Why the FS industry needs to grow green fingers, ASAP

Like everyone else locked down here in the UK, I’ve been working my way through Netflix at an unrelenting pace...

This is taken from our Unfiltered newsletter. Subscribe now for a no BS, uncensored analysis of fintech news and hot topics delivered to your inbox each fortnight.

If you haven’t already seen it, I would urge you to check out David Attenborough's ‘A Life on our Planet’, in which he shares some pretty hard-hitting facts, like how overfishing is dramatically affecting the marine ecosystem and how coral reefs - which are essential for absorbing heat in our atmosphere to maintain critical balances in biodiversity - are bleaching due to increasing global temperatures.

Most governments have signed up to some form of carbon neutrality target by now, with the UK government aiming to be carbon neutral by 2050. But is there a way that the financial services industry could help us deliver on that pledge? And who is already taking steps in the right direction?

The FS industry has been a silent contributor to global warming

Traditionally, the fossil fuel industry has been steadily profitable and well subsidised. The International Monetary Fund estimated that worldwide subsidies to fossil fuels (tax breaks and cash grants) and industry avoidance of social impacts totaled a cool $5.2 trillion in 2017.

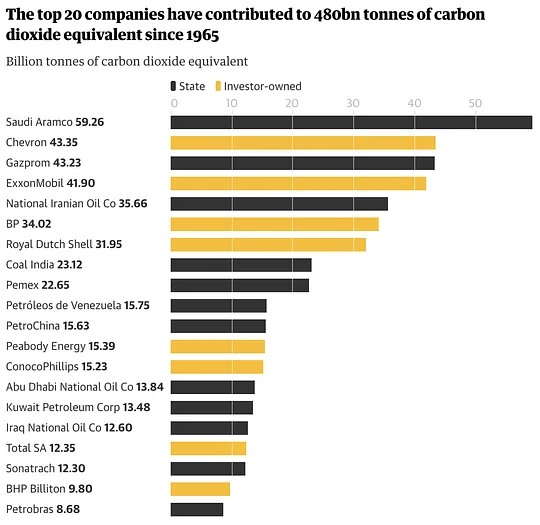

One third of all global carbon emissions comes from just 20 companies (including BP and Shell) and most of those companies are staples in retirement/pension funds. It’s paid both long and short term to be a backer of high carbon emitting entities.

But the sentiment is slowly changing

Back in 2019, my colleague Simon wrote that “If you change how money moves, you change the world.” And he’s right.

David Attenborough himself called for financial services to play a part in moving towards a sustainable economy in the film Our Planet: Too Big to Fail. And in February 2020, when passing the Pensions Schemes Bill in the UK, Mark Carney (the then Governor of the Bank of England) stated that “trillions of pounds could be wiped out of pension funds due to climate change”.

The UK then became the first country in the world to put climate change reporting into Pension Funds (part of the Pensions Schemes Bill). This Bill makes it a legal requirement to tell pension savers the carbon footprint of their retirement pots and how their investments contribute to climate change.

As a result, fund managers from around the world are beginning to preach the benefits of both impact investing and sustainable investing:

In the US 🇺🇸 pension funds have told US regulators that climate change poses a systemic risk to the financial system, and they're demanding rapid action.

In the UK 🇬🇧 Cheshire East Council (with a £6bn investment portfolio) became the first local pension fund in the country to report on the portfolio’s carbon footprint in September 2020.

Back in 2019, my colleague Simon wrote that “If you change how money moves, you change the world.” And he’s right.

The fintech industry is also contributing:

Nutmeg and Wealthsimple offer Socially Responsible Investing (SRI) products, designed to align investments to your values.

Triodos Bank is the granddaddy of sustainable banks, whose numbers have swelled recently thanks to customer acquisition through organic means.

BUNQ offers a tree planting scheme in a bid to reduce CO2 emissions.

CoGo is a real-time carbon footprint tracker that places sustainability at the forefront of consumers’ spending.

Clim8 Invest is the sustainable investment app with the goal of empowering its community to make a positive impact on climate change (early access only at the moment).

The growing popularity and returns of ESG funds

There’s been a 2500% increase in inflows into ESG products since 2014, and $31 trillion is now held in ESG investments. ESG ETFs (Exchange Traded Funds) represent $52 billion of the $6 trillion global AUM (assets under management) of the ETF market, and 2019 saw 479 green bonds issued globally - that’s up a quarter on 2018.

Increasing data shows ESG funds are out-performing non-ESG ones, especially during Covid. "The global sustainable fund ‘universe’ pulled in USD 45.6 billion in the first quarter of 2020, compared with an outflow of USD 384.7 billion for the overall fund universe" according to Morningstar.

PwC has predicted that the share of European assets held in ESG investments could swell from 15% today to 57% as soon as 2025, suggesting ESG assets will soon outstrip traditional investment strategies.

And it’s mainly large institutional investors driving the trend. More than 75% of 300 investors surveyed by PwC (including pension funds and insurance companies) said they would stop buying conventional funds in favour of ESG products by 2022.

Increasing data shows ESG funds are out-performing non-ESG ones, especially during Covid.

This table from Blackrock’s website says it all:

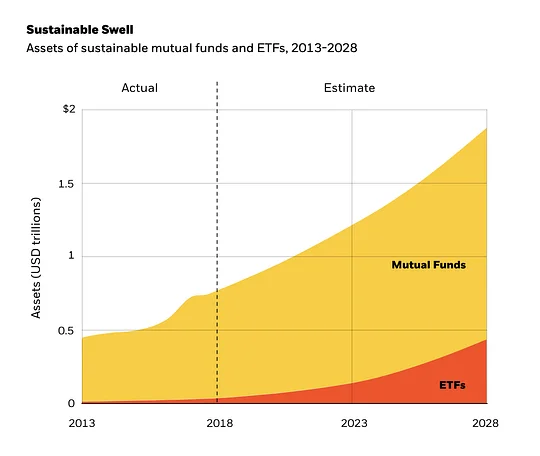

This chart shows the total assets under management in ESG mutual funds (MFs) and ETFs globally. The 2019 to 2028 figures are based on BlackRock estimates, assuming a 5% annual growth rate in the underlying markets.

The fossil fuel free fund (try saying that five times 🧐)

Just last month, Pensionbee launched its fossil fuel free fund, in partnership with Legal & General Investment Management. This fund excludes a number of ethically questionable businesses, including:

Fossil fuel producers

Tobacco companies

Manufacturers of controversial weapons

Violators of the UN global compact mandate.

The fund tracks a new election of ‘climate indexes’, combining expertise in sustainable investment index design and analysis on how the world's most carbon-exposed public companies are managing climate transitions thanks to new targets.

My unfiltered opinion

As public concern for the world around us grows, there are opportunities for FS companies to get on board - and they should do so, fast. For many, ESG is now about future-proofing their brand as much as their products.

I believe two things will help to move the needle and see increased, meaningful contribution from the FS industry.

One is to agree on a definition of ‘sustainable’, which can apply to a broad range of categories; to companies, investments and transactions. This needs to be tighter than referring to the widely misused UN sustainable goals as default. Then, we must apply this definition to a supply chain, so we can calculate the impact of transactions through an end-to-end carbon footprint. These rankings should be normalised and integrated into UI’s, for example committed to a filter in a bank's in-app transaction feed.

For this data to be relatable and digestible for the consumer, FS companies will need to consider how they convey useful snippets of information around our carbon emissions and focus their efforts on designing meaningful user experiences. We need to get used to seeing sustainable indexes as standard.

Younger generations are already interested, aware and ready to consume data that will help them and the environment - 72% of UK millennials and 64% of Gen X-ers say they find impact investing appealing - and getting this right will be as much of a data challenge as a design challenge.

The second thing focuses on the accountability of large institutional funds. While ESG funds might be outperforming the wider market, helping to build a herd perception of progress, this shouldn’t be essential for the industry to take action.

It’s great that pension funds and investment funds are speaking out, but it might be further regulation - not herd sentiment - that will ultimately make the biggest difference to how institutional funds are managed and invested.

For many, ESG is now about future-proofing their brand as much as their products.