What’s going on in African insurtech?

Africa is the second biggest continent in the world with a population of 1.3 billion. It makes up 20% of the Earth’s total land surface. It comprises 54 countries and its people speak between 1500-2000 languages. Not each, obviously.

You’d be forgiven for thinking that a continent that big had a pretty thriving insurance industry. But the penetration rate sits way below the global average - just 2.8% in 2019.

Let’s take a look at why numbers are so low and what the future has in store.

What’s the landscape like?

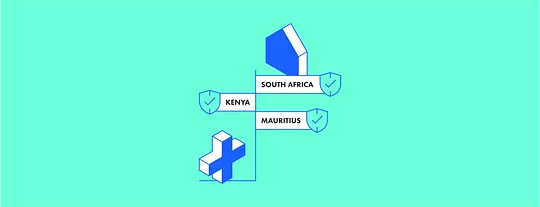

Largely underinsured. There are a few exceptions to the rule - countries like Mauritius, South Africa and Zimbabwe boast rates above 8%. South Africa leads the way with 16%. But the picture is pretty much the same everywhere else. In some countries, it even falls below 1%.

Penetration in Kenya is a lowly 2.3%. The most popular product on the market is motor insurance - a legal requirement. Next is health insurance. As a country steeped in poverty, access is limited. A staggering 35.5% of Kenyans live below the poverty line.

There has been a slight increase in uptake recently. Incurable conditions such as cancer, diabetes and high blood pressure are becoming more widespread among the country’s poorest civilians. And Covid is giving added incentive for people to insure themselves and their families. But progress continues at a snail’s pace.

Why’s uptake so low?

For a variety of reasons. For starters, insurance products just aren’t on everyone’s radar. Added to which there’s a lack of services aimed at specific markets and a general uncertainty about the benefits of insurance.

insurance products just aren’t on everyone’s radar.

There hasn’t really been the massive digital buzz everyone was expecting. You know the one I’m talking about. The surge of excitement when financial services companies start digitising their offerings. Shiny new apps! Paperless correspondence! Well, Head of Digital at Resolution Insurance Kenya Francis Ngari has ‘not recorded an increase in the number of people buying insurance’ in the last year. Kinda pours cold water on the whole ‘great opportunity’ argument.

Another problem is that 70% of GDP in the continent comes from South Africa, which completely skews the market picture. Elsewhere there’s the problem of distribution and accessibility. Despite massive urbanisation over the last 60 years, nearly 60% of Sub-Saharan Africa comprises rural areas.

What’s in store?

That said, there’s definitely a lot of promise on the horizon. Flutterwave, Wave and Kuda have put African fintech squarely on the map with some mighty funding rounds in recent memory. There’s a real appetite for innovation in the FS space.

That said, there’s definitely a lot of promise on the horizon.

The Dawn of the Age of Embedded Insurance offers some additional glimmers of hope. It’s a dead-cert way to address insurance companies’ historical, um, baggage. And it makes the consumer’s life a lot easier. From allowing customers to quickly protect their product to cutting out a lot of - ugh! - paperwork, embedded insurance is a milestone for the industry. Everybody’s a winner.

Bima is a mobile platform providing life and health insurance policies alongside telemedicine. Raising $30 million in funding last year, the startup is active in Tanzania, Ghana and Senegal.

And Safaricom, aka Kenya’s largest telco, is gingerly making a move into the space with a home insurance product protecting electronics and furniture. Whether it pans out is another matter. But when the big players start getting involved, you know it’s time to sit up and listen.

That’s all, folks!

And there it is. A toe dipped into the reservoir of African insurtech. The space is on the cusp of taking off and there’s a lot to keep an eye out for. If you fancy a deeper dive, check out our Insurtech Insider podcast. We’ve got heaps of great content to share. Would you believe it - we’ve even got an episode on insurtech in Africa. Check it out here.