New neobanks need to take bolder bets

Do you remember where you were when you first spotted that hot coral card in the queue at a coffee shop? For me, it was early 2016. A short while after they’d changed their name from ‘Mondo’ but still early enough to feel like I was an ‘early adopter’.

This is taken from our Unfiltered newsletter. Subscribe now for a no BS, uncensored analysis of fintech news and hot topics delivered to your inbox each fortnight.

When I finally signed up to Monzo, it was because I’d heard I could use their card abroad as though I was using it at home - no commission, FX charges or ATM fees. What’s more, the whole thing was free, took five minutes and I would never have to go into a branch.

What, I asked myself, was the catch?

It turns out there wasn’t really one. Monzo, Starling and Revolut were simply a fantastic upgrade to the UK consumer banking experience.

Monzo, Starling and Revolut were simply a fantastic upgrade to the UK consumer banking experience.

First mover advantage

By 2017, the neobank craze was in full swing. Dozens of digital only banks started to pop up in the years that followed. One was looking to Revolutionise the European ecosystem by creating an ‘all-in-one’ super app. Across the pond, a plucky challenger was trying to ‘Chime in’ with paycheck-to-paycheck customers.

The first generation of neobanks gained massive traction because they represented a paradigm shift from legacy banking that was truly game-changing. On top of this, they were masters of marketing, achieving virality in ways that no bank had ever managed (hot coral cards, waitlists, communities, etc.).

A drawer full of colourful cards

Then the fast followers arrived and, for a while, it felt like every bus in London had an advert for a new neobank. But it wasn’t clear what they were doing differently. What value were they bringing to their customers that the first generation weren’t?

After finding some early engagement, many fast followers discovered customers were relegating their cards to a drawer along with all the others. Even though their growth in the wider banking market has stalled since the early days, the Big Three (Monzo, Revolut and Starling) still dominate the UK digital banking landscape with a combined 71% of market share.

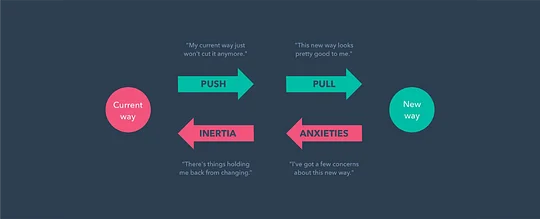

A clue as to why the fast followers failed may lie in the Jobs To Be Done Four Forces diagram, specifically the arrows labelled ‘inertia’ and ‘pull’.

A perception exists among consumers that banking products are annoying to switch from. First there’s onboarding, then you have to wait to get the card, then you have to switch your direct debits and your salary, etc. Even though in practice some markets have made this process far easier, the perception leads to inertia. This means it would take something genuinely persuasive (the ‘pull’) for most customers to switch to regularly using another product.

How to beat switching inertia as a neobank

Maybe the key is not to build a bank at all. One way to ensure your financial product delivers merely incremental value is to build on top of legacy financial systems. If your plan is to make money via net interest margin and overdraft fees, you’re going to have a tricky time putting your customers’ interests first. Eco leverages blockchain technology to align their incentives with their customers’ to build a genuinely differentiated product.

Maybe the key is not to build a bank at all.

Qapital is another example of a challenger which is doing things differently. Instead of focusing on being a ‘neobank for X’, it's making a bold bet on a specific customer job: helping customers to put aside more money for savings. With leading behavioural scientist Dan Ariely influential in product development, Qapital’s features are so laser-focused on this particular job that they’re persuasive enough to overcome switching inertia.

My unfiltered opinion

The inertia around switching bank accounts is real. The Big Three made the biggest step forward in consumer banking for decades and still dominate the neobank market. These days, however, a digital onboarding experience, real-time push notifications and saving pots now feel like table stakes.

In order to cut through, new entrant challengers need to offer a powerful and unique pull. I look forward to seeing how they’ll innovate to challenge established neobanks’ dominance. For more on how to build next-generation financial services, check out our Truly Digital Manifesto.