Banking Battlefield: Winning the War For Customers

Over the last two years we have kept coming back to one diagram, the 11:FS Banking Battlefield. We use this to explain the changes we see in the financial services industry. In fact, one particular workshop we did in Australia last year had us talking through this diagram for the entire day! Seriously. It also featured in three bank board packs in the last 6 months which is also a pretty good indication we’re onto something.

At 11:FS we like to describe the state of banking today as a battlefield where incumbent banks are being attacked from all sides by new challengers and non-FS digital players. This battlefield is under more pressure today than ever before and filled with micro battles, all of which are shaping the future of the industry we all work within. It could not be a more volatile and interesting time to be looking at banking.

The context for this diagram is super important. When we stood back from the industry far enough to take it all in and try to make sense of it, we saw two main drivers in the market that are shaping all of the player’s futures.

- Number of Customers - The number of customers you have (in turn this is about the level of success you have/the amount of revenue you’re making and so on and so forth) denotes your impact on the industry, but also your perspective on the industry and what needs to change.

- Intelligent Digital Service (IDS) - The sophistication of the digital services that are being provided by those organisations in Financial Services. These could be internally or externally but we mainly focus this on service to customers. Note: this isn’t about how fancy your website is, but deeper digital services that might be operational in nature as well as your mobile app. But that deserves its own blog post in the future.

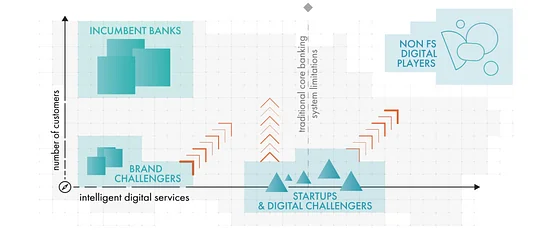

Once you have your head around the axes it’s about the players on the board. You have 4 main ones that we see today vying for customers’ attention:

1. Incumbent Banks

- What?: The big banks all have one thing in common and that is vast amounts of customers in the market, but also all the bad connotations of the word “legacy” when it comes to their level of sophistication of digital services.

- Key Challenges: Incumbent banks have the issue and burden of past successes. The largest customer base comes with a significant sense of importance as to how they conduct business, as well as all of the costs you would expect from a company of such a size. Both technological and regulatory. Add in the rising sense of customer expectation as to what services they offer and they are facing a war on many fronts.

- Who are they?: RBS, HSBC, Barclays etc – you know, the “big banks”.

2. Brand Challengers

- What?: These guys are the MNOs and surrounding industries that have taken advantage of their position and customer base to launch banks with a brand who are mostly recognised for something else.

- Key Challenges: The brand challengers in this space for the most part have all of the issues of their bigger brothers, but a fraction of the customers. Most have built their banks on the same structures and technologies that hold back the big banks.

- Who are they?: Metro Bank, First Direct, Tesco Bank.

3. Startups and Digital Challengers

- What?: These are the new kids on the block: brand new banking players with fully digital banking systems,intelligent services, and products to offer their customers.

- Key Challenges: Gaining customers. These are usually new, small startups that are just starting out with limited market spend and therefore reach and growth (at least at first).

- Who are they?: Monzo, Starling, Atom, Tandem, Revolut (in the UK).

4. Consumer Digital Giants

- What?: These are big tech giants who are not traditionally banking providers, but have a lot of customers, a lot of sophisticated technology and huge amounts of customer data (and money). This gives them the resources they need to start providing banking services with relative ease.

- Key Challenges: Trust. They hold a lot of customer’s data, but will customers trust them enough to make the switch to use them as a banking provider? Likewise these companies have hugely sophisticated tech systems, but do they want to make the switch to become a banking service and be regulated accordingly?

- Who are they?: Amazon, Google, Facebook, Apple, Ant Financial, Baidu, Tencent

As you can see, everyone is trying to get to the top right of this diagram. Everyone wants the most customers and the most sophisticated IDS.

Incumbent banks have the customers but they need the tech, new challengers have the tech but not the customers, and the big tech companies seemingly have everything they need to be a real threat, if and when they start offering banking services.

Getting Across the Page

At 11:FS we work with a number of people on this battlefield at different points but this is always the funnest part of any presentation. There is usually a pause at the end of this explanation. The question then comes....

“Okay okay… so how do we get across the page?”

So the advice we give is pretty to the point:

“You can’t, and should stop trying. It’s too hard. What you’re trying to do is take the legacy systems and drag them forward kicking and screaming, and it’s going to take too long and cost too much. There’s a reason why most big bank’s announcements surrounding innovation manifest themselves predominantly in terms of how much they’re spending, not what they’ve done or plan to do.”

The Red Queen's Race

Don't get me wrong here. Big banks have it tough. To make billions they have to spend billions. They have to constantly be ensuring regulatory compliance. Ensuring mandatory changes are made, the lights are kept on. Then and only then, after all those other things are taken care of, can they look to move the dial towards changing the organisation’s future.

A starving man doesn’t worry about what he is having for dinner in the future, he’s got to eat today! Likewise banks rightly have to be so preoccupied with eating today and ensuring the bank’s lights stay on, by which I mean looking after the here and now. That’s a lot of lights to keep on and a lot of mouths to feed.

This leads to the behaviour we see. Billions of pounds being provisioned for “Digital Transformation”, most of which end up with little being changed beyond incrementally moving something forwards. Its the Red Queen’s race I’ve written about in the past. Banks have to run as hard as they can just to stay in the same place.

What's the Plan for Banking?

So if you can’t get across the page, what should banks do instead? If you work in a bank strategy department I’m about to save you millions on consultancy fees for the McConsultancys of the world. This is a financial services incumbent bank’s strategy for the next 5 years, summarised into a 3 sentence joke, ready?

There’s a man driving through the countryside, trying to find a nearby town. He is desperately lost surrounded by fields and so when he sees a woman by the side of the road pushing a bike he pulls over and asks for directions. After a long pause and head scratching the woman says, “Well, If you want to get there I wouldn’t start from here.”

Okay, translation time. Banks cannot get to where they want to at the speed they want to, and with the quality of outcome if they start from where they currently are. It’s just not possible or at least not effective.

Sisyphean Task

I’ve said that’s the wrong strategy for years now and will only lead to billions being spent and disappointment by the CEOs and Boards of those banks who they serve. The change they create will take too long and ultimately not make a big enough change to make a marked difference, not when the world around them is moving faster.

If banks continue to continue to try to carry the boulder of legacy technology and culture up the mountain of the changing banking battlefield, they will be punished in Sisyphean style. The boulder will roll back down and they’ll be back to where they started and ultimately, beaten to the post by those who think about this problem in a different way.

Doing nothing is no longer an option. The big tech giants are also getting ever closer to announcing their invasion into the market; they have the tech, the customers and the money to make seismic shifts. They won’t just copy the traditional banking model, they’ll be doing something brand new which causes tension in the market. For the big banks, the time to act is now, to cross the Banking Battlefield and start winning the war for customers.

To get across the page get in touch with 11:FS at hello@11fs.com or reach out to us on Twitter. 11:FS is a challenger consultancy that believes digital banking is only 1% finished. We can help you overcome legacy systems, create new business models, and develop the best next-gen products.