U.S. Millennials: A balancing act of YOLO and debt-induced anxiety

We all know this tale.

U.S. Millennials, the nation’s largest living generation, grew up at a time when America faced its biggest economic challenge since the Great Depression.

When you reach the end of your rope, tie a knot in it and hang on

Franklin D. Roosevelt

They’ve been permeating a broken system that’s turned into a messy, slippery slope of debts, resulting in a trillion dollar student loan crisis. Not to mention, a majority of 18-24 year olds (“young” millennials) have less than $1,000 in savings, with half of those surveyed having no savings at all.

Tuition fee hell

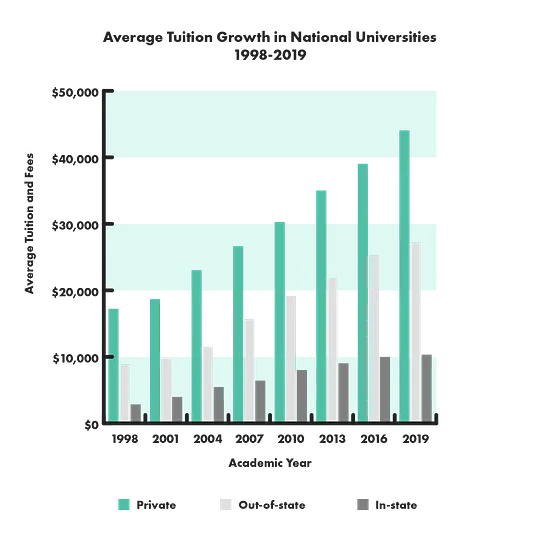

It makes sense, given the amount of money required to pay for tuition is rising every single year—an average of 157% over the past two decades, with more and more students taking out loans.

While it’s become standard to write off this massive generation as lazy, self-entitled hipsters, millennials have now arrived at a pivotal moment in their burdened financial lives, a moment that matches up almost perfectly to the drastic emergence of fintech innovations, open banking technology, blockchain and cryptocurrencies. Coincidence? I think not.

It’s time to recognize that the narrative on millennials is not only wrong, but ignores the key external environments that have brought millennials into their current financial situation.

When you add in the debt incurred by this digital ad-consuming, experience-driven generation; concert tickets, avocado toast, Uber rides and cocktails, millennials in the U.S. now owe an average of roughly $40,000 according to a recent report from Gallup.

Take that in for a second. That kind of debt will affect millennials for the rest of their lives.

Born into financial uncertainty with an aching hunger for more: more impact, more fulfilment, more harmony, more experiences—what on earth do we do?

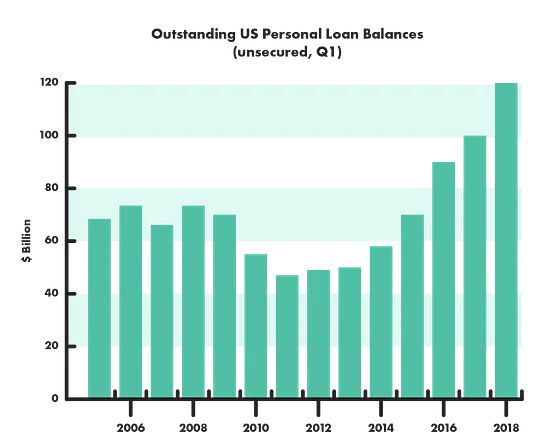

- We splurge on personal loans and we continue to accrue a massive amount of credit card debt from credit cards we opened years ago.

- JPMorgan Chase & Co and OZY found that 1/4 of millennials still haven’t paid off credit card debt incurred during the 2016 holiday season.

- We don’t (and can’t) buy houses. We live with our parents or roommates to save on urban rent prices

- We pick up side jobs (and job hop) whenever possible.

- We aren’t getting married or having kids any time soon and are skeptical of the idea of “settling down”; who can settle down when you think of your future in terms of next month’s paycheck?

- We express our raging frustration of low wages and economic insecurity through pop culture, comedy, film, artistic mediums, music and blogging.

Debt, lies and avocado toast

When you take to Twitter, you’ll discover countless cynical memes as this generation copes through self-deprecating humor:

Alright, I did the math. If I stopped eating avocado toast every day, I would be able to afford a bad house in Los Angeles in 642 years.pic.twitter.com/nqhiqnQ07E

— Kaleb Horton (@kalebhorton) May 15, 2017

Jokes aside, with grim times comes the rare opportunity to redefine what digital banking and financial literacy actually looks like for the growing generations that come after. But to what extent will the industry be shaped by this generation? Will the overbearing debt crisis be the catalyst to millennials taking the reins at disrupting one of the biggest industries in the world?

Most banking products and services in the U.S. are not taking into account the unique user experiences and values millennials have as they navigate through their stressful, unpredictable, fast-paced financial lives. This is one of the many reasons for 11:FS Pulse, a next-generation benchmarking platform that provides access to 1,000’s of real user journeys from fintechs around the world.

If digital banking products and services focused more on guiding millennials through their financial wellness and education instead of their financial obligations, how would they respond?

If US banking service providers can start to focus on that then maybe there’s hope for the future of US millennials finances.