Fintech's climate fight starts with changing consumer behaviour

Fintech has a big part to play in the fight against climate change and can help solve financial exclusion for millions worldwide.

This article is the first in a trilogy on fintech for good. You can find the link to the second at the bottom of this one.

By now, we’re all acutely aware of the mess that’s been made when it comes to our climate, but we as an industry and as consumers all have big parts to play.

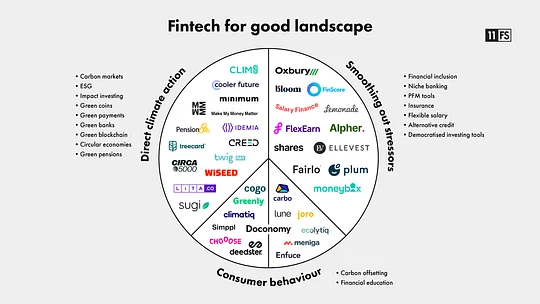

What’s the first thing that comes to mind when the phrase ‘fintech for good’ pops up on your LinkedIn feed? Something about ESG? Or carbon offsetting? Great! They’re undoubtedly key parts, but it’s bigger than that.

FFG can simply be thought of as financial brands that are tackling environmental, societal, and financial issues to help the planet become more hospitable. And over the course of a series of articles, we’re going to explore just how vast that scope is and why so much of it is being overlooked.

We’ll focus on:

Consumer behaviour - how fintechs are looking to educate and shift consumer behaviour.

Direct climate action - the fintechs directly supporting the climate.

Smoothing the stresses - what’s being done.

Carbon trackers alone won’t defeat climate change

When banks and fintechs stick carbon trackers on a long list of product features, you have to take it with a pinch of salt. But when you look at a holistic picture of what FFG is actually doing, its contribution towards raising consumer awareness and changing behaviour is clear.

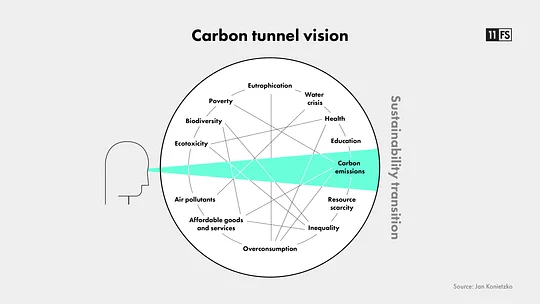

There’s a slew of fintechs with carbon tracking features enabled, either within their feature set or as a standalone. Just last year Natwest partnered with carbon tracking expert CoGo so their customers could track the impact of their daily spending. But as carbon trackers become table stakes for fintechs and incumbents, there’s still a key issue that needs to be addressed - the carbon tunnel.

Carbon is one of the negative fallouts that comes with any purchase. Trying to offset one aspect of your financial purchase, while ignoring the toxicity of the chemicals used, the water impact, reusability of materials, and the impact on the people in the supply chain, will lead to a continued carbon tunnel. In the long-term, this will erode the trust that financial institutions have spent years trying to build. Incumbents and fintechs need to offer offset tools for all the negative environmental impacts that purchases have - without it, they’ll lose customers and trust.

The first step in going further than carbon offsetting is building in all the metrics that are required to help support a healthier planet. But this information alone can be overwhelming and simply add to consumer guilt. Companies must build additional tools alongside this information for maximum impact. Firstly, educate what these metrics actually mean - who knows what 1 tonne of carbon is? Then package this new knowledge into something customers can build into their everyday lives. This will create a positive cycle that moves beyond carbon offsetting.

Who’s leading the way and who’s trailing behind?

The Nordic countries are really ahead of the pack, especially Sweden. Being one of the first countries to go cash-free and with a culture of sustainability, they’re blazing a trail with these three FFG standouts all hailing from Stockholm:

Doconomy provides impact data services for individuals and corporations to help educate, engage and reduce environmental impact. The Doconomy DO credit card is a fantastic example of how to educate and nudge on the go. Once you reach your carbon quota, your card is blocked and you can’t spend any more. This forces people to truly rethink their daily actions and not simply think they can offset their way out of the climate crisis.

Gimi provides financial super skills for young adults and children. Start them young - it takes years to unlearn bad habits. Helping children understand the value of money will only help them to continuously make healthy financial choices.

Simpppl uses behavioural sciences and AI-powered analysis to help customers understand their spending behaviours. Its aim is to help you analyse your emotions after shopping to help you realise if your purchases made you feel good or bad in the long run, helping customers become more self-aware in their shopping patterns.

On the flip side, we do expect quite a lot from neobanks. But there is a deafening lack of partnerships between neobanks and sustainability programmes. Notable examples include Green-Got’s partnership with ecolytiq, empowering customers with climate metrics. The aim of the partnership is to educate and nudge customers to make decisions that will better impact the environment. Other neobanks should stand up and take notice.

...there is a deafening lack of partnerships between neobanks and sustainability programmes.

So what next?

Nothing happens overnight. Changing consumer behaviour means changing habits over a long period, which is not easy. But customers want to become more aware of their impact on the environment, and that's the first step.

Offsetting is just one aspect. Education and spending habit changes are also required for people to have a better environmental impact. Between them, the likes of Doconomy, Gimi and Simppl cover all aspects of this required change. The next generation of behaviour-challenging fintechs must build on all these aspects to provide a fully holistic service for long-term change. The planet depends on it.

No need to wait, go and check out part two of this article series here.

Inclusive design - building financial services for everyone

In our latest report, we make the argument against designing for the 'average user' and how FS needs to design products and services that cater to as many people as possible. Take the first step towards making that change and give it a read.