Best in class onboarding

Introduction

Onboarding comprises of the processes by which a consumer or business becomes a customer. The term applies to the end-to-end journey, from a customer seeking insight into which product is right for them, through the application process, and onto the issuing of that product and the customer starting to use it.

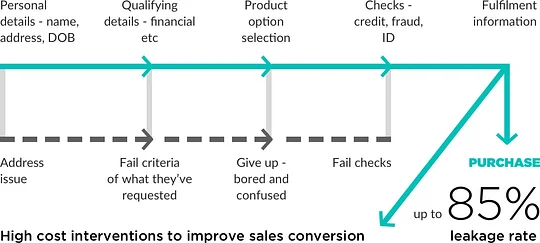

In financial services these processes are highly manual, with financial institutions (FIs) requiring would-be customers to visit branches, fill in paper forms, provide original identity documents and get hold of paper copies of bills that are mostly delivered electronically these days. These requirements result in many points of friction and can lead to significant levels of dropout mid journey. They are also costly and time inefficient for staff to carry out.

At the same time, startups in the financial services industry are using technology to reimagine how onboarding can be carried out. Taking their cues from the likes of Google and Facebook, they are using smartphone cameras and APIs alongside software such as optical character recognition (OCR) and electronic signatures to make onboarding a faster, cheaper, lower-friction experience.

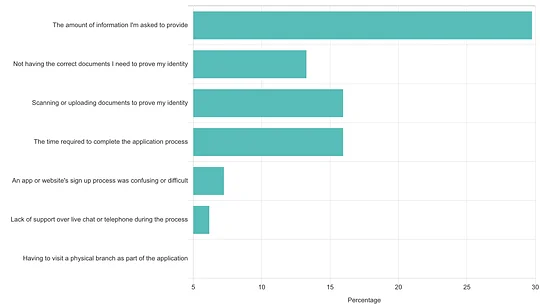

These factors are putting pressure on FIs to take another look at how their onboarding journeys work. They have also resulted in a significant number of companies, in many cases startups, creating products and services specifically designed to help FIs with this issue. It's not easy, however, and there are a number of hurdles that must be overcome by FIs in order to avoid replicating pain points that exist in manual onboarding journeys in digitalised versions. For example, 11:FS found that of customers who had signed up to use a digital financial service or app, 22% found the amount of information they had to provide the most painful part of the experience. That's likely the result of FIs simply turning analogue processes digital, without thinking about how technology could help them improve those processes.

I took a look at the current state of onboarding in financial services, examined the drivers outlined above in greater detail, explored the most common pitfalls made by FIs moving their onboarding processes online and spoke to a range of companies in this space. The result is a set of principles and features, illustrated with case studies, that FIs looking to create best in class onboarding journeys would be wise to follow if they want to unleash the promised benefits of digitalised onboarding.

Basic customer digital onboarding process

Why should big FIs with millions of customers bother?

Overhauling any process needs serious consideration in a financial organisation, given the highly regulated nature of the business and the number of customers that could be negatively affected if something goes wrong. So why should FIs bother?

Customers expect it

Everyone knows that thanks to Google, Amazon, Facebook and Apple – collectively known as GAFA – expectations around what constitutes a good user experience have shifted radically. These companies have trained us to expect slick, digital user journeys that can be completed with as few steps as possible, wherever and whenever we want. And if we don't get that, we lose interest and wander off; or worse, we complain. Loudly. On social media.

It’s accessible by a huge range of potential customers

The ubiquity of smartphones means FIs large and small can reasonably assume those applying for a new product digitally will be able to take a photo of their ID and then upload it. Additionally, many other documents used in the identity verification process, such as household bills, are now delivered electronically, while fewer and fewer people have access to printers. This means that uploading such documents digitally is actually easier for many than obtaining a printed copy.

New market entrants are doing it

Challengers to incumbents are springing up in every area of financial services. These firms have many advantages over their more-established peers, including a desire to use innovative technologies and strategies. They also have newer IT systems, which are much easier to incorporate third party products and services into. Starting from this base enables challengers to create onboarding journeys which are more appealing to most would-be customers than those offered by incumbents. Partly as a result of this, customers are signing up for startup services at a rate large banks and insurers can only currently dream of. Whether they go on to use those services regularly is a subject for another time.

Manual processes can’t keep up with changing regulation

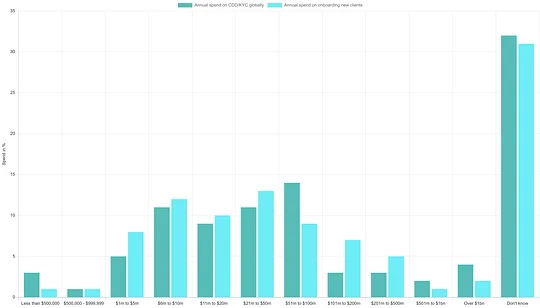

Increasing regulatory requirements around Know-Your-Customer (KYC) and Customer Due Diligence (CDD) mean onboarding is now taking longer using manual processes. That not only makes customers unhappy, it’s increasingly expensive for FIs – firms with annual turnover of $10 billion+ spent on average $150 million on KYC/CDD in 2017, up from $142 million in 2016. To further add to FIs' woes, it seems likely that these manual processes will simply not be able to keep up with compliance requirements in future, no matter how much they spend. But that doesn't have to be the case – the same technologies used by new market entrants can also be used by incumbent FIs, especially if they are willing to access them via a third party supplier. These technologies enable compliant, remote onboarding at scale, which can massively reduce existing FIs' compliance burdens and similarly reduce costs.

It saves money

Running an FI is an expensive business, especially as the costs of compliance, branch network maintenance and IT system upgrades continue to rise. These factors, combined with a low interest rate environment that prevents them earning decent returns on capital, mean FIs are constantly looking for ways to cut costs. Meanwhile, startups with fewer resources to begin with are equally keen to ensure cost efficiency wherever possible. Digitalised onboarding implemented effectively can significantly reduce costs associated with frontline staff, who would no longer have to manually fill in and file forms; instead document management could be automated and centralised. That would result in more easily achieved – or in some areas, outsourced – compliance as data formats are standardised.

Source: Thompson Reuters

Onboarding should be thought of as an opportunity to kick-start new ways of thinking across the business

Rather than viewing the modernisation of onboarding as a defensive move, FIs of all sizes should view it as an opportunity to kick start their digitalisation process, if they haven't already done so. For a more detailed look at digitalisation, and how it differs from digitisation, check out our blog post here.

Areas where onboarding can have an impact on the broader business, and

therefore help enable a truly digital business include:

-

Provoking FIs to rethink expected dropout rates

By making onboarding as frictionless as possible, FIs can capture customers that would otherwise have dropped out during the process. Currently, firms plan for a drop out rate as high as 85% for those who start an application for a digital product. If this can be reduced, then it’s a win-win situation for the firm, which will not only have new customers, but will be able to more accurately predict uptake of future digital products.

-

Future proof against increasing rules and regulations

KYC and anti-money laundering (AML) rules are multiplying, making laborious manual processes become even more time-consuming, and further increasing the pain felt by customers during onboarding. The creation of new and updated KYC and AML rules is unlikely to slow down anytime soon, but FIs can help future-proof themselves against having to inflict any further pain on customers by implementing new processes and technologies now. They can also look at how new business processes, such as taking an ongoing approach to KYC, can help. It requires asking for the minimum legally required for customer verification during initial onboarding, and then asking for more supporting information as and when the customer’s behaviour calls for it.

-

Find new demographics to serve

FIs miss out on a potentially huge chunk of business by making it hard, or in some cases impossible, for those with non-typical backgrounds to be onboarded easily. These people who may have government ID from an unusual location and unrecognised credit histories are not necessarily high risk, but they are being turned away or put off applying before banks get the chance to ascertain whether that's the case. Implementing new technology and compliance processes can enable FIs to reverse this, and therefore digitalising onboarding should be part of any strategy to acquire customers from previously unserved demographics.

-

Reimagine document management

By revinenting the processes involved in customer onboarding, FIs also have an opportunity to reconsider how, where, and if, they store customer data and documents. Most will already have this issue on their mind, thanks to recent regulation such as GDPR, and if it is combined with a thoughtful approach to introducing new technologies such as optical character recognition (OCR) and central digital storage, they can kill two birds with one stone.

Potential hurdles to creating a truly digital onboarding process

What hurdles need to be considered?

It should be pointed out that digitalising onboarding is not simple. Simply digitising existing processes does not work and results in customer pain points throughout the customer journey.

Source: 11:FS and CitizenMe

These pain points are typically caused by FIs failing to address one of a number of common hurdles.

Struggling to integrate new technologies to existing systems

The technologies involved in creating onboarding journeys are myriad. They include smartphone cameras and webcams, OCR, biometric software and hardware, Machine Learning (ML), and electronic signatures – not to mention APIs to connect it all together. Ensuring all these technologies connect to existing systems in order to pull or push relevant data is no easy task, especially if a firm wants to integrate each one individually.

Failing to rethink compliance

The most time-consuming and annoying parts of onboarding for customers are the processes designed to ensure that FIs are compliant with global AML and KYC rules. Visiting a branch and providing original copies of documents are both ways that the FI in question can verify that the customer is who they say they are, which is integral to the firm being able to check its services are not being used for money laundering or the financing of terrorism. FIs that choose to digitalise these processes will need to be certain that in so doing they remain compliant with the relevant rules while finding ways to ensure the speed and friction-free experience customers expect.

Not understanding how to handle multiple suppliers

Many FIs choose to outsource both the technology and the compliance aspects of digital onboarding to third parties. However, there are many such providers around, and the number is growing, making it harder to choose the best partners. In most cases FIs will also need a number of suppliers if they wish to update their onboarding process end-to-end, and how well these third-party's solutions complement each other is an important consideration if the FI wants to avoid introducing new pain points.

Truly digital onboarding journeys

The benefits of rethinking customer onboarding in financial services are clear, but how do firms go about it?

We went under the hood of some of the best onboarding journeys out there to find out what goes on behind the scenes to make the experience as seamless as possible for customers, and as easy to implement as possible for FIs.

Monzo

…overcame an unusual challenge as it developed one onboarding flow for its prepaid product, with the intention of updating that journey when its current account product was launched. The October 2017 launch of that product was preceded by new European AML laws, which were introduced in July 2017. The combination of these two factors meant that not only did Monzo have to design a transition journey for existing customers as they moved to the current account, but also to redesign an onboarding journey that would allow for additional AML checks for customers who had signed up before July 2017. This combination of factors could have caused friction and customer attrition, so Monzo went out of its way to make its new onboarding journey as good as it could possibly be.

Key principles

Despite being known for having taken the more complex route of building its own core banking systems – rather than relying on a third party supplier – when it came to its onboarding processes, Monzo is collaborating with other organisations. Today, they use a number of third party suppliers, including RDC, Jumio, AU10TIX and Onfido.

Monzo also has an ongoing approach to KYC, so it can make getting started as quick as possible, and then if required at a later date, ask for more information.

We might need to know the range your salary falls into, or whether you have any kids or other dependants. You could also be asked to give us a clearer picture about a particular transaction.

Natasha Vernier, Head of Financial Crime at Monzo

Another example where Monzo might ask for more detailed information is if a customer is using their Monzo account to buy cryptocurrencies. They make clear that if a customer can’t give a reasonable response to such questions, then the bank may have to suspend their account.

Current account registration for existing customers

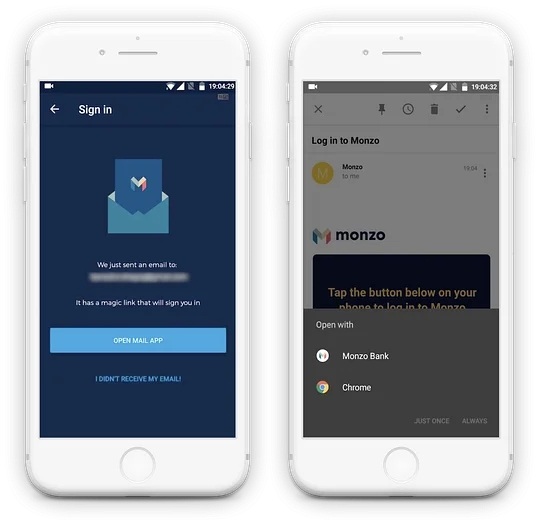

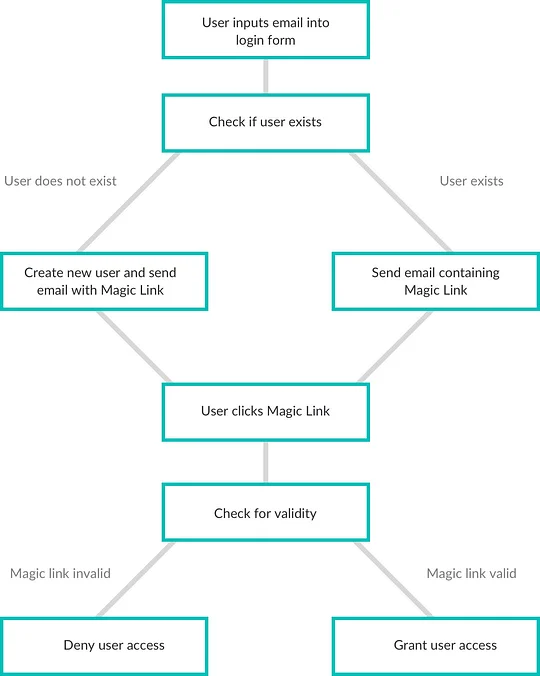

Customers with Monzo’s prepaid product who upgraded to a full current account could either start the process from within the app, or they could click a “magic link” sent in an email notifying them of their ability to upgrade. A magic link was used to verify that the email address being used to register an account belonged to the person who is going through the onboarding process. Once clicked, it automatically returned the user to the app and logged them on, moving them seamlessly onto the next stage of the process.

The customer was then asked to confirm their postcode and select their address from a drop down list. At this point, if the customer had signed up to Monzo before July 2017 they went through the full KYC and AML processes that have applied to all new applicants since that date and which are outlined below. Customers who had signed up after July 2017 had already been through these processes and could upgrade their account with no further checks needed.

Current account registration for new applicants

New applicants download the app and enter basic details such as name, address and email address. Once they have confirmed their email address the full KYC and AML checks begin. This starts with Onfido performing what are known as electronic ID checks, where the customer’s details are checked against credit reference agencies, electoral registers and mortality lists.

Next, an SMS with a verification code is sent to the user’s phone, again with the number being pulled from existing account details where possible. The app auto-detects the SMS and the code it contains and moves the customer onto the next step of the process. Customers submit a photo of their photo ID in app, which is then sent to either Jumio or AU10TIX to be checked for legitimacy. That’s followed by the customer recording a short video, a still of which is sent onto Jumio to perform voice and facial recognition checks.

While these checks are taking place, the user can exit the process to await confirmation, which in the majority of cases takes only minutes.

Monzo retains a copy of ID documents to use for financial crime purposes, and videos so they can be used for other purposes, such as confirming customers’ IDs to enable them to recover their PIN quickly by submitting another video.

Standout features

Having reviewed the elements of the Monzo onboarding process, it becomes clear that the challenger bank is doing a number of things that have a direct impact on the customer experience.

Use of multiple suppliers

Monzo does this both to ensure there is never a time when the bank is unable to onboard customers, even if one of its suppliers is down, and in order to maintain control over the entire onboarding journey. Notably, Monzo uses its suppliers’ APIs so it can keep all aspects of the process within the app, as far as the customer is concerned, rather than their SDKs which would involve building a separate journey outside of it. This also prevents Monzo having to ensure its suppliers’ solutions are interoperable with each other.

Inclusive process

For customers unable to provide voice content, the option to use sign language in the video was provided – a nice touch creating an inclusive experience.

Reusing information

Wherever possible Monzo reused customer information it already had, rather than asking them to provide it again. This meant fewer steps in the journey and helps to solve the most commonly cited pain point in digital onboarding – the amount of information customers are asked to provide during the process. While not an option for all firms, this is great best practice for startups that have gathered customer information while in beta or the pre-launch phase.

Excellent conversion rates

94% of Monzo customers upgraded their accounts, equating to 362,000 account holders. While this is likely due to a combination of factors, including customers’ love of Monzo’s products, the slick onboarding flow from prepaid to current account more than likely helped bolster this conversion rate. That’s especially true when you consider the 85% dropout rate for customers applying for digital products online.

Enabling contact with a human if necessary

Despite most customers completing their current account registration entirely digitally, Monzo also offers an in-app chat option for users with queries. Unlike phoning a call centre, the customer does not have to stop what they are doing while they wait for a response, they simply type their question and await a response via instant message.

KBC

...is an Irish bank that has one of the best onboarding journeys for an incumbent bank we've seen. It was the first bank in the country to enable mobile account opening back in 2016, and its seven-step onboarding process remains market leading globally – despite other banks racing to implement similar journeys. Most customers are verified within five minutes and receive a digital card they can start using straight away.

KBC’s onboarding journey: the principles

The bank worked with third parties to create the onboarding journey for its current account after realising that it would take too long to build much of the technology required in-house.

We're in a very collaborative space, you have to partner with other fintechs out there. If you try to do it on your own it would take too long, you'd be left behind, you'd have missed the boat. Fintechs have the expertise in all that ML verification bit so we all came together to come up with the best solution.

Petrina Grady, Head of Current Accounts

KBC also made the decision to rethink their entire onboarding journey, rather than just digitise some processes.

We knew we couldn't just tweak the journey here and there if we wanted to be competitive, we had to knock the whole journey on its head.

Petrina Grady

Chatbot-guided onboarding

KBC uses a chatbot to guide customers through the onboarding process. Initially it gathers information such as name, date of birth, mother's maiden name and mobile number. It then sends a verification SMS, in much the same way as Monzo. However, unlike the challenger bank's onboarding journey, it doesn’t auto-populate the code. Customers go on to use the chatbot to set up a PIN, and say if they'd like to use fingerprint recognition, followed by a KYC checking process similar to that provided by Onfido and used by Monzo.

In a final step, KBC asks applicants to respond to a series of legally required questions individually in app via the chatbot interface. Once they have provided answers via yes or no buttons, most customers are verified instantly and receive an IBAN along with a virtual card, which they can start using immediately and add to their Apple or Google wallet from within the KBC app. Throughout the process customers can keep track of how far through they are thanks to a progress bar at the top of the screen.

Standout features

In comparison to the majority of the Irish market, KBC's onboarding process improves on a number of key elements.

Chatbot guided user journey

Using the chatbot approach keeps the customer focused on providing one piece of information at a time, and prevents them being daunted by long forms. In turn that can significantly reduce drop off during the application process.

Making legal questions easy to digest

FIs are required to ask a number of questions such as whether the customer is a citizen of any other country for tax purposes. These questions are normally presented as part of a terms and conditions document which the customer initials to prove they have read them. In reality, few customers fully digest what they are signing. KBC presents these questions in chatbot form, making it more likely they have read the question and are comfortable with agreeing to them.

Instant IBAN and card

In order to enable this, KBC uses an API to add a customer's card details to their account in real time. Historically, all new cards were added to customer accounts, or provisioned, in one go once a day. That's appropriate when a card is being sent out by post, but less so when a customer has just been through a five-minute onboarding journey.

Third-party providers

As mentioned, few FIs create fantastic digital onboarding journeys on their own, so we spoke to a firm that’s been incredibly successful in helping FIs digitise processes in this area.

Onfido

...provide identity verification solutions – a key component of digital onboarding – to 1500 companies, of which around ¾ are in financial services. Its customers come in all sizes and include startups Revolut and Pockit, and BNP Paribas' digital brand Nickel.

What they provide

Identity verification is an essential part of ensuring compliance in onboarding in financial services. Onfido digitises the processes associated with ID verification using a combination of OCR and ML. A customer snaps a picture of their government-issued photo ID document on their phone, followed by a selfie or short video, and submits them either via an FI’s app or a website. Onfido's proprietary machine learning software, Blackhawk, is specially designed to scrape information from government ID documents. Once the data has been gathered, Onfido's ML algorithms determine whether the ID is legitimate, and whether the photo on the ID matches the selfie. Having confirmed someone’s identity, Onfido can then check that person against major credit bureaus and global watchlists via API integrations.

Standout features

From a bank's perspective, Onfido provides a number of benefits from a cost, compliance and customer-facing perspective.

Cost savings

Onfido claims that the majority of the identity verification checks it performs go through automatically, with the remaining 10% sent for further analysis by compliance teams. This means that the FIs using Onfido's service need much smaller in-house compliance teams, resulting in significant cost savings. Additionally, by using Onfido's platform which has fully integrated software and technology, FIs save themselves the time and expense of building and implementing their own solutions.

Compliance

For most startups which use an ongoing approach to KYC rules, Onfido's services provide all they need to ensure they are compliant in the first instance. That frees up a huge amount of compliance resource to focus on the few customers that require extra checks.

Increased customer acquisition

When Revolut implemented Onfido's solution as part of its account opening journey it sped up the overall process by 38 seconds, compared to Revolut's previous supplier. That translates to an ability to onboard 12% more customers.

New ways of working

Again looking to Revolut as an example, its previous provider had kept its technology team "behind the scenes" making for a disjointed relationship. In contrast, Revolut and Onfido's tech teams set up Slack channels, and communication between the two remained constant throughout the implementation process. That meant Revolut's back-end developers were able to ask questions of Onfido as they arose and get instant responses.

What it takes to create a "Best in Class" onboarding

I want to point out that none of the journeys I've seen, including those highlighted here, are perfect. In order to provide as much guidance and inspiration as possible for firms embarking on their own onboarding upgrade journey, I've pulled out some features and best-practice principles from other firms we've looked at and created "The 11:FS Best in Class Onboarding Journey".

Magic links

As highlighted in the Monzo case study above, do not underestimate the power of magic links for authentication purposes. They remove steps from the onboarding journey and ensure customers do not get distracted between receiving a communication and completing the process.

Leverage technology customers are already comfortable with

When it comes to KYC and identity verification, selfies are your best friends. Customers looking to apply for products digitally will be comfortable with taking photographs on their phones, and most will also be willing to film a short video of themselves. A word of caution here though, some customers will need more information about if/where these images and videos will be stored.

Use third parties

Following on from the previous point, where appropriate bring in the specialists. You will save time and money getting your updated onboarding journey to market, which will keep you competitive. Outside of KYC and ID verification, there are also third parties providing support in the form of live chat functionality such as Intercom, while Auth0 enables magic links.

Explore new ways of customer engagement

Chatbots work to ensure data gathering doesn’t put customers off, and there is more than one way to implement them. Lemonade has a one-question-per-screen journey that keeps the customer focused when applying for an insurance policy, a process notoriously full of what can seem to customers like spurious questions. Additionally its chatbot is called Maya, creating a more engaging experience.

Keep things simple

For more complex user journeys such as applying for a mortgage, where it’s not necessarily appropriate to use chatbots, firms can still digitise the initial data gathering part of the process. Hello Bank uses the one-question-per-screen strategy to speedily gather basic information before providing a personalised mortgage offer that the customer can go on to accept online.

Give customers the option of human contact

For some FIs digitalised onboarding will remain optional as there will be some groups that need, or prefer to, interact with a person. In that case, digitalisation is even more important as it enables FIs to integrate multiple touchpoints to create a seamless cross-channel experience. Even where a firm has strategically decided to only offer a digital onboarding process, they will still need to offer a human customer support service to ensure minimal drop off. Like Monzo, Coconut offers a live chat displaying the customer service representatives available and the estimated response time.

Let customers start using their product ASAP

If you don't, there’s a chance the customer will put it off or even forget about it completely. Like KBC, Revolut gives you a digital card as soon as you've completed the authorisation process, while Wealthsimple invites customers to fund their portfolio on the first screen of the app as soon as onboarding is complete.