3 ways community banks can win the day

Banks and bankers are often vilified in the media. Films like The Big Short, Boiler Room, Glengarry Glen Ross, Wall Street, Rogue Trader, and The Wolf of Wall Street portray the worst greed and excesses of investment banking. The antics of investment banks create distrust in the banking sector as a whole.

It’s been a while since the last film in which the hero was a banker. Yet George Bailey and the Bailey Building & Loan of Bedford Falls in the 1947 classic It’s A Wonderful Life had it right. Well-run banks sit at the heart of their communities and local economies, changing lives by funneling savings to people who need capital to buy property or set up and grow local businesses.

And this is where community banks have the inside track against the rest of the financial services ecosystem. With deep, established roots within their local communities, community banks have a human, personal, and trusted offering that fast-moving fintechs would kill for.

On top of that, community banks also have the advantage of not being plagued by legacy tech issues like their big bank counterparts. Whilst their architecture might be more basic, it also hasn't been continuously yet ineffectively built upon over time, avoiding the accumulation of different coding languages and interfaces that banks are finding so hard to get out of in pursuit of going truly digital.

In this article, we explore the 3 key ways that we at 11:FS Ventures believe North American community banks can capitalize on these advantages and increase their market share.

1. Keeping pace with SMBs

99.9% of all US businesses are small businesses. That’s a pretty big market.

And it’s a market that community banks have historically served very well as they have played a critical role in keeping their local economies vibrant and growing by lending to creditworthy business borrowers.

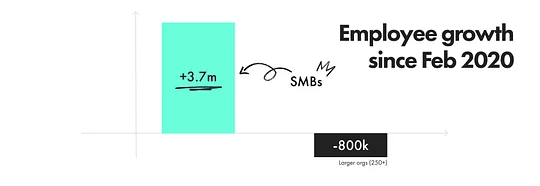

But, SMBs are ever-evolving, and the demands they’re placing on their local banking partners are also changing.

So, what do community banks need to do to keep up with the 33.2 million small businesses operating in the US today? And with a record-breaking 5.5 million new business applications filed in the US in 2023, how do they plan ahead for the SMBs of the future?

Source: Forbes

Major corporations make a lot of noise, but American small businesses are credited with just under two-thirds (63%) of the new jobs created from 1995 to 2021.

Running a small business is not for the faint-hearted. The fact that around 20% of new businesses fail in the first year, and just shy of 50% have failed by the fifth year shows how difficult they are to run.

There are 2 key things for community banks to consider here if they want to make a difference.

Firstly. The practical financial challenges of running a small business.

Cash flow is likely to fluctuate massively. Clients are unlikely to pay you on time. And getting access to credit is expensive and time consuming for established small businesses, and sometimes nigh on impossible for businesses just getting started.

Secondly. The lack of financial expertise of most business owners.

Very few entrepreneurs start a business because they’re desperate to administer a payroll process or monitor cash flow cycles. It’s not what they want to be doing, and for most business owners, it’s also not what they have experience in. Getting their head around what they need to do - and actually executing it correctly - takes up valuable time and energy which means they drop balls elsewhere.

Historically, community banks leaned on their local knowledge to help business owners overcome many of these challenges, driven by their bankers. And in times of crisis - like during COVID - the importance of human-led relationships comes to the fore again.

But as fintechs and tech platforms allow business owners to automate key tasks like invoicing, reconciliation and expense management, the equation is changing. SMB customers now have an increasing set of digital tools competing for their attention. But also for their deposits and their credit lines.

2. Building deeper roots

I don’t mean to start by stating the obvious but, access to financial services is the bedrock to building a stable and prosperous community. Now, with that in mind, the 24.6 million collective US households that were classed as being either “unbanked” (no credit or checking account at a bank or credit union) or “underbanked” (regularly uses alternative financial services) in 2021 should be pretty mind blowing.

This is in a country with over 72,000 bank branches.

Zooming in even further, we can see that minority communities especially are the ones being underserved - only 145 of the 4,000+ banks in the US are focused on serving minority and low-to-moderate-income communities. Sheena Allen of CapWay summed it up perfectly when she joined us for a Fintech Insider episode:

"I can drive through the delta of the Mississippi for 30 minutes to an hour and you're not going to see a bank."

Sheena Allen, CapWay

The eyes of financial services have always been firmly fixed on mass audiences, world domination, and dollar signs. But that’s left smaller communities to look elsewhere.

Harder access to financial services gives birth to alternative solutions like same-day lenders and pawn shops which, in turn, make it even harder for people in the community to save money, build credit, and access loans for starting new businesses or buying a home. You can see how this quickly spirals, leaving people on the outside looking in when it comes to finance.

This is where community banks put on their capes and spandex.

Entry points are limited for people who a) don’t trust the system and, b) see their needs ignored. Offering products like prepaid cards, microinsurance, and basic bank accounts provide accessible services that act as a ramp for people to enter the financial system.

If you nail customer-centric product design with these offerings alongside an understanding of your customers’ financial situations, you’ve got yourself a community that’s ready to thrive in your financial ecosystem.

Mobile apps are the perfect platform to push financial education and access. Talk to your customers and community, understand where the gaps are and take proactive steps to build the bridges. At 11:FS Ventures, we offer strategic advisory and customer research so can be on-hand if this is something you want to get started with right away.

Meet your customers at their pain points. It’s something unique to community banks that incumbents simply can’t do. Fintech has already shown the appetite for this and how effective the approach can be: just last year Greenwood acquired Kinly, bringing together two of the largest black-owned fintechs, and Comun, the Latino-founded neobank, closed a $4.5m seed round.

Financial services has the ability to change people’s lives, and that shouldn’t be exclusive. By doubling down on financial inclusion, community banks can grow even deeper roots within their local areas and build lasting relationships with communities who have been grossly underserved to date.

3. Putting the customer first

Given how the last couple of years have gone for the US financial system with a full blown banking crisis last year, it's fair to say that the public is looking for assurance regarding their finances which invariably leads people and small businesses to turn to the faces they know - their community.

Community banks showed through the 2008 crisis that they are able to thrive, not just survive, in tough financial times. By nature, they don’t take on the level of risk or exposure that the big banks do and are therefore able to more tightly manage their balance sheets.

These two factors combined leave community banks with a golden opportunity.

"Just because a bank is ranked by Forbes or is the cool bank in Silicon Valley doesn't mean it's run in a way that properly manages risk."

Sharon Anderson, Williamstown Bank

Leaning into digital and focusing on customer experiences is the first place for community banks to start. Digital and tech firms don’t come with the baggage that big financial institutions do and are therefore a more attractive proposition for audiences on the move. Oh, and banks are cottoning on to this too with 90% of financial institutions actively pursuing new fintech partnerships.

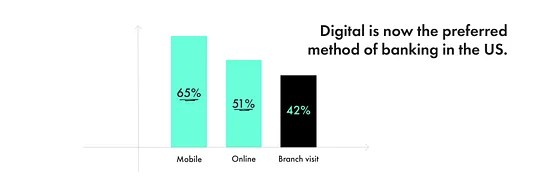

60% of your customers are using their phones to access their accounts, that number jumps closer to 70% if we start talking about millennials. As time passes, those numbers are only going to grow as this tech-driven generation become the big financial decision-makers in their homes and in their businesses.

The term “going to the bank” may not be in the vernacular for much longer thanks to digital, so community banks need to flip it on its head and go to their customers.

Source: Temenos

Enter stage left: embedded finance.

Embedded finance is all about taking financial services products directly to people, utilizing available data points to inform the problems they’re trying to solve, and meeting them where they’re working, living, paying, and trading in the digital space.

For community banks with close links to local businesses, this means being able to develop tailor-made lending products that integrate directly into regional supply chains and marketplaces.

Just focusing on the SME market, there is an estimated $92 billion of growth potential based on the willingness of small and medium-sized businesses to pay more for value-added banking services. Understanding the touch points of your SME customers and positioning your services along their journey is the key to getting your slice of the pie.

This is before even mentioning the 24.6 million unbanked and underbanked households in the US that we touched on above. Kenya’s M-Pesa has already shown the potential of addressing the needs of this community through its mobile money service which now has an eye-watering market share of 99%. It’s time for the Western world to catch up with this line of thinking and put an end to making it harder for people to get access to credit.

Community banks are in prime position to capitalize on a lack of trust in the financial system during a time where digital growth is paramount for banks. And embedded finance could well give them the boost they need to win the race.

Where to start

The brutal reality is that community banks have to think differently to compete. Those that don't change will fade away in an ever-competitive and digital-first financial world. Big banks are starting to come to terms with the need for becoming truly digital and the trust in fintechs is building, but community banks still have the advantage.

We've covered 3 key areas where we believe community banks can win, but how do you start? Here are some quick-fire ways to start making a change within your organization and take a bite out of that market share:

Build stronger digital capabilities.

Many community banks need better digital capabilities, notably mobile apps, if they are to win more younger consumers and businesses. To do that, community banks need to modernize their technology stack by building truly digital architectures that enable them to buy and integrate flexible off-the-shelf capabilities from specialist providers – and compete with larger banks.

Partner for economies of scale.

Many smaller community banks are already merging to gain efficiencies. Community banks need to go further by working with an ever-wider range of partners to serve customers more efficiently.

Clarify which communities you are supporting.

Many community banks are focused on geographic communities. But some of the most successful financial-services businesses in North America, like Navy Federal Credit Union, Thrivent, TIAA, and USAA are instead focused on communities of shared experience, such as doctors, teachers, or Lutherans. Servus Credit Union, for example, aims to help newcomers to Canada.

Go where your customers are.

Community banks need to be where their customers are. For many customers, that’s no longer on main street. Instead, community banks need to build stronger presences at the live events and on the social platforms where communities live and interact.

Get smarter about credit scoring.

Traditional credit-scoring models are broken, resulting in 1,000s of small businesses not getting the credit that they need to grow. Community banks can fill the gap by combining their local and community knowledge with alternative credit scoring data to make smarter decisions about which entrepreneurs in their communities are worthy of a helping hand.

Articulate a clearer message.

Many Americans and Canadians don’t understand the difference between a bank and a credit union, let alone the benefits of a community bank. To stand out, learn from community banks and credit unions like Coast Capital Savings, Thrivent, and VanCity that put how they support their communities at the heart of their messaging.

Speak to community banking specialists

Whether you're launching a new digital proposition, looking to streamline your tech stack or carry out in-depth market research, our in-house community banking specialists would love to help turn your ideas into a reality.

Get in touch

More content

We like our content here at 11:FS which is why we've got plenty more on community banks and the topics we've covered here for you to enjoy.

How do community banks stay relevant? | Podcast

Benjamin Ensor and Kate Moody are joined by experts from Bridge built by Citi and Seattle Bank to discuss: what is the role of community banks in 2023, the challenges and opportunities of innovation, and what the future may look like for these institutions dating back to the 1800s.

What are US Community Banks? | Video

Community banks come in all shapes and sizes but, combined, their asset size matches Bank of America – so why are these financial institutions slowly disappearing? In this episode of Explores, Sam Muele takes us through the ins and outs of these organizations.

Customer acquisition 101 | Video

Pretty much every single business on the planet is obsessed with customer acquisition costs. But what does the term actually mean? What's the formula for working it out? And most importantly, what can businesses do to theirs? Kate Moody, Customer Strategy Director, dives into all this and more.

Embedded finance for the unbanked | Podcast

David Barton-Grimley, 11:FS resident embedded finance whizz, was joined by some great guests from Spiralem and The Aspen Insitute for this pod, to discuss how embedded finance could be the trojan horse of financial inclusion.

Is the future of SME banking in specialization? | Podcast

Benjamin Ensor is joined by some great guests, from Branch, Iwoca, and Treyd, to look at the opportunities and challenges of opportunities of specialized offerings for small and medium-sized businesses.

The Banking Battlefield with David M. Brear | Video

In this all-timer video, David takes a look at the shifting landscape of financial services, the threats incumbents face, and why it’s no longer good enough to just shift from analog to digitized. The time to embrace truly digital is now.