A perfect fintech storm is brewing: the tale of the Middle East

As the Middle East looks to diversify its economy, what role can fintech play?

In fintech, we spend a lot of time talking about the unicorns of the West and the tech-fins of the East.

Seemingly everywhere, we read headlines about the rise of Decacorns, new multi-million dollar investment rounds or the latest metal payment card.

But beyond the headlines, we’re starting to see the industry taking shape in markets that haven’t typically drawn attention. It’s here, where financial inclusion is low and financial confusion is high, that fintech is really needed and could have the biggest impact.

The Middle East is among the most promising of these uncovered markets. Already a centre of global trade, the region is developing a fintech industry at an astonishing rate. So what does the state of Middle Eastern financial services look like, and what does the future hold for it?

Diversification has already started

Traditionally, a large share of the Middle Eastern economy has rested on its abundance of oil and gas. It accounts for 90% of Saudi Arabia’s export earnings alone, and Qatar is ‘the world’s leading exporter of liquefied natural gas’, according to Forbes.

However, other industries also play key roles in the Middle East and North Africa (MENA) region. Agriculture is responsible for 25% of employment in Turkey, while the UAE attracts investment from multiple sectors, from finance to real estate to luxury.

And more change is coming as key Middle Eastern economies lessen their dependence on petroleum. Today, the oil and gas sector’s share of the GDP has dropped to 30% in the UAE, while the region’s finance industry is expected to expand – Dubai plans to grow its financial hub threefold, while Saudi Arabia aims to become a financial pinnacle in its own right with its Vision 2030 plan.

Despite these diversification efforts, financial inclusion remains low in the Middle East

That’s all before you take into account China’s Belt and Road Initiative (BRI). The trade route, which is planned to run through the Red Sea, is endorsed by more than 125 countries and will involve up to $8 trillion worth of infrastructure across Asia, Africa and Europe. Beyond physical trade, the BRI impacts investments in its member countries. Given the fact that the Middle East plans to connect three parts of the world by 2030 as part of the BRI, it’s clear that the region is certainly not shy of ambition.

Financial inclusion has yet to take hold

Despite these diversification efforts, financial inclusion remains low in the Middle East. According to the Dubai International Fintech Centre (DIFC), ‘the MEA (Middle East and Africa) region has the highest percentage of unbanked population in the world’.

World Bank statistics from 2018 also report that less than half (43.5%) of the adult population in MENA possess bank accounts. While financial access continues to improve across the globe, the region still lags behind.

‘Financial inclusion is the biggest demand-side driver of growth in the Middle East’, says Pierre Proner, CEO of risk analytics as a service firm Statys, in a DIFC report.

This is where the Middle Eastern fintech story begins.

The fintech market is growing

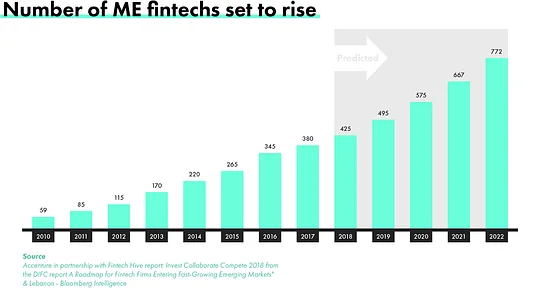

As the shift away from oil continues, the Middle Eastern market is opening up to real innovation. Fintech adoption has increased, with many countries nurturing growth by opening gateways, starting fintech funds and changing regulations and policy.

So far, things look promising. Fintechs are responsible for three percent of MEA’s financial services revenue, and that figure is expected to grow to eight percent by 2020.

Part of this success can be attributed to payments and remittances, which stands out as one of the most prominent sectors. Currently, 84% of the area’s fintech start-ups play in the payments space.

The rise of remittances in particular have solved customer issues with ease and simplicity, particularly for the expat community. With the large number of foreign workers across the region, easy remittance providers such as STC Pay allow workers to send money back to their families without having to queue for hours to move their money around in cash.

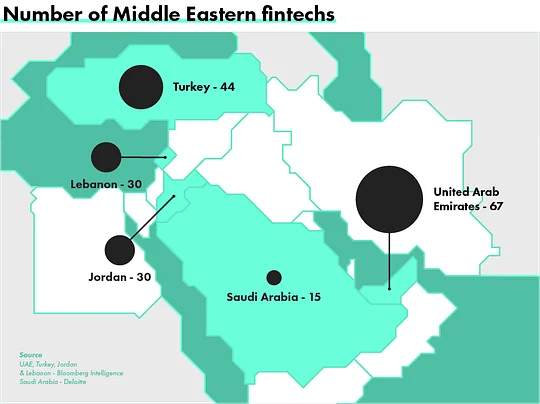

One third of all Middle Eastern fintech companies operate in the UAE, which has partnered with Singapore and Hong Kong to undertake joint fintech projects and regulation. It’s home to the Dubai International Fintech Centre (DIFC), which launched a $100 million fintech-focused fund in 2017. The city itself is also a valuable passage to other regions, says Erich Hoefer, Co-Founder and Head of Strategy and Product at Starling Trust Sciences.

`Dubai is a gateway market to reach other countries in the Middle East and Africa and also high-growth markets in Asia’, he says in a report from the DFIC. ‘There is ambition and drive in the region, particularly in Dubai, to experiment and grow’.

UAE bank Emirates NBD has been very successful at pivoting from its brand through the creation of Liv., their innovative fintech offering. Liv. has been a hit in the UAE: an average of 10,000 customers have joined each month since its 2017 launch, while 86% of acquired customers are new to the bank.

The app’s features, which include bill splitting and easy payments that can be made with the push of a button, have also been a big hit in the UAE, particularly among millenials. Goal-based savings and pots make saving easy for millennials; goals are flexible for the user, allowing them to choose between automatic savings per week/month and one-shot savings.

Liv. is thought of very highly by our 11:FS Pulse experts.

Emirates NBD Liv. app interface

In Saudia Arabia, fintech is set to play a key role in Vision 2030 diversification efforts. The country plans to go 70% cashless within the next decade, and planned VC growth and investment from funds and accelerators will help fintechs achieve this transition.

The Saudi Arabian Monetary Authority (SAMA) intends to roll out a digital Know Your Customer (KYC) process for the nation; however, gaps still exist in the space, and there’s plenty of room for fintech companies to add value and innovate in the Kingdom. By listening to what customers really want, fintechs could provide truly digital services.

Bahrain, meanwhile, is seeking foreign fintech investment through its Economic Development Board (EDB). In addition to introducing a fintech regulatory sandbox and a fast-track programme for global start-ups, the Central Bank of Bahrain (CBB) plans to enable equity, debt-based and Shariah-compliant crowdfunding activity.

Beyond bank-created initiatives, a number of independent fintechs are expanding across the MENA region. One prominent example is MoneyFellows, an Egyptian-based start-up that applies technology to the Middle Eastern and North African tradition of pooling money between familiar individuals.

Using an informal lending app, customers can pool money with friends and family to form a funding circle. Each user can then take from the pool interest-free. MoneyFellows is an example of how Fintech can be shaped towards a region and customer needs. Such a model combines tradition with modern technology. Interest-free loans further provide the Shariah compliance, which is culturally appropriate for the region.

MoneyFellows Interface

Whilst the underlying product is similar to competitors in the region (loan providers), the added value of MoneyFellows lies in the service that sits on top of the product layer – the community focus, the relationship between lenders enabled by the digital service and the cultural fit.

MoneyFellows already boasts a 60% month-on month growth rate and over $1 million in pre-series A funding. It’s currently raising for another round with intentions to expand across the region.

Clearly, there’s a lot going on in the region. Arif Amiri, Chief Executive Officer of the DIFC, perhaps sums it up best: ‘Despite its notable growth on the global level, the fintech industry has only realised a fraction of its true potential’.

That may not be the case for very long.

The future looks bright

With the conditions for Middle Eastern fintech already in place, the future looks promising.

Security, mobile payments and online remittances will become prominent fintech trends, according to Plug and Play. Both investment and the total number of startups are expected to double by 2020, while the online payments market in the MENA region is expected to reach $69 billion by 2020, according to the Dubai International Fintech Centre.

So while the current state of Middle Eastern fintech seems calm, the conditions are in place for a perfect storm of rapid growth.