How fintechs are changing the meaning of trust

Mortgages and ancient sex positions aren’t two things you’d usually put together (or want to read about at the same time, for that matter).

But digital mortgage broker Habito has ripped up the rulebook and created a Mortgage Kamasutra book in its place. And we can’t help but respect them for it.

How can Habito still be taken seriously as a brand after such a rogue move? How has it managed to toe the line between credibility and irreverence?

Or has it just chosen to ignore the line entirely? 🤷♀️

Trust is everything

For any business operating in financial services, customer trust is a key brand ingredient. And yet Habito’s campaign couldn’t be further from black horses galloping down grey British beaches.

From ANNA Money’s miaow-ing debit cards to Bettr’s hip-hop led launch campaign, some brands seem to be making a deliberate effort to look as different as possible to traditional banks.

Incumbents have been creating “trusted brands” for decades by acting like serious grown-ups. Because you need to act professional for customers to trust you with their money, right?

But, unluckily for the incumbents, the 2008 financial crisis broke customers’ trust in big banks. And now a new generation of home buyers, pension investors, salary earners and so on have a very different view of what trusted behaviour looks like.

So what can the big boys in FS learn from fintechs when it comes to building consumer trust in today’s world?

Switching up the trust toolkit

So-called “trust toolkits” have been used by finance marketers for decades.

Most (if not all) of these elements will appear on their websites in some shape or form:

- Social proof - Case studies, testimonials, review scores - any form of community feedback that validates the value you’re trying to deliver.

- PR - Working with media outlets popular with your audience is an easy way to get them to say what you want on your behalf. Plus, the credibility of having your name ‘in the papers’ still goes a long way. Find this in the ‘as seen in the media’ website section.

Regulator approvals - Are you regulated by the FCA or the FDA? (We’d hope so…) Stick it on your website - it can’t hurt.

Then there’s the slightly less tangible but equally well used methods:

- Stability - If you haven’t played the “we’ve been around for ages” card, where have you been?

Scale / size - When it comes to financial services, banks often believe customers agree with “the bigger the better” mantra. This usually results in them touting their “millions of customers” or “billions of transactions” on their website.

- Security - Get those visual cues of padlocks with reassuring language around how seriously they take security briefed into design before anyone notices.

Quality - This one is less overt but it’s one of the most important and effective. In a digital age, we’ve been conditioned to immediately distrust a website or app that looks shoddy. While people might not necessarily be able to articulate what’s wrong with it, anything that looks vaguely unprofessional will have alarm bells ringing. Any designer or marketer worth their salt can spot mixed fonts, misaligned columns, a low res image, or (god forbid) a typo a mile off. But that’s not who you need to worry about: your consumers will see it as a preview of your low quality brand, and the seed of doubt will be planted. Once that seed of doubt is planted, we all know how hard it is to remove…

Borrowed credibility - An increasingly common way to create consumer trust is to brag about the (highly reputable) people who helped build your business. Hence the “From the people who built Skype” type stuff you often see on tech websites.

But what about the fintech trust toolkit?

Does it look any different? Has the system changed dramatically, or are these brands just having to lean more heavily on certain elements and avoid others completely?

Here’s what the new kids on the block are leaning into:

Relatability - Hearing from people that look like you about their positive experience using products built by people that think like you can be very appealing. Tech founders often try to be as visible as possible because it makes them appear human and their brand relatable. Some even build in public, allowing their community, investors and wider teams to have full visibility of their roadmaps, strategy, performance stats, even salaries. Why? You get your community’s buy-in and you make your journey relatable - simple.

- Relevance - There’s no doubt that showing up for your customers with real solutions to problems they’re facing today, with a true understanding of their money worries, will build affinity and trust. Nubank cuts to the core of a Brazilian audience that’s overcharged and underserved, and Bettr is an expert in the new generation of South Africans unable to access banking in a way that helps them to build financial stability.

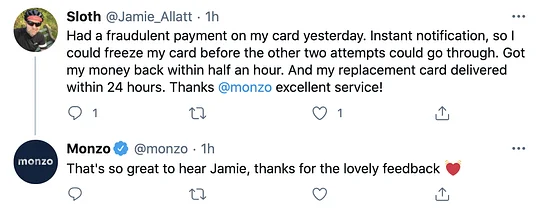

- Responsiveness - When (not if) things go wrong, is when trust can be won or lost for good. How you react to that pitfall - and how quickly - will either move you up or down the trust score amongst your users. This isn’t a new lever in the trust toolkit, but the way fintechs approach this today is very different.

Monzo on Twitter

Which leads me onto…

Transparency - To quote my colleague Simon, “transparent is the new trusted”. Tell your customers how you actually make money. Tell your customers when you’ve made a mistake and how you’re going to fix it. If you’re brave enough, you’ll even tell them where they can get your service but cheaper, like Wise’s (formerly TransferWise) price comparison tool. That takes guts. It takes a real belief in what you’re doing and the customer problems you’re solving - it’s not for the faint hearted. And customers will love you more for it.

- Privacy - I mention this separately even though it’s really a subset of transparency, because it’s such a key issue in tech. Financial brands handle the most sensitive and private data that most people have. You’ll probably find that many people will confess their favourite sex position before they share their bank balance with you. I believe it’s also why our CEO David Brear’s recent social poll showed that most people wouldn’t bank with Google. You just don’t know how they’re using your data, and that lack of control breeds distrust.

All change, please

So how can Habito get away with a Mortgage Kamasutra campaign, and still be seen as credible and trustworthy?

Imagine an agency pitching that idea to Chase or HSBC 😅

Fintechs certainly lean on the traditional levers, like social proof, PR and quality. But their interpretation of modern levers means we’re seeing more relatable, relevant and transparent FS companies.

And that can only be a good thing.