Tweetstorms and testimonies: is Libra the threat bankers think it is?

To say it’s been a busy month for Libra would be a massive understatement.

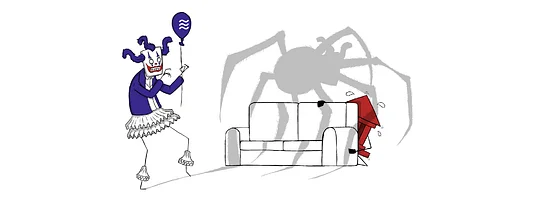

Libra is almost like a test. People tend to see it as whatever they fear most. If you’re scared of scary clowns, Libra is a scary clown. If you’re scared of spiders, Libra is a scary spider. You can see this in the way Europeans have reacted to the potential lack of privacy, central bankers to the systemic risk to the global banking system or how bankers see Libra as a threat to liquidity (which is already pretty strained). Whatever you’re scared of, Libra seems to have something for you.

But what is Libra? Well that’s a bit of a problem, because Libra itself is a bit of a moving target.

Right now, Libra is many different things to many different people.

Only a few weeks ago, co-founder David Marcus unleashed a tweetstorm clarifying Libra’s relationship with existing currencies. Since then, well… all the things have happened. It’s been a period that could define how, or maybe even whether, Libra comes to fruition.

To recap: Mark Zuckerberg agreed to defend the blockchain payments project before the House Financial Services committee, but when he did show up, there was a lot of talk about Facebook’s targeted ads and precious little about Libra. Two Senators sent warnings to major association members before several founding companies, including PayPal, Stripe and Visa, pulled out of the not-for-profit org. Through it all, David Marcus has remained a picture of composure.

Obviously, there’s a lot to unpack. So let’s look at Libra’s recent developments through a few different lenses to give a clearer view of where the association stands and where it’s headed next.

No, really: *what is Libra*?

Right now, Libra is many different things to many different people.

Technically, it’s a private, permissioned distribution ledger. Legally, it’s a not-for-profit registered in Geneva with 21 member organisations. Financially, it started out looking like a stable coin backed by a reserve of assets, but now… we’ll get to that in a sec. For Facebook, Libra is their foray into a payments space that’s already home to mature offerings from giants such as Apple, Alibaba and Tencent.

Essentially, it’s hard to make definitive statements about what Libra is because it encompasses many different things that keep changing. Which brings us to the recent news...

Changes to Libra's financial model

When Libra was first announced in June, it looked a lot like a payment token that was reserve backed. Central bankers didn’t like that. Enter the David Marcus tweetstorm:

‘Libra will be backed 1:1 by strong currencies,’ he wrote on Sept. 16. ‘This means for any unit of Libra to exist, there must be an equivalent value in its reserve’.

A few days later, Facebook announced the original basket would be 1:1 backed with 50% USD, 18% EUR, then GBP, YEN and more. Recently, Marcus raised the idea of having ‘a series of stablecoins’, with each one meant to ‘represent national currencies in a tokenised digital form’. It goes without saying that there are still questions about how exactly each model would work.

A backed model would make Libra more attractive to banks — if you can hold deposits at the reserve, tied to the dollar with customers’ Facebook accounts, why wouldn’t you?

Libra looks a lot less like a cryptocurrency than it did five months ago

But that doesn’t mean bankers will suddenly treat Libra like a cute kitten rather than a creepy clown. Late last week, Nick Ogden raised concerns about the project draining liquidity from banks, noting that no one really knows where the money used to buy Libra will be stored. Banks won’t be able to use that money for mortgages if it’s locked up in Facebook’s coffers, he wrote.

Economists also hate the thing because Libra is making vague statements about how the tokens are pegged. What Facebook isn’t explaining is what happens if something goes wrong.

‘... There is no new money creation, which will strictly remain the province of sovereign nations,’ Marcus wrote.

The takeaway: Libra looks a lot less like a cryptocurrency than it did five months ago. And bankers are still having serious doubts. And Libra is a moving target. Basically, you have to follow the last thing David Marcus says.

On government regulation

In both Europe and the US, scrutiny of Libra is not going away.

A few weeks ago, Germany and France did everything in their power to block it. Their reasoning: a private company, or even a network of private companies, shouldn’t have control over a currency. It was an ‘oh shit’ moment for regulators, who are pumping the brakes and asking for more information.

It remains to be seen if Libra can gain its own voice and momentum.

The probing from the US is even more significant, as regulators there can pressure Facebook in a way the Europeans haven’t so far. The letter from Senators Brian Schatz and Sherrod Brown was the equivalent of saying, 'Check yourself before you wreck yourself'. It has everything to do with Facebook being in the firing line already. For lawmakers, the company’s end-to-end privacy in chat is deeply concerning and has the potential to prevent child exploitation investigations.

Which speaks to a different issue: most people still struggle to separate Calibra and Facebook from the association. In his tweetstorm, Marcus said he’s looking forward to when the Libra Association can speak for itself rather than Facebook speaking for it. Right now, it remains to be seen if it can gain its own voice and momentum.

The takeaway: Officials of all political persuasions are unhappy with Facebook and regulators are taking it out on Libra. This has impacted the very shape of the foundation.

On companies dropping out

PayPal was one of the first names attached to Libra; now, they’re the first to leave. Other payment giants, such as Visa, Mastercard and Stripe, quickly followed suit. The message is clear: anyone regulated or close to being regulated is concerned at this point.

These exits raise more than a few questions. How much commitment was there to Libra in the first place? Were companies poking their heads in to see what their competitors were up to, or was there belief in the Libra mission? Of the names announced at the beginning, how many will really convert?

Basically the genie’s out of the bottle, and everyone’s trying to rub it the right way

Regardless, Libra now has 21 members who have paid $10 million apiece. Bertrand Perez, the association’s COO, estimates it will have 100 members by the time Libra launches. If you do the math, that’s an association with a lot of users and a good chunk of cash.

The takeaway: Libra is well backed. Its partners include companies with hundreds of millions of users apiece and a shared commitment to a new type of consumer-based payment infrastructure. That’s not nothing, but Libra still has imposing regulatory hurdles to clear before it can reassure potential partners.

So what’s next?

For lawmakers and central bankers, the response to Libra seems to be: 'Ah crap, we’d better make our own’.

Two members of the US House of Representatives have raised the possibility of a digital dollar with Federal Reserve Chairman Jerome Powell. Germany’s finance minister has also proposed a digital euro, and central bank digital currency is also on the horizon.

Basically the genie’s out of the bottle, and everyone’s trying to rub it the right way.

As for Libra itself, Facebook seems to be very responsive to concerns about the reserve, but there are still more questions than answers. The specifics of its model, liquidity, partners, the Calibra wallet – all of these issues and more will need to be addressed before banks stop shuddering at the mere mention of Libra.

Struggling to stay up to date on the latest Libra news? Subscribe to Blockchain Insider and never miss another story.