Serving the unbanked in Southeast Asia

There is huge growth projected for digital financial services in Southeast Asia but up to 50% of the population are unbanked and will therefore remain excluded from this explosion.

Digital financial services revenue in Southeast Asia is estimated to grow from $11bn in 2019 to $38bn in 2025.

This growth is huge but isn’t the full realised potential for digital financial services in Southeast Asia. At its full potential, it is estimated that revenue could reach $60bn by 2025.

That’s almost a 60% increase.

So, why is there such a big gap between the estimated growth of digital financial services revenue and its full potential?

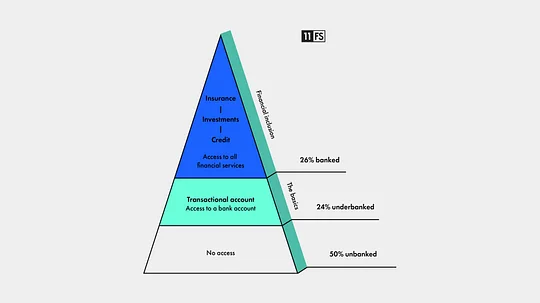

The reason why is that almost 50% of Southeast Asia’s population remain ‘unbanked’. That’s every one in two people, with a further 24% estimated to be ‘underbanked’.

What’s the difference between banked, underbanked and unbanked?

In general, ‘banked’ means having access to all financial services. That’s a bank account and access to different forms of credit, insurance and options for savings, investments and wealth management.

Underbanked is defined as people with a bank account but who still lack access to all other financial services on top of a basic account. The additional services that banked people do have access to.

Unbanked are people who don’t even have access to a bank account.

That’s right. People who are excluded from even a basic everyday bank account.

And because you need a bank account to make and receive transactions and payments from, this means they are excluded from all other financial services that are layered on top of an everyday bank account.

The huge projected growth of digital financial services in Southeast Asia, and the innovative products that come with it, is definitely something to celebrate. But can we truly celebrate this growth if half of the population are excluded from its success?

can we truly celebrate this growth if half of the population are excluded from its success?

So why are people excluded from formal financial services? And what are the barriers to Southeast Asia realising its full digital financial inclusion potential?

Financial inclusion in Southeast Asia varies depending on the country. The market in Singapore is obviously very different to the market in Vietnam which is different to the market in Malaysia and so on. That said, the three countries with the lowest levels of financial inclusion and the highest number of unbanked people are Vietnam (69%), the Philippines (65%) and Indonesia (51%).

Typically, the barriers to financial inclusion are:

Limited access - rural and low-income communities often struggle to access formal financial services because travelling to branches takes time and money.

Financial literacy - low levels of financial literacy and familiarity with financial services results in low adoption.

Gender divides - traditionally women have less access to finance and also less access to technology - and therefore also less financial autonomy that technology enables.

Cash is king - cash payments still dominate in many Southeast Asian countries, especially in rural and low-income communities. One study of digital government payments to low-income Indonesian households found that 82% of recipients pulled the subsidy out in one cash withdrawal.

While the barriers to financial inclusion are complicated, and digital financial services are not a panacea, there are ways to increase the uptake of digital financial services among unbanked populations.

One of these is to increase the number of use cases of digital finance among the unbanked.

Are mobile wallets a key to digital financial inclusion?

More people in Southeast Asia have a mobile phone (73%) than a bank account (50%) and the number of mobile phone users is estimated to grow to 80% by 2025.

The ubiquity of mobile phones is important as it enables everyone to be able to access a transaction account through mobile wallets and embedded financial services on digital platforms.

The ubiquity of mobile phones is important as it enables everyone to be able to access a transaction account

Payments are the precondition for accessing every other type of digital financial service, and the precondition for a digital payment is a transaction account, like a bank account or e-wallet.

One of the most well-known examples is GrabPay which is widely used in many Southeast Asian markets. Ovo, Dana, GoPay and PayFazz are all well-known mobile wallet providers in Indonesia, while MoMo is the most used e-wallet in Vietnam.

Mobile wallets and digital platforms offering embedded financial services can overcome financial exclusion because it increases the number of use cases to use digital financial services and to pay digitally without having to have a bank account.

The more that customers use their e-wallets, the more data can be built around their financial lives which 1) increases access to other products like credit, and 2) increases comfortability with digital financial services in general.

The huge growth projected for Southeast Asia mainly focuses on providing better digital experiences for the banked and underbanked and excludes the unbanked - which increases inequality and expands the divide between the banked and unbanked.

With high - and still growing - numbers of mobile users in Southeast Asia, mobile wallet providers are best placed to include unbanked populations in digital financial services. However, uptake depends on 1) getting technology and data into peoples' hands, 2) increasing the number of use cases to increase usage among rural and low-income communities, 3) technology that is better, cheaper or more efficient than cash to convert more customers, and 4) financial literacy that increases knowledge of, and trust in, digital finance.