US fintechs using design to create impactful savings products

America has seemed a beacon of prosperity for as long as anyone can remember. But a closer look into the state of American household finances reveals a bleak picture.

Most Americans live ‘paycheck to paycheck’, meaning they don’t save anything and sink further into debt on a monthly basis. In 2019, 40% of Americans would have been unable to pay a $400 emergency bill from their savings. Paying with credit cards is leading to increasing numbers falling into the debt spiral.

There are signs that Americans are waking up to bad financial habits and willing to try new methods. Dave Ramsey, a popular finance guru, recommends building an emergency fund before paying off debt. He preaches ‘the snowball method’, paying off the smallest lines of credit first to boost morale and gain momentum. His popular 'Envelopes model' encourages people to assign a purpose to each dollar and stick to it — essentially sticking money in an envelope at the start of the month. Consciously or not, most American households recognise the Envelopes model, and many try to replicate it using a spreadsheet.

Further help is coming in the form of US-based fintechs. Free from traditional banking business models (and therefore not incentivised to push households further into debt), these fintechs are lifting struggling households out of debt and helping them save. Here’s how some of our favourite personal finance fintechs are embedding healthy habit-forming features into their products.

Digit

Digit plays on the financial mental model of 50-30-20, originally coined by Senator Elizabeth Warren. In theory, 50% of a user’s income should be assigned to essential living expenses, 30% on discretionary spend and 20% on saving or reducing debt. Digit aims to align its users' expenditure with this rule through automation.

Automation does the hard work

Digit uses machine learning to calculate smart amounts to save and invest each day. By analysing a customer’s incomings and outgoings, it automatically moves money into savings for short or long term goals. The idea is that the customer is squirrelling money away without necessarily feeling the pain of money leaving their account.

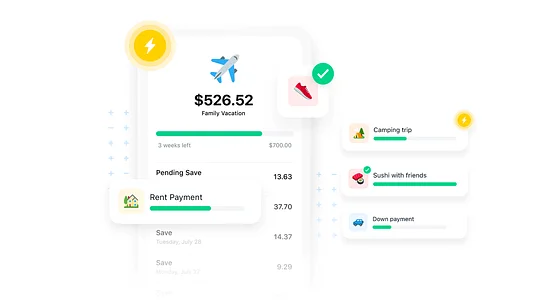

Make saving a challenge, not a chore

Framing saving as a challenge can often create more of an incentive and gamify the experience of saving money, countering the feeling that it is too painful or tiresome. Digit does this really successfully, allowing customers to create unlimited goals to strive towards. A customer just needs to input what they are saving for and when they want to achieve that goal. Gaming mechanics such as progress trackers then illustrate how well a user is performing against their target.

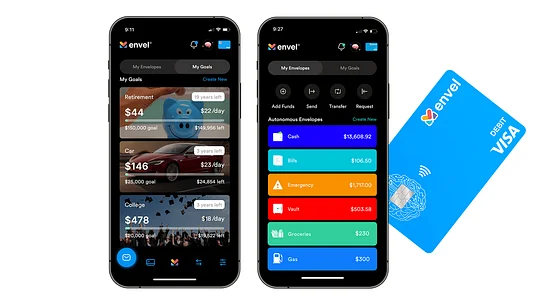

Envel

Using Dave Ramsey’s Envelopes model, Envel aims to form greater savings habits by helping its users to consciously track how much they spend across different categories. By allowing users to organise their money across ‘envelopes’, a user can attribute a set budget to a select category, ensuring that they don’t overspend and have money left over to move towards a savings goal.

Automation

As with Digit, Envel uses automation to take away the strain of saving. Envel automatically splits a customers's deposits across envelopes to help with budgeting and also suggests daily and weekly limits to help them stay on track.

Make saving personalised to me

Saving is a sensitive subject and it’s important to have an experience that is tailored to a user, giving them a sense of ownership. Not only can users create custom savings goals with Envel, they can also personalise the experience. Whether that’s naming the goal, or uploading a specific image that reflects the goal’s ambition, it all helps to create an experience that feels unique to individual users.

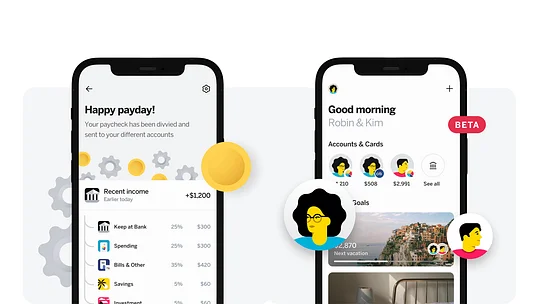

Qapital

Qapital harnesses its customers' existing bank accounts to help them save. Using transaction data pulled in via open banking, Qapital allows customers to track a path towards reaching their savings goals.

Show my progress against a goal

Having a clear and realistic goal and a plan for achieving it gives individuals something to focus on, and evidence shows that savings habits can then form through cycles of success as these goals are achieved. Qapital leans on this heavily, prompting its users to create savings goals that can be personalised in duration and type.

Rules rule

Along with goals, users of Qapital can assign spending rules that automate the saving process. Perhaps the most common rule is the ‘round-up’ rule, where any spend on the user's linked account is rounded to the nearest dollar, with the difference being moved directly into a savings goal.

Rules also give the Qapital brand more opportunity to be playful in their expression. Take the 'Guilty Pleasure' rule that automatically moves over a set amount of money every time a user spends at McDonald’s or any other guilty pleasure location they find. Or the 'Apple Health' rule that moves money into a savings pot every time a user meets a fitness goal.

Americans may be struggling to save, but there are fintechs stepping up to the plate to bring creative solutions that benefit everyone. As the landscape evolves it's becoming more pressing than ever for all financial services businesses to understand their customers through-and-through, and to create solutions tailored to them. If you'd like to talk about how 11:FS can help deliver truly digital services, get in touch.