Are card payments under threat? The rise of the A2A payment

Much has been written about how Open Banking has announced itself with more of a whimper than a bang, since going live at the beginning of 2018.

To be fair, a lot has happened behind the scenes, although it’s true that so far it has been a relatively slow burn in terms of customer impact. Some traction has been gained in the Account Information Services (AIS) space — Barclays was the first of the CMA9 to take advantage here and enable customers to view transaction histories from other providers in its app — but very little progress has been made using the ‘other’ strand of Open Banking.

Open Banking also makes a provision for third parties to generate payments from customers’ current accounts on their behalf (with their permission), known as payment initiation, and it remains relatively uncommon knowledge. It enables “account to account” (A2A) payments to be facilitated by licensed providers known as Payment Initiation Service Providers (PISPs). Why should we take notice? Because A2A payments can effectively negate the need for a payment card.

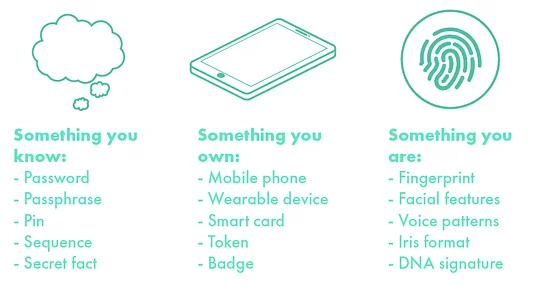

The fact that PISPs remain uncommon knowledge could all change next September when we will see Strong Customer Authentication (SCA) for digital card transactions, brought in under the PSD2 regulations in an attempt to combat online fraud. SCA is a requirement that a customer must prove who they are by demonstrating two of the following three elements — knowledge, possession and inherence — in order to authorise a payment. That could translate to authorising a payment using a thumbprint (inherence) on the one phone with your banking app installed on it (possession).

Some industry experts believe that the extra layer of friction added via SCA marks an inflection point in payments. It will coincide with the introduction of the third and final version of the Open Banking standards, which were in part designed to address the criticisms of poor user experiences. So the Open Banking payment mechanism could become comparable, if not easier, than traditional online card transactions.

And there’s a huge incentive for retailers to make this happen.

Payments initiated through Open Banking are done via APIs connected directly to the bank, taking the card scheme operators and other intermediaries out of the equation. In 2016, £904 billion was spent on cards in the UK. The fees that merchants pay for card processing vary depending on a range of factors, but a typical rate for a high-street business is around 0.7% for debit and 1.3% for credit cards. Payment processors iZettle and Stripe charge 1.75%, and 1.4% + 20p respectively. DIsintermediating these parties could mean a potential cost saving in the tens of billions every year. Merchants who rely on a high volume of card transactions could save through reverting sales traffic via a scaled and useable application of the OB journey...we are talking some serious Christmas trimmings to the balance sheets...

Exemptions to SCA

Now for the science bit….Many in the payments industry were understandably concerned by the extra friction that SCA would bring, and they successfully lobbied for a number of exemptions, namely:

- Low-value transactions of under €30 (unless totalling more than €100 in a 24 hour period..)

- ‘Subscriptions’, where the same amount is paid to the same merchant on a repeat basis

- A risk-based exemption, structured around the payment provider having low fraud rates (a fraud rate below 0.06% will allow transactions up to €250 to be frictionless, for example)

- The final exemption is an important one - customers have the option to ‘whitelist’ various trusted beneficiaries, so after the first payment is made (with SCA), the customer can choose to add the merchant to their whitelist. Whether it will form a smooth customer experience (and who owns the list and what services they derive from the facility...), is another question entirely.

Given all the above, will we see a seismic shift in how we select our payment methods online?

This is the million dollar question (...or £904 billion in the UK). The incentive for merchants and business who see a lot of their sales online is obvious, they will save millions in fees by removing the schemes from the payment flows. However, there is the initial hurdle of customers adopting a new payments solution, even if it is incentivised by merchants on their websites. The schemes might very well put faith in the exemptions allowed by PSD2, especially the ‘whitelisting’ of trusted beneficiaries.

Industry players have different views on extent of the disruption. We have seen speculation that over 40% of all online payments volume will be through A2A mechanisms by 2022 (using Open Banking as a primary tool), while others claim it will be as little as 3-5% in the same period. Could it be that the latter perhaps have a vested interest in the stability of current payment methods?

To many, the ideal end situation looks like the Swedish market and the joint bank initiative Swish, which currently has over 6 million users. That said we must remember that using Sweden as a barometer is slightly unfair given their cultural aversion to cash BUT it does show there is customer mass demand for real-time, easy payments.

Stripped back A2A payments will be cheaper for businesses; card processing fees which eat into profit margins can be removed from the equation. These savings could be passed onto the customer (*scrunches face in skepticism*), or more realistically split between the PISP, merchant and then, hopefully, the customer. Before being banned, it wasn’t uncommon to see a surcharge for paying by card - could we see an “A2A” discount across the board?

The argument can go either way, but where there are substantial savings to be had, don’t bet against merchants and big businesses pushing the Open Banking payment bandwagon to customers and a rocket of adoption ensuing forthwith.

This article was written by Adam Davis in collaboration with Toby Whitlock an FCA associate who's on secondment with 11:FS.

If you want to hear more of Adam’s views on Open Banking check out the roundtable discussion he was on with some of the best experts there are.