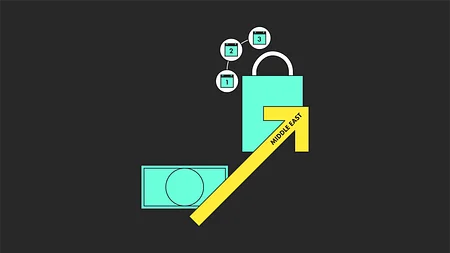

Reaching unbanked migrant workers in the Middle East

Despite the global fintech boom, a lot of people in the Middle East remain unbanked, and there is plenty of work to do.

The Arab Monetary Fund states that almost 50% of the Middle Eastern population is financially excluded, with other sources claiming the figure to be as high as 70%.

A lack of access to financial services leads to inequalities in society and poorer living standards for those that are excluded. Over the course of two articles, we’re going to examine part of the makeup of the unbanked population in the Middle East - migrant workers and women. This first article will focus on migrant workers.

The Middle East is a vast, diverse place but for the purposes of this article, we’re focusing mainly on Saudi Arabia and the United Arab Emirates (UAE).

What financial difficulties do migrant populations experience?

In Saudi Arabia and the UAE, migrants make up a large proportion of the unbanked population. Because of this, they depend heavily on high-fee money exchanges and informal networks to receive their wages and remit home savings to support their dependents back home.

According to the World Bank, the UAE and Saudi Arabia became the world’s second and third highest senders of remittances, transferring $43bn and $35bn abroad, respectively, in 2020. Most of these transfers come from South and South East Asian workers, who account for more than 88% of the UAE’s population and more than 38% of Saudi Arabia’s.

Unbanked migrants usually have to look for physical exchange houses - which incur high fees - wait in long queues, and then return for follow-up visits if problems arise. These exchange houses can be cheaper than banks, but it’s neither safe nor convenient. Plus, even if exchange houses are more affordable, they may still need facilitators from their network to access financial services that require bank accounts and, yep, you bet they come with high fees.

It’s important to remember that migrant workers aren’t a homogenous group. Alongside those working in the construction and hospitality sectors, there are also migrants working in (and living in) households. In cases like this, migrant workers might have no option but to ask their employers for a loan. In these situations, financial support is dependent on their employers. Everywhere you look, the problem is pretty grim.

It’s important to remember that migrant workers aren’t a homogenous group.

Why don’t migrant workers just use banks?

Most migrant workers cannot meet the threshold to access a bank account. For example, many banks in the UAE require a salary certificate from the person’s employer, with a minimum salary requirement of up to AED 5,000. Banks can also request a six-month bank statement and reference letter from the person’s bank in their country of origin, which can be a difficult request to meet logistically. Even when these conditions are met, many banks have minimum balance requirements that incur penalty fees if not met.

Traditionally, banks were the most common (and sometimes only) method of sending money internationally, but they’re expensive. So remittance costs are very high. Fortunately, there are some international initiatives focused on the issue. For example, the IMF has suggested that a fixed fee should be charged rather than a percentage, and the Remittance Community Task Force (RCTF) has pushed for changes in remittances policy.

Inability to access financial services also means that people don’t have records, so banks can’t determine their creditworthiness. This leaves migrant workers vulnerable to services like loan sharks.

Inability to access financial services also means that people don’t have records, so banks can’t determine their creditworthiness.

Fintech to the rescue?

Many fintechs are waking up to the potential of the remittances space. The Gulf countries are ahead of the curve, with 85% of fintech firms in the region operating in the payments, transfer, and remittances sectors.

Rise was established to help migrants send remittances with no-minimum bank accounts, as well as offering financial products like loans and insurance from various financial institutions. Founder Padmini Gupta also founded Xare, which lets people send money globally with just the recipient’s phone number. If people have unused credit card limits, they can also issue credit to their friends. Since launching in January 2021, more than 1 million users across 170+ countries have shared over $350m through Xare.

Dubai-based Now Money is a digital payroll system that enables all employees to have mobile bank accounts. It offers low-cost money transfer options and debit cards without minimum salary or minimum account balance requirements. The app is fully inclusive and available in nine different languages, using text and audio aimed at people with lower literacy skills. Now Money has already signed an agreement with a partner bank in Saudi Arabia.

Hubpay was the first digital financial services start-up to be licensed in the UAE in 2020. It lets people make transfers and payments to friends and family in different countries. Off the back of a $20m funding round back in February, Hubpay plans to expand into new markets across Asia and Africa this year.

Looking forward

Migrant workers in the Middle East have experienced the brutalities of financial exclusion for years. The good news is that a cluster of fintechs dedicated to turning the tide has emerged in the last few years. But this is just the beginning. There is a long way to go, but we’re taking important steps toward banking the unbanked in the Middle East, and a more equal, balanced society as a result.

Want to navigate the financial services minefield and bring cutting-edge propositions to market? We wrote a handy 'how-to' guide. You can check it out here.

How to build a bank

We've popped our learnings into a handy guide that will help businesses navigate the waters of financial services to successfully create truly digital propositions that customers will love.

Download now