Do you really want to offer alternative payment methods?

Delivered straight to your inbox

Get each edition of Unfiltered - our no-BS, uncensored analysis of fintech news and hot topics sent to your inbox each fortnight.

Find out more

In today's globalized business environment, the discussion around offering alternative payment methods (APMs) to end users continues to grow. APMs can provide businesses with improved cost efficiency, better user experience, broader access to various user segments, and thus increased conversion rates. However, it is essential to carefully consider the challenges and potential drawbacks that come with adopting APMs before fully embracing them.

The benefits of offering alternative payment methods

It is no secret that integrating alternative payment methods can bring substantial benefits to digital platforms. By allowing customers to use their preferred payment methods, such as PayPal, Alipay, mobile wallets like Apple Pay or Google Pay, or even local bank transfers, merchants can enhance overall satisfaction and loyalty, leading to a better user experience. Additionally, APMs are often cheaper to process than credit cards, thus, resulting in cost savings for digital platforms. By offering APMs, businesses can tap into new markets and customer bases that may have been previously inaccessible, extending their reach to different user segments. However, enabling alternative payments is not as simple as flipping a switch, as the integration will require considerable efforts.

Enabling alternative payments is not as simple as flipping a switch.

The challenges of integrating alternative payment methods

Integrating APMs as a part of your checkout option involves several steps, which can be complex and time-consuming, especially if you’re also navigating unfamiliar languages and local regulations along the way.

The first step is to design and develop the necessary integrations with existing systems. This process typically includes analyzing current infrastructure, creating custom APIs or adapting existing ones, and ensuring compatibility with the new payment methods. Once the integration is complete, it's crucial to conduct extensive testing to ensure seamless operation. This testing phase involves validating transaction processing, handling edge cases, checking for security vulnerabilities, and confirming that the user experience is smooth and error-free. These steps are vital to guaranteeing that the introduction of APMs does not disrupt the business's core functions or negatively impact customer satisfaction.

However, the challenge does not end with successful integration and testing. As the number of supported payment methods increases, the process of reconciling financial records becomes more complex. This is due to the wider variety of payment methods, each with its own transaction types, formats, and reporting standards, making it more challenging to identify and resolve any discrepancies or inconsistencies in the records.

As such, before adopting any APMs, businesses must carefully consider the following questions: What problem does this payment method solve for my business and customers? And is it worth investing in the legal, technical, and operational efforts required for the implementation?

How to choose the right payment methods for your business

It's crucial to ensure that the payment method you choose aligns with your business goals and target audience. How do you decide? Follow these 6 steps:

Analyze the competitive landscape: Research which payment methods your competitors are offering. Understanding the competitive landscape can help you identify potential opportunities or gaps in the market that your business could capitalize on.

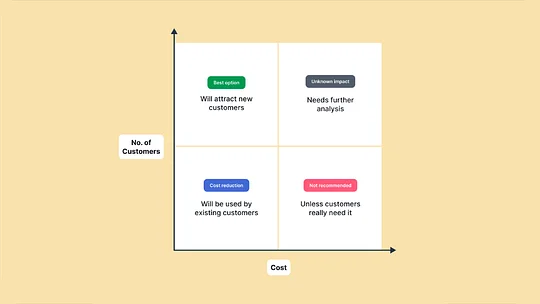

Assess the business impact: Consider the potential effects of integrating a specific payment method on your business's profits. Will it lead to cost reductions, user acquisition, or both?

Evaluate the alternative payment methods category: Investigate the different categories of APMs, such as wallets, A2A payments, or even cryptocurrencies, and determine which category best aligns with your business objectives and customer preferences.

Seek feedback from your users: Conduct surveys or gather feedback from your existing customer base to understand their preferences and needs regarding alternative payment methods. This information can provide valuable insights into which payment methods will most likely resonate with your customers and lead to increased satisfaction and loyalty. It is also much cheaper to validate things at this stage rather than after going through the entire journey of integrating a new payment method.

Monitor industry trends and developments: Stay informed about emerging trends and innovations in the world of alternative payment methods. Keeping an eye on the future can help you anticipate changes in customer preferences and make proactive decisions to maintain a competitive edge.

Evaluate less risky APMs: Some alternative payment methods may offer lower risk for businesses, as customers cannot claim a chargeback or reverse the payment. Assess the risk levels associated with each payment method and determine if they align with your business's risk tolerance and fraud prevention strategies.

My unfiltered opinion

There is no doubt that when done correctly, the implementation of APMs can fuel sales growth, elevate customer satisfaction, and fortify a business's position in the market. Staying abreast of industry trends and prioritizing customer preferences enables businesses to create a standout user experience that fosters loyalty and repeat purchases. However, it's essential not to underestimate the considerable investment in time, resources, and effort accompanying APM integrations, as companies may face challenges such as navigating unfamiliar languages, local regulations, and complex integrations.

Before adding alternative payment methods, it's essential to determine the primary objective behind this new integration. Is the goal to reduce costs or perhaps to reach a wider customer base? Having a clear purpose steers the decision-making process, enabling businesses to concentrate on selecting the most appropriate payment method that accomplishes their intended goal without jeopardizing other aspects of their operations.