The State Of Retail Payments In Europe

Firms are disrupting legacy payments infrastructure in Europe

In this part of the changing payments landscape series, I will be looking at how providers in Europe have used technology, regulation and changing consumer behaviour to disrupt legacy payments infrastructure.

Europe was an early adopter of some forms of payment innovation such as integrating NFC technology into cards and terminals, which has both driven and helped meet customer demand for convenience and speed.

Regulation such as the previously mentioned PSD2 and Open Banking is also starting to have an impact. Furthermore, some parts of Europe, particularly the Nordics, are using regulation to shift towards becoming cashless societies, which has created demand for innovative payment methods to serve as alternatives to cash.

Disrupting a market that already has a functioning payments infrastructure can be challenging, but providers are starting to reduce the pain points caused by that infrastructure and its legacy systems while also rising to meet changing consumer expectations. The focus in this region has been largely on reinventing existing payment methods and removing as much friction from the process as possible, to enable faster, more efficient payments.

Contactless - wearable

Contactless payments were first introduced to the masses in 2007 using NFC technology on payment cards. However, it took another decade for this form of payment to become the norm and a favourite of European consumers.

When first introduced, the major hurdle to customer adoption was convincing them that such payments were secure. A key factor in changing this situation was when contactless cards and debit cards started being accepted for transit purposes, notably on the London Underground transport system. The increased convenience it offered outweighed security concerns for many. That drove changing consumer habits — once they were familiar with using it to get on a bus, customers were more likely to use it in a store. From there, it naturally followed that customers were more willing to try contactless payments on their phones via mechanisms such as Google Pay and Apple Pay. European adoption rates for these digital wallets are nowhere near those of contactless cards, but they are increasing steadily.

A further driver for the adoption of contactless cards was a change in European regulation that barred merchants from charging a fee to accept low value card payments. Contactless card payments are capped at £30 or €30, meaning that before regulation was changed people were limited as to where they could use contactless payments, even if they wanted to.

The next phase in the growth of contactless payments is the introduction of wearables, which combine faster payments, fashion and technology.

Fitbit Pay

Fitbit began with fitness trackers and soon expanded to offering smartwatches, it then launched a payment wallet which can only be used with its devices. This adds an extra layer of convenience for users that are more likely than most to have no access to their phone or wallet. For instance, when exercising, consumers might not want to carry any extra items but still want the ability to make payments. In such an instance, a fitness tracker becomes a fitting payment choice. Fitbit Pay is an example of a payment mechanism tailored to a specific demographic.

A2A Payments

European regulation is now promoting Account-to-Account (A2A) payments; a payment mechanism that has been around for a while in the form of iDEAL in the Netherlands, Trustly in Sweden and Sofort, which is used in eight countries including Germany, Switzerland and Belgium.

The regulation in question is once again PSD2, which requires financial institutions to build APIs that allow third parties to initiate payments from a customer’s account on their behalf once linked to their accounts. That’s different to the majority of existing systems which involve using the customer’s online banking details or a government-issued ID.

One benefit of A2A payments is that the customer is able to check they have sufficient funds before authorising payment and the transaction is usually processed in real-time. Another advantage is that there is no need to enter card details which many perceive to be a less secure method. For the merchants, there should be the benefit of cutting out the card scheme and therefore reducing the cost of payment acceptance — that said, many A2A payment systems do charge merchants a fee to participate.

This method might prove to be popular in the future, and potentially overtake card payments for e-commerce payments, with Swift’s David Scola explaining why.

One of the interesting outcomes of the growing attention surrounding A2A payments has been the race by card giants such as Mastercard and American Express to move into the space by either building their own infrastructure or acquiring existing ones. This should facilitate domestic B2B payments especially to be paid in real-time, an area where innovation has been somewhat slower compared to B2C.

iDEAL

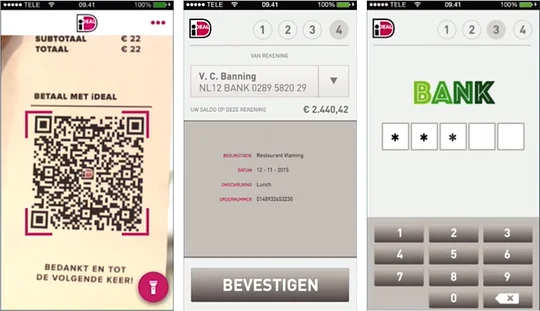

Launched in 2005, Netherland’s iDEAL was one of the first payment systems to offer A2A payments and is used for P2P, B2C and B2B purposes. With most banks participating in the iDEAL scheme, this system was already using API technology to integrate with Dutch banks and initiate A2A payments long before the advent of PSD2. It remains by far the most common payment method for online purchases in the Netherlands, with a 57 percent market share in 2019, processing over 669 million transactions. To keep up with consumer expectations of being able to use their mobiles for banking needs, iDEAL launched a mobile app to support mobile transactions using QR codes.

iDEAL's mobile payments app (Source: iDEAL)

Mobile-based instant payments networks

The Nordics have seen a significant decline in cash usage and migration towards digital payments. They are moving quickly towards becoming cashless, with the government and banks working together on supporting initiatives such as payment systems like Sweden’s Swish, Luxembourg’s Payconiq and Norway’s Vipps mobile payment systems.

Swish

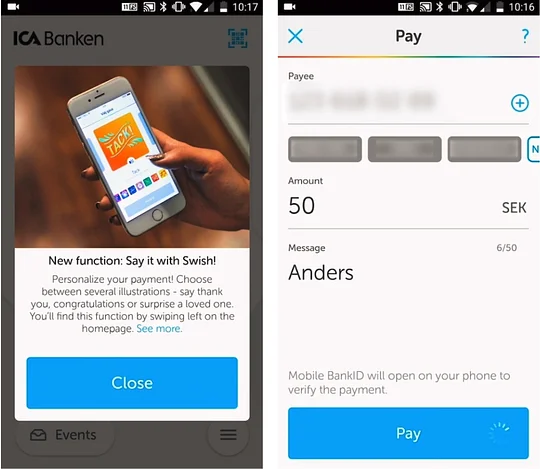

The Swish mobile payments network was formed in 2012 by a collaboration of some of the largest banks in the country. It facilitates mobile banking and enables instant P2P, B2C and B2B online payments. As the app is linked to the country’s digital ID system, users and payments are easily verified. Before payment is finalised, the recipient’s name and profile picture is shown so the sender can be sure and, for instance, not have to worry about losing out money should they make a mistake.

Swish's mobile payments app

With more than two-thirds of the population registered to the network, Swish has quickly evolved from a P2P platform, where it started. In addition to being an e-commerce payment option, the network is on a quest to increase its services to in-store payments, following its partnership with Denmark’s Nets payment system.