Best in class SMB financial services

Introduction

Financial institutions (FIs) very rarely offer products and services that are truly tailored to the needs of Small- and Medium-sized Businesses (SMBs). Whether that’s bank accounts, access to credit, suitable payments products, insurance, capital management, or foreign exchange, most “SMB products” are either stripped down versions of corporate products, or overpriced versions of consumer ones.

These issues of provision, and the efforts of an increasing number of startups to fill this gap, have been covered extensively by the media and research houses. 11:FS has also covered the area in its podcast series in partnership with Xero.

What is less commonly discussed is what SMBs actually want and the broader problems these firms face in running their businesses. This report aims to dig deeper into what SMBs need to operate successfully – and by that I mean not only financially, but also emotionally, efficiently and productively. SMB owners often run high growth, revenue-generating businesses, but are unhappy because instead of spending time running their firm, they spend all their time doing admin. One major cause of this situation is the need for SMB owners to make millions of decisions, everyday, but with incomplete data sets to go on.

That’s a situation that can be eased by intelligent services built into financial products that make SMB owners’ and employees’ lives better.

Intelligent services solve problems, or get jobs done for people, without that person having to coordinate the moving parts or make as many decisions. A generic example would be using Uber to get home – you no longer have to find a taxi number, call the taxi office, work out your exact location, figure out which taxi is yours, tell the driver your address and stop at an ATM for cash to pay when the card machine is “broken”. Instead, you just tap your phone and all of the above is done for you. Let’s be clear, Uber on its own didn’t make this happen, it had to integrate with Google Maps, Braintree and Stripe, among others, to create this service, but as far as the customer is concerned, this is Uber fulfilling their need.

You’re juggling lots and lots of balls but one of them is actually more like a knife

Caroline Plumb, Founder and CEO of Fluidly

This is what we need to see more of in SMB services. SMB owners have less time than almost any other group in business, largely because they have to coordinate so many moving parts without assistance. Those parts can include HR, invoicing, payments, managing suppliers, accounting, buying insurance, applying for credit, tax returns, customer service and stock management among a myriad of others. Most don’t have the money to employ others to do these jobs for them, nor – ironically – the time to try and purchase individual software programs that could save them time and ease decision making. SMBs need services that offer an “autopilot” for the operational and financial aspects of their business, leaving owners free to focus on its actual running.

The root of the problem

Running a successful business boils down to the need to make the right decisions. But in order to do that, the decision maker needs access to all the relevant data in order to have a clear view of the state of the business at that point in time. The ability to make broader decisions often hinges on the ability to get an accurate picture of the business' financial position. According to David Brear, CEO of 11:FS, there are three key financial data sets that businesses, including SMBs, need to have available to them in order to make the most informed decisions.

Right now, most SMBs only have access to one or two of these data sets, and more often than not they are inaccurate. So what’s getting in the way?

Banking Data

Banking data comprises of transaction data and is the building block on which other data sets are built. It should show how much money the SMB has in the bank and how much it owes, but getting a complete picture is often not as simple as it should be.

Lack of real time information from banks

SMB bank accounts typically offer no more functionality than a retail current account. That means that balances don’t update in real-time, with payments taking days to leave an account, and even longer at weekends or over public holidays. SMBs, therefore, rarely get an accurate picture of their finances, especially if they are making large numbers of transactions or paying in takings on a daily basis.

Transaction categorisation

Transactions in current accounts from big banks are listed by merchant, leaving the SMB to sort them into categories of spending. That’s typically done when accounts are due to be filed or tax returns are due and requires the SMB working backwards to try and remember what each purchase was for.

Inability to get a full overview of all accounts

Despite the promise of Open Banking and PSD2, we have yet to see banks providing any account aggregation services for SMBs. In fact in the UK only one bank has so far offered any kind of aggregation service at all, HSBC’s Connected Money, which is for retail customers. Arguably, SMBs are in as much need as retail customers for such services, given they often have multiple products from multiple providers as they seek to find the best products for their needs. At the very least, most will have both a current account and a credit card. Without being able to see all their balances in one place, SMBs run the risk of missing transactions and will have an incomplete view of their finances.

Accounting Data

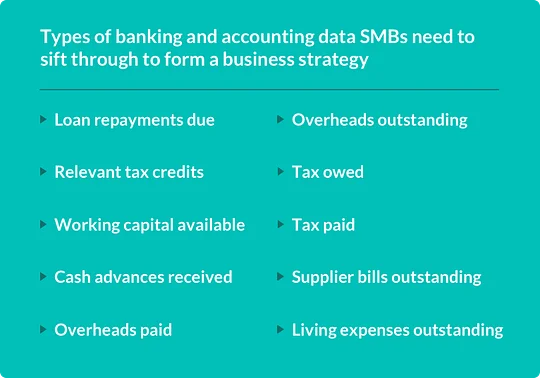

Accounting data is data regarding the business’ broader finances that is combined with banking data by an SMB to create forward-looking financial forecasts and a business strategy. For smaller companies “accounting” is often as basic as ensuring income and expenditure are recorded and transactions are categorised. For larger firms it can include managing payroll, different types of taxation and multiple forms of credit. This is the dataset most prone to gaps and inaccuracies for a number of reasons outlined below.

Manual financial management

Or to put it another way, spreadsheets. Many SMBs are managing their finances using spreadsheets or (in extreme examples) pen and paper. These methods are hugely prone to human error – numbers can easily be entered incorrectly or not kept up to date. It’s also incredibly time consuming as figures are transferred from paper invoices, bank statements, bills and other primary sources.

Invoice sending and chasing

Ensuring that invoices are accurate, and sent and paid in a timely fashion, often falls to a system of phone calls, letters, emails and even in some cases faxes, that are sent when someone finds the time. Such a solution means that invoices can fall through the gaps, not being chased on time, or even worse not being sent. The result can be a set of books with significant holes in them.

Late payments

The above problems often stem from how SMBs are forced to manage their accounts, but there is another issue faced by these firms which is out of their control. SMBs typically operate on shorter payment cycles than their larger customers, which is problematic when it comes to accurately managing what has come in. For context, small businesses in the UK are owed on average £6,142, mostly by larger firms not paying them for goods and services on time. That can make it nearly impossible for SMBs to accurately predict what funding is coming in at what time.

Business Strategies

The time taken handling all of the above prevents SMBs from spending time on developing a comprehensive business strategy. Without a business strategy what should be simple decisions become fraught with stress and anxiety.

Unexpected expenses

Poor accounting data, for whatever reason, leaves SMBs particularly vulnerable to unexpected expenses. Either they are unprepared for a scheduled bill, or don’t have enough information to decide the best way to cover a sudden outgoing, such as replacing a piece of machinery. That could result in an SMB taking out a high interest emergency loan, rather than exploring a more efficient way to plug the gap.

Hiring

Knowing whether to hire an employee when you don’t know your short, medium and long-term plans can be nigh on impossible. SMBs may need someone immediately, but how will they know if they will have work for that person to do in six weeks time, or how they will find the funds to pay them in six months? All firms – small, medium and large – need hiring strategies, otherwise employing people becomes a game of roulette.

Applying for credit

SMBs looking to apply for a loan, whether from a bank or a startup, will need a detailed business strategy if they are to stand any chance of success. Time taken on administration prevents them even thinking about if they want to expand, let alone how they will fund such growth, and so it becomes a vicious circle. And even if the SMB owner miraculously finds extra time in the day, the holes and inaccuracy in its banking and accounting data would make putting together a strategy a bank would accept nigh on impossible anyway.

Managing assets

The same goes for efficient management of assets. As mentioned, SMBs often need unexpected access to funds, so they are already wary of locking spare capital up in investment strategies to start with and instead keep it in current accounts. While the funds may not be working for the SMB, they are at least available in the event of an emergency. At the same time, they don’t know when they might need it because their banking and accounting data is inaccurate. All in, most SMBs’ capital management is highly inefficient while larger corporations, with departments and teams of people to plug gaps in data, get access to broad investment strategies that let them make the most of any spare funds.

You can hire an accountant and a bookkeeper but they aren’t making strategic decisions, only operational.

David Brear, CEO of 11:FS

What solutions are out there for SMBs?

Some SMBs have the money to outsource the management of their bank and accounting data, but these data sets will remain disparate even if they are being managed by a single person because that person will be missing the third part of the puzzle – the business strategy. The smallest businesses, like sole traders, often don’t need anything sophisticated but do need help with basic accounting and forecasting. But all SMBs need services that link their data together, automate operational decisions and provide them with adequate insight to make strategic ones.

There are a number of firms that are starting to create these links and provide services that are closer to being intelligent – but none has perfected it yet.

SMB banking+

All SMBs, down to sole traders, need somewhere to hold their money. The best SMB products available today combine banking services such as holding and moving money with basic cash accounting or bookkeeping features that automate some tasks.

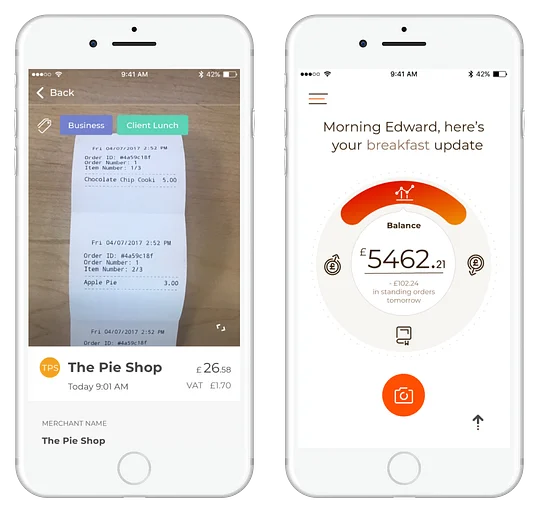

UK firms Tide and Coconut provide most applicants with a sort code and account number minutes after the user applies for an account: a significant improvement on the time taken for most legacy banks to open an SMB account. Once the account is up and running, transactions are automatically categorised, again saving businesses a huge amount of time. If required, transactions are then automatically fed into the SMB’s accounting software every 24 hours, a feature that’s rapidly becoming a hygiene factor. With Tide, users can also generate invoices and apply for a loan (via partner iwoca) in app or via their desktop interface. Loans can be approved and paid out in as little as five minutes. Additionally, Tide offers the option of multiple cards linked to the same account which can be managed by a designated staff member in app. It targets sole traders along with SMBs registered with the UK’s Companies House (limited businesses).

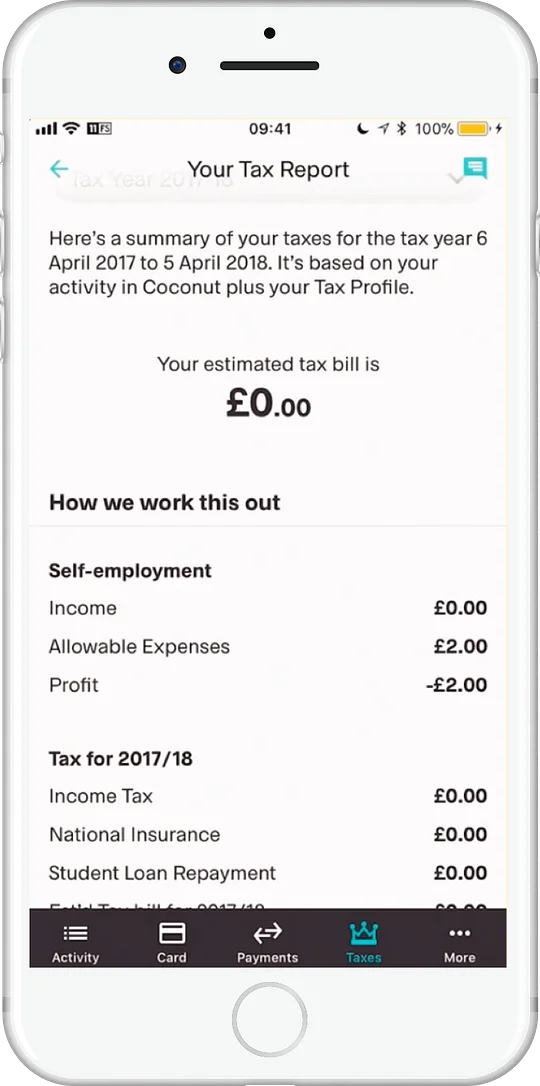

Coconut offers receipt capture, tax estimates and tax reports for its sole trader customers. Its premium offering, targeting sole traders and limited businesses, will offer invoicing, the ability to connect accounts from other financial service providers, to share access with an accountant and VAT management.

Coconut’s Tax Report Interface

Asto (currently in beta) is a Santander-backed product focusing for now on “micro businesses” (up to 10 people). It offers receipt capture and tagging for easier transaction management, as well as a snapshot view of finances, including upcoming incomings and outgoings from a customer’s Santander account. Other accounts and services such as access to credit will be linked using Open Banking APIs in the near future.

The need for practical products and services tailored to SMBs’ needs is widely accepted, but SMB owners also need support more broadly. Asto’s creators found that running an SMB is often an isolating experience, and that many owners and managers would relish the creation of an SMB owners’ community.

Asto aims to create a community of SMBs on its platform, where people can share experiences and advice, as well as request the features and product they would like to see the tech business launch next.

Why they are different

These services, along with those from the likes of Penta and Azlo are designed specifically for SMBs. Interestingly none of the above have their own banking licenses, allowing them to focus on functionality, and how to differentiate their services from one another, rather than getting bogged down in compliance.

By automating some of the functions of basic accounting (e.g. transaction categorisation) they save sole traders, SMB owners, or the person handling their finances, valuable time.

Asto’s Beta App

Features like estimating tax payments go one step further, and are the type of intelligent services that give SMB owners valuable insight into what’s coming down the road. That enables even sole traders to devise more accurate business strategies. That’s a huge market that can be targeted when you consider 4.3 million, or 76 percent, of SMBs in the UK, don’t employ anyone. In the US, it’s around 22 million – 79 percent.

What’s next?

A service that aggregates of all a customer’s financial products in one place and provides an automatic overview of financial position would be useful to many SMBs. Especially if it results in nudges that prompt better financial management and suggestions for additions or updates to a business’ strategy. Integrations with a wider range of third parties, for example relevant regulators or tax authorities, and automating reports to those bodies would reduce manual mistakes being made in form-filling, and in some cases the need for an accountant at all. These are the type of intelligent services that can significantly boost a company’s efficiency.

Accounting+

Larger SMBs with more complex finances often decide it’s worth spending money on digital accounting software, whether alongside or instead of an accountant.

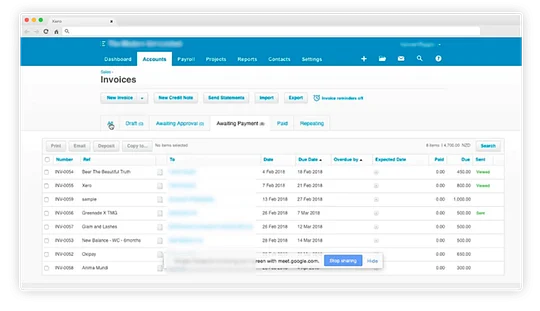

The advances in this area over the last 10 years have been huge, led by the likes of New Zealand’s Xero. It launched cloud accounting software for SMBs in 2006 and over the years has expanded its product suite and formed partnerships with a large number of other software applications in order to offer a wider range of services to its customers such as HR and expenses management. Xero has already started to move into financial services by offering payment tools and credit to its customers through partnerships with the likes of Stripe and PayPal, and is poised to move deeper into the space.

Xero’s Invoice Dashboard

Why Xero is different

By providing access to a wide range of services and integrations to software an SMB might already be using, Xero is combining bank and accounting data in once place as well as offering value added services. It gives larger SMBs a digital business hub that means those firms need only go to Xero to get all the information about their business they might need. That could make them a threat to banks, as customers engaging less frequently with their account providers typically leads to decreased loyalty and fewer opportunities for the bank to market them additional products. Customers are also exposed to a huge range of services, including financial ones, through Xero, making it less likely that they will go directly to their bank for products like credit.

To combat this effect the banks are working with Xero to find new ways to serve SMBs with digital products and services. This is particularly true in the lending and credit space, where licensed banks have an advantage over startups in the form of their lower cost of capital. That’s because they are able to hold customer deposits which they can then lend out, as opposed to having to find lines of credit or sell loans onto third parties through a marketplace.

What banks have struggled with is streamlining and digitalising their processes in this space, and that’s an area where Xero is well placed to help them. That suggests jointly developed products will serve both SMBs and banks well, and ultimately that’s good for Xero.

Other players in this space

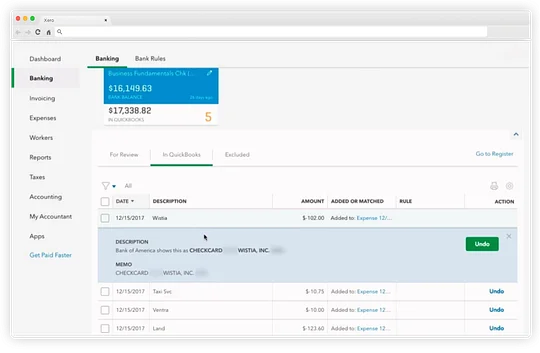

Intuit-owned QuickBooks is arguably Xero’s main competitor. It also serves SMBs directly along with accountants, and offers them a selection of third party services via a marketplace model. It has a two tiered system – its closed platform features only a few partners selected by QuickBooks which it then promotes to its users. For SMBs looking for a wider choice, there's the open platform where third parties of all kinds can offer services to QuickBooks customers. Like Xero, it has built a powerful ecosystem that means for many SMBs it is their only regular point of contact with their finances.

There are many other accounting platforms out there targeting SMBs, but as far as I’m aware, none have ecosystems, agility and innovative mindsets to match Xero and QuickBooks and are therefore unlikely to take the lead when it comes to intelligent services.

Quickbooks’ Bank Account and Credit Card Management Interface

What’s next?

Once open banking gets into full swing, accounting platforms will be able to move even further into financial services and start to provide SMBs with data to inform their business strategy. Should these firms wish, open APIs will also enable them to generate and hold the bank data itself, rather than waiting for the bank to send it across. Eventually they will be able generate payments on a customer’s behalf.

This all makes it easier for them to become the SMBs’ single source of data for making those all important financial decisions. That said, we are still a long way off a fully realised version of open banking and it may well be that the accounting platforms and the banks partner to create a joint solution before that happens.

The final piece of this puzzle will be when Xero and its competitors can create effective business strategies for SMBs, suggesting when the best time to hire a new employee or expand office space is.

Cashflow & forecasting

Those SMBs that use accounting software typically find it helps with the day-to-day management of their finances, but not with accurately forecasting what is coming down the line. These firms often cannot afford to hire someone with the relevant skills to help them forecast and are therefore left with a gap where facilitating a business strategy is concerned.

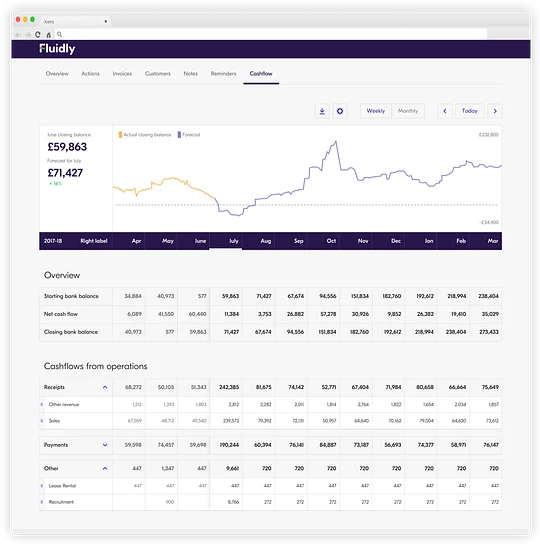

UK-firm Fluidly helps solve this problem by working with accounting platforms such as Xero and Quickbooks to provide SMBs with an “intelligence layer”. Fluidly ingests both bank and accounting data sets, and then uses that data to automatically model a business’ cash flow. It does this by analysing all the business’ historical data (the average SMB has around 25,000 transactions in their accounting system of choice) and presenting the business owner with a financial forecast.

As transaction data grows, the forecast becomes increasingly accurate. This form of forecasting makes it easier for business owners to confidently make decisions and develop an appropriate business strategy. SMBs can also use Fluidly to show potential outcomes of a business owner’s theoretical actions to very quickly see whether those decisions are the right ones for the business. As Caroline Plumb, CEO and co-founder of Fluidly says, “forecasting is basically the gateway to financial decision making”.

Fluidly's Financial Overview Dashboard

Why Fluidly is different

Giving SMBs access to tools that make forecasting easier can have a huge impact on the way the business is run, enabling better future proofing and operational efficiency. Fluidly aims to augment SMB owners and managers, rather than replacing them by automating parts of the forecasting process via what Caroline calls “Autopilot”. It removes the need for calculations to be done in spreadsheets (the most common alternative) which has the dual effect of saving businesses time and reducing the chance of errors made in manual calculations. Fluidly also provides significant value to the business by helping them make better decisions, and in some cases facilitating decisions which would previously have been impossible.

Other players in this space

Barclays UK offers its SMB customers cash flow services via its SmartBusiness Dashboard which connects to accounting, HR, analytics and marketing apps with the aim of becoming SMBs’ financial hub. As yet it doesn’t connect to accounts from other providers. Meanwhile Strands is working with Mastercard on its Business Financial Management (BFM) software which provides SMBs with tools to help with invoice management, cash flow analysis and budgeting.

There are also a large number of smaller players all over the world in this space, too many to name here, but some of those recommended by Xero, alongside Fluidly, include Fathom, Spotlight and Futrli.

What’s next?

Fluidly’s product roadmap includes real-time transaction monitoring, and notifications and alerts to let SMBs know if something out of the ordinary is happening. Such features enable business owners to focus on their business strategy and means less need to constantly check in on their financial position. However, for forecasting services to be truly intelligent they will need to be deeply integrated with other products and tools such as accounting software or the new SMB bank accounts. As with all intelligent services, it should also be understood that not all SMBs will need everything, and the best providers will be able to tailor their offerings to suit all needs automatically.

What's next for SMB financial services

The areas outlined in this report by no means cover every aspect of SMBs’ financial lives but are aimed to give guidance as to where problems lie and how some firms are working to solve them. There are also some other factors that providers in this space should be watching closely if they want to make sure their own offerings are useful and relevant to SMBs.

Open Banking

In Europe the creation of open APIs that can be used by different parties in the financial system to access customer data or carry out actions on their behalf is being driven by regulation. In the UK, the rollout of Open Banking rules started in early 2018 for consumer accounts, and will soon also apply to SMBs. Some banks are already experimenting with APIs, typically in partnership with accounting platforms like Xero and QuickBooks. As Ed Berks points out in the clip above, Open Banking creates a wealth of opportunity for providers to create new and improved SMB financial services.

In the US there is as yet no regulatory requirement for banks to build APIs but a number, including Capital One and JPMorgan Chase, have created them and are again working with the big accounting platforms to explore where they can be used to facilitate better products for smaller businesses.

Government Initiatives

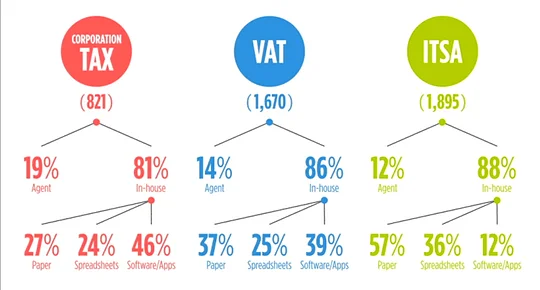

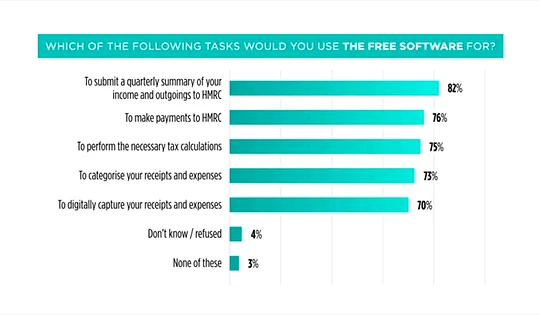

HMRC, the UK’s tax office, initiated a scheme to make it easier for SMBs to submit tax returns back in 2017. The Making Tax Digital scheme is intended to reduce the time taken to complete tax returns, as well as enable businesses to submit relevant data to HMRC as and when ready, rather than having to sit down and sort through everything once a year.

This scheme should stimulate financial services providers to make it easier for SMBs to gather and hold all pertinent data in one place that’s easy to access and navigate. In turn, that will help other providers develop complementary services that can make best use of that data, for example in the business strategy area. Additionally, in the UK, as result of RBS’ bailout the bank has been forced to set aside a fund of £775 million to boost competition in the SMB banking market. £425 million will be divided up between challenger banks some time this year, while £350 million is going to be used to encourage SMBs to switch away from RBS. The latter fund is the one service providers should be keeping an eye on, and prepping to take advantage of once the campaign starts.

What it takes

- Listen to your customers. Don’t assume you know what they want, ask them. The approach taken by Asto of building a community is a great idea and will likely lead to faster adoption of its products.

- Think beyond the basics. SMBs rarely have departments, instead it’s often one person doing everything – typically the owner. Think in terms of Jobs To Be Done, or end-to-end journeys to create really valuable products.

- Keep it simple. As has been repeated throughout this report, SMB owners’ most precious commodity is time. They will not use your product if learning to use it is time consuming and complex. Start with a standout feature and go from there.

- Transparency wins. Charging fees will be necessary at some point along the road, but that’s not the end of the world. Follow Tide and Coconut’s approach and make them simple and transparent and you’ll find customers willing to pay for excellent products and services.