Best Onboarding Experience

The ability to get users through the onboarding process quickly and painlessly has never been more in demand, with Signicat reporting an average drop-off rate of 52% during the onboarding processes of Europe’s retail banks in 2018.

This is clearly a problem for those who would have us switch accounts, such as the UK’s Current Account Switch Service (CASS), and a full post-mortem of why an onboarding user might drop off would reveal that speed and the format of the process are key components of the experience.

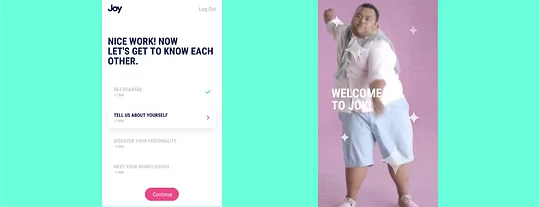

Winner: Joy

In this category, the winner proved that thinking hard about how this crucial experience can be as sticky as possible, as well as introducing new, non-financial elements into the journey, can create striking results.

Joy is a PFM tool which has taken a radical approach to both finance and wellness – and combined these two forms of support into one app. The following quote from their website sums up their mission pretty well:

“At Joy, we work with clinical psychologists, data scientists, neuroscientists, tech experts and financial services professionals to try and connect what’s going on in your wallet with what’s going on in your mood, helping you make smarter spending decisions over time.”

So, how does Joy use its onboarding process to successfully leverage these insights – and keep their users on track - when lots of information is being requested? Their approach has been to utilise a series of different data-entry formats to keep the process fresh, while breaking up the KYC process into four stages to ensure the experience delivers a continual sense of progress. Nice strikethrough text also helps with mentally chalking off these tasks.

The app also needs to get some insight into the user’s personality which it does via call-to-action buttons in the personality assessment questions that activate once the user moves a really playful and interactive slider bar. That keeps the process both interactive and progressive. Further, informal language within a chatbot interface throughout the phased questioning helps to lighten the mood of what is a potentially stressful process.

Not only is Joy great at getting its users onto the platform, its KYC process means that it gains instant insight into these users, which can very quickly pay off in the form of insights. The ability to onboard financial data and psychological data is really unique, here, and wouldn’t work if the process were anything but perfect!

Runner-up: Starling Bank

We were also really impressed by Starling Bank’s updated onboarding flow. The UK challenger current account scene is increasingly competitive , with Monzo switching all its pre-paid cards off, N26 entering the market, Monese offering a great product, and so on. Starling began with an update to its brand, with a great green card and a clean interface to compliment.

The initial stage features a product highlights carousel to get the user excited about the features available once the account is open. A considerate progress update screen details how long the checking of input data should take, which is an enormously valuable commodity for maintaining user interest. The Onfido-powered video and photo identity checks are seamless and instructions are clear. After this is all done, we’ve got instructions as to when the card will arrive, and the ability to get spending right away via a virtual card.

As well as the current account registration, Starling also launched a business account onboarding process which we loved, and a joint account onboarding process that uses Bluetooth to connect the two users. They’ve had to design a lot of creative onboarding flows!

Starling proves that there are always improvements that can be made, even for the challengers, and that constant refinement and iteration delivers a better product for the user. We were really impressed by these journeys.

Be impressed by the strength of the competition over at 11:FS Pulse.