% in the last 10 years globally, trust in the technology industry has dropped by 6% in the last year alone. Hence, with the pandemic further necessitating the use of technology, it’s more important than ever for digital financial services to develop and maintain trust from their users.

A recent 11:FS report (courtesy of Sarah Kocianski) in association with Mitek sets out a framework for how financial services can counter this declining technological trust and build trust in the services they are delivering via apps and websites.

There are four central components to this framework: Capable, Competent, Caring, and Purposeful. These can be applied to develop trust-building moments within digital touchpoints. What’s clearly emphasised throughout is that trust is slowly built and maintained and cannot be achieved with one-off events.

So, for digital financial services to build and maintain trust from their users they need to demonstrate that they are:

1. Capable

In that they can prove to customers that they can deliver secure, reliable products and services through apps and websites.

Being Capable involves getting the whole business on board – it’s crucial that all relevant stakeholders are involved in order to quickly deliver the types of product offerings that instil trust from users.

For digital services in particular, it means choosing partners carefully. As few brands can deliver all components of financial services alone, financial providers should look for vendors whose commitment to building trust matches their own.

A recent McKinsey report found that 52% of US customers trust companies that request only relevant data...

Establishing robust data privacy processes is also essential, especially where third parties are handling data. This is why it’s also very important to always communicate the roles of third parties to customers, allowing them to find out more information about them, should they choose.

A recent McKinsey report found that 52% of US customers trust companies that request only relevant data, which is why it’s important to ask for the bare minimum of data and to be transparent about its relevance.

Central, also, to demonstrating capability is encouraging usage. This means ensuring that a journey can be completed, ideally within a single app, as trust can be lost when switching between digital channels. We all know how unsettling it is to be launched into an unfamiliar webpage, especially when providing sensitive information.

Trust and subsequent usage can also be encouraged by increasing security with the level of risk. For example, the higher the stakes are for a given transaction, the more security users will expect to go alongside it.

That being said, it’s important that digital financial services strike a balance between ease and security, as additional security friction can result in poor UX, which is particularly unnecessary if sufficient trust has already been achieved with previous security steps.

Finally, it’s crucial that financial services explain how data is used. Some customers will be very unsure about sharing any data if they aren’t aware of what’s being taken, why it’s necessary, who is taking it and where it’s being used.

Our Example - Marcus by Goldman Sachs

https://pulse.11fs.com/videos/marcus-by-goldman-sachs/marcus-insights

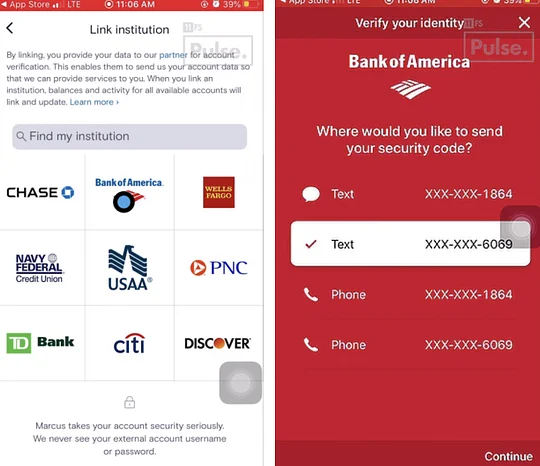

Marcus demonstrates great capability when aggregating accounts for the “Marcus Insights” feature. Two-factor authentication is required to connect accounts, which is certainly reasonable given the sensitivity of the data, so the additional friction is helpful in this case. That said, users can get their security code sent to a range of different verified devices, so choice and convenience is being prioritised in this process:

Whilst the security steps are contingent on the financial institution, the user is not taken outside of the app itself – which is likely to give confidence to users sharing personal data.

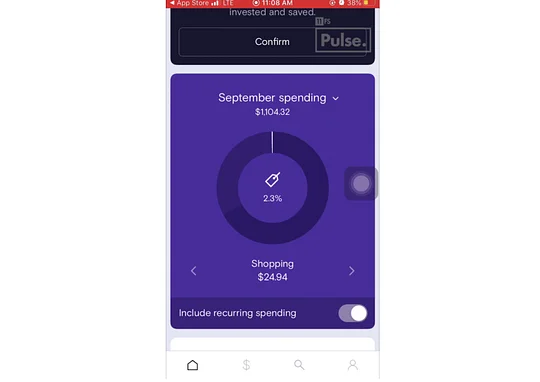

Once the bank account’s been connected, users are encouraged to add other accounts (such as their pensions and investments). Given how smooth the initial connecting account flow had been, it’s likely that users will look to connect more accounts following this well timed prompt.

After the transaction and balance activity has been (quickly) loaded, data is organised and presented in such a way that means users can actually derive meaning. Pie-charts, distilled information and clear sign-posting, means that this aggregation feature actually has some utility, instead of just surfacing a list of transactions.

2. Competent

In that the financial service is responsive and consistent with digital touch-points.

Showing competency involves managing expectations and then delivering on them. For example, signalling how long a journey will take to complete is a great way to build trust from users whilst encouraging engagement.

Using digital authentication to create better customer experiences is very helpful for speeding up processes where users can often get lost or frustrated (a key moment when trust can be lost). Pre-populated fields, for example, not only make authentication quicker but can also serve to reduce the anxiety some users may have about needing to re-submit personal details.

Remember that trust is built slowly – and in order to achieve this financial services need to ensure that digital technologies are used to deliver consistently. It’s important that users experience the same (trusted) digital interaction each time they return to the app or website.

Part of delivering consistently, though, is having a plan B for when things go wrong. For example, trust can be maintained if customers can correct an issue without having to re-authenticate or start over. Thoroughly testing products before their launch can help iron out bugs and edge case journeys.

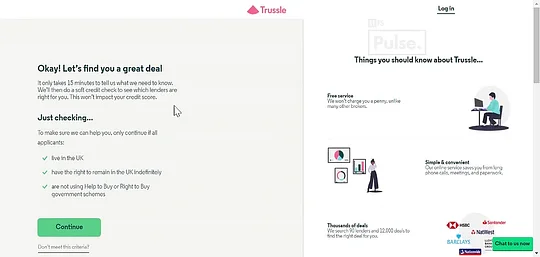

Competent Example - Trussle

https://pulse.11fs.com/videos/trussle/mortgage-application-desktop-uk

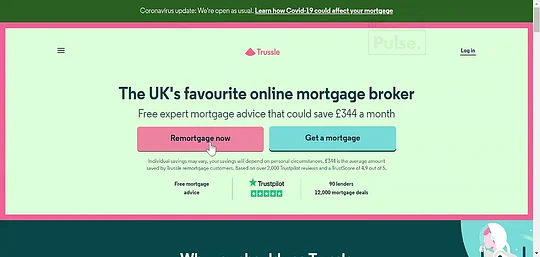

Before the fact finding remortgage journey begins, users can chat with a Trussle representative which will certainly benefit users who haven't come across their service and are looking for guidance and reassurance. Expectations are certainly managed as users are told how long this process can take as well as what is required from them.

Trussle clearly takes trust very seriously as they're keen to showcase the high Trustpilot score on their landing page and even at the start of the fact finding journey. Control is offered as users can stop this journey whenever they choose and return to it at a convenient time, without the need to reenter any further data.

For those who want to know more about how their data is being used and why it’s being collected, this information is available via the large tooltips. As Trussle is asking for a lot of sensitive information as well as time and effort from the user, it's essential that this trust is established from the get-go – and they've done a great job achieving this!

Setting out an explicit value exchange is very important for maintaining trust as it ensures that customers know what they’re getting in return.

3. Caring

In that the financial service can prove to customers that they care, even if a representative isn’t available.

Setting out an explicit value exchange is very important for maintaining trust as it ensures that customers know what they’re getting in return. For example, simply explaining to users that providing biometrics data will allow a faster login will likely see increased usage of that feature.

Similarly, being clear on how customers’ privacy and security is being protected is also a central component for demonstrating customer care. Whilst information overload needs to be considered in the design, there should always be more detailed information for customers that want it.

Finally, giving customers choice and control demonstrates that a business cares about the wants and needs of all its customers. Forcing users down a predefined user flow might make a business more efficient, but it may come at the price of losing trust.

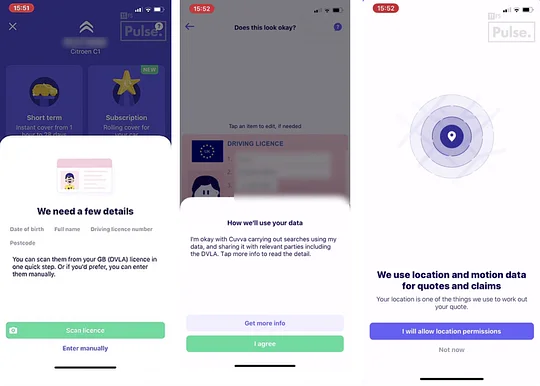

Caring Example - Cuvva

Motor insurtech Cuvva has an excellent onboarding journey. Users are always aware of what is required from them and how much is left to complete. Details are saved should the user wish to return to complete the signup process at a different time, catering for emergency cups of tea and misplaced driving licenses. It also utilises OCR technology to get through the KYC steps as quickly as possible, whilst allowing users to skip parts if they don't want to proceed at any given stage.

Best of all, though, Cuvva is very open about how the user's data will be used, with succinct pop ups appearing in-situ before details are submitted. Should the user wish to find out more, that option is also available. Cuvva really does show that they care about the users needs and concerns throughout this journey.

4. Purpose

In that the financial service knows what they stand for and organises their business around it.

Creating purposeful brand values is an important part of defining the core principles of a business. If customers identify with these values, it can create a basis for trust to be built and maintained if these values guide the product. It’s also worth noting that there’s a lot of interest in value-based finance at the moment, and evidence that this is becoming increasingly important to consumers.

Simply stating values isn’t enough, it should be instilled in the internal culture.

Achieving this, though, means involving employees as well as customers. Simply stating values isn’t enough, it should be instilled in the internal culture.

Another key contributing factor towards “purpose” is being transparent, which involves businesses explaining themselves whenever a change is made. Letting customers know why you are doing something can help them get on board with it and appreciate your reasons behind it. Leaving them out in the cold or being unclear is an easy way to lose trust. There were certainly lessons to be learned from the GameStop saga – the different approaches trading platforms took to explaining the same action made a huge difference to how their customers reacted.

The final important factor for providing purpose and nurturing trust is being accountable. When something goes wrong it’s important for brands to own and explain their mistake, shifting blame onto third parties is not the right way to go about things.

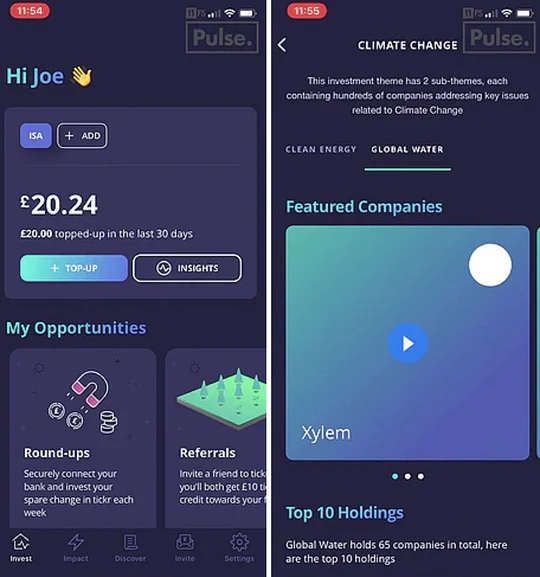

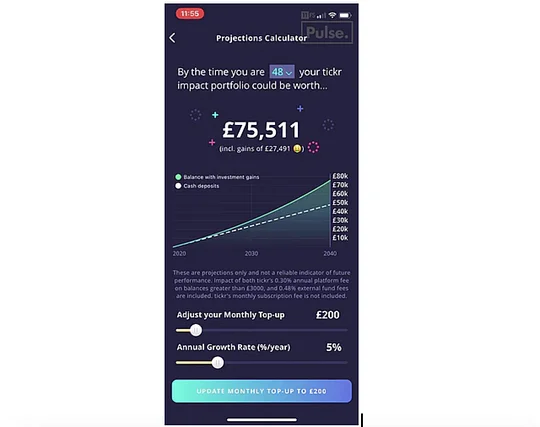

Purpose Example - Tickr

https://pulse.11fs.com/videos/tickr/insights

Tickr, a UK-based green investments platform, is very good at communicating its purpose and values to its audience. Whether they’re picking investment themes during onboarding or getting a detailed breakdown of their off-set plan and green investment portfolio – from the get-go, users will be acutely aware of Tickr’s dedication to impact investing. Almost every screen reminds the user of the app’s core purpose, encouraging users to get increasingly onboard with their mission.

Whilst Tickr does an excellent job of outlining exactly what the invested and donated money will be used for, it goes further in explaining why this movement is important. By simultaneously educating users on the importance of impact investing whilst providing them the means to make those investments happen, Tickr really maintains its pledge to be the app that “lets you change the world from the palm of your hand”.

Conclusion

These examples are just a few standouts in a crowd of brands rushing to incorporate trust into their products, making them as attractive as possible to consumers. In a competitive market, features that reinforce trust are no longer just nice to have or something to take for granted. Especially in financial services, users expect brands and products to show they are Capable, Competent, Caring, and Purposeful. This is achieved through transparency, ease of use, and powerful features in slick and beautiful digital experiences. The companies and brands that don’t meet this standard run the risk of losing their customers’ trust, and being left behind.