The Evolution of the UK Savings Market

Introduction

In 2018, UK consumers were more likely to be borrowers than savers for the first time in nearly 30 years as average outgoings surpassed income, according to the Office for National Statistics. This shift towards borrowing more and saving less has mainly been driven by high living costs, slow wage growth and the interest rate – which has been at or near a record low since 2009.

In its simplest form, saving can be defined as income not spent. When we talk about saving in the context of personal finance, we are referring to the action of putting aside money for future use. Saving is a fundamental aspect of money management, but one that many people struggle with. In fact, 46% (12.6 million) of UK households have either no savings or less than £1,500 in savings, based on data from The Money Charity.

Many consumers are struggling to save.

The recent fintech revolution has sparked innovation across all aspects of personal finance, not least the savings market, where there’s been a substantial increase in the number of solutions targeted specifically at consumers who need help saving money. New digital savings propositions are being developed which attempt to get to the heart of why people want to save whilst also addressing the hurdles that are perhaps getting in the way of their saving as effectively as they could be. Alternative providers are challenging the customer mindset and offering products that bridge the gap between understanding how to save money and doing it in a sustainable way.

The purpose of this report is to take a detailed look at the UK savings market and consider how it is evolving to better meet the primary needs of retail customers. I will discuss how the competitor landscape is becoming more diversified, driven by increasing demand for digital solutions and a greater willingness amongst consumers to consider alternative financial providers. Examples of some of the most innovative new savings propositions will be explored in detail, focusing on how they are changing consumer attitudes towards saving and helping people to establish more positive savings habits.

Retail customer savings needs

Different people have different motivations for saving, typically dependent on factors such as age, employment status and financial situation. A young person in temporary employment, for instance, is going to have different savings needs and goals to an older and more affluent person with a more stable income.

Savings account providers must therefore recognise individual circumstances and consider a broad spectrum of customer needs if they want to develop and deliver effective solutions that cater to a variety of demographics.

Why do people open a savings account?

I've identified three primary drivers for opening a personal savings account:

- To increase personal wealth

- To store funds in a safe and easily accessible place, and

- To build up a separate savings pot, generally for a specific purpose or goal

Customers’ individual needs are also affected by how great a deposit they have to start with and how regularly or easily they will need to access the funds once they have been deposited.

The savings market has historically been dominated by the big incumbent banks, which have tended to offer products that fail to meet these primary needs. Accounts with minimal interest rates, complex terms and limited flexibility have long saturated the market – leaving savers feeling apathetic and struggling to achieve their goals.

1. To increase wealth

Saving to grow deposits.

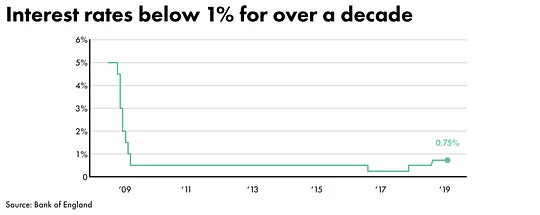

For many people, the primary function of a savings account is to generate interest on their existing deposits and grow their wealth. However, over the past decade, the UK savings market has had very little to offer consumers in the way of interest rate rewards. This is mainly due to the persistent low interest rate environment that’s left the Bank of England base rate languishing below 1% since 2009. This situation doesn’t look set to change anytime soon, particularly as ongoing Brexit uncertainty further weakens economic growth and slows inflation, prolonging low interest rates for the foreseeable future.

National interest rates are not the only factor impacting the returns offered on savings accounts. Beyond individual bank decisions, another major factor is the type of savings account in question.

Personal savings products typically fall into one of five categories in the UK: instant-access accounts, notice accounts, regular savers, ISAs and fixed-rate bonds. Each account comes with different rates, features and restrictions; for example, fixed-rate bonds typically require the account holder to lock their money away for at least a year, whereas an instant-access account has no minimum term. Generally, the easier it is to access funds held in an account, the lower the interest rate.

Average interest rates have been steadily falling across the majority of product categories. The average easy-access rate now sits at just 0.64%, with some providers offering well below this. HSBC’s Flexible Saver, for example, pays only 0.15%. Long-term rates are not much better, with the average cash ISA paying just 1.41%, a two-year low according to Which?. If we put these rates into the context of inflation, currently measured at 1.5%, it’s clear that there aren’t many savings accounts on the market which are actually outperforming price growth.

2. For security and convenience

Saving for security.

Although chasing a market-leading interest rate is important for some customers, it’s not everyone’s priority. There are many people who are comfortable with earning less of a return on their savings – described as being ‘actively inert’ in a report by Fairer Finance. These people are fully aware that they could be earning more on their money elsewhere, but choose to stay put as they believe there would be materially little benefit to moving or are put off by the expected hassle. In fact, only nine percent of savers switched their easy-access account to another provider over a three-year period, research from the FCA shows. For this group of customers, there may be other factors which they consider more important than the interest rate when selecting a savings product, such as how easily they can access their funds.

Saving for security is one of the primary reasons why many people open a savings account, as it provides them with a safe place to set aside an emergency fund. Moneyfacts recommends saving up at least three months’ salary just in case individuals need to cover any unexpected costs, such as car repairs or a new washing machine. It’s essential that this emergency money is secure and easily accessible in an account that won’t penalise the customer for making a withdrawal. In this case, an easy-access savings account is a logical choice.

Despite the lower returns associated with easy-access accounts, they represent the most popular type of UK consumer savings product by far, even for those with significant savings pots. Over the last two years, the amount held in instant-access accounts has increased whilst the amount deposited in fixed-rate and notice accounts has fallen. This is partly due to the fact that easy-access accounts can be opened with a minimal deposit (usually just £1), but also suggests that a significant number of people value the flexibility of anytime withdrawals above receiving a higher interest rate.

Many consumers also find it difficult to budget and save money effectively due to inconsistent or irregular incomes. This may be the result of being self-employed, on benefit, or on a temporary contract. Temporary work is becoming increasingly common in the UK due to the growth of the gig economy, where companies employ freelancers on flexible, short-term contracts. This type of work can make it difficult for individuals to assess whether they’re in a position to set aside money into savings. A key need for these customers is to have an account offering unrestricted and fee-free deposits and withdrawals to suit the flexible nature of their employment and to give them greater financial security.

3. To reach their goals

Saving for something big.

For some savers, the primary function of a savings account is to act as a separate pot where they can set aside money they would otherwise be tempted to spend. In this case, customers are often looking to save money for a specific purpose or goal, such as buying a house or going on holiday.

The nature of the goal should determine the most appropriate type of account. ISAs, for example, are a popular choice for long-term commitments like buying a property, as they can provide tax-free interest allowances and cash bonuses (as in the case of the government Help to Buy ISA). For a shorter-term goal like a holiday, a notice account is a better option, as it’s likely to offer a higher rate than an easy-access account whilst still allowing withdrawals at relatively short notice (typically 30 to 90 days).

In these examples, the customer’s ability to withdraw money is restricted, which adds a layer of “positive friction” (i.e. beneficial extra steps in the user journey), thus making it difficult for them to spend their money on other things. That said, the fact that the volume of deposits in these types of restricted access accounts is decreasing suggests that despite the variety of savings products currently on offer, they are not meeting the needs of customers looking to save for a specific purpose.

There’s been a lot written about the behavioural economics of saving, specifically the idea of categorising money into separate pots for defined purposes – also called mental accounting. When people assign money to a recognised goal, such as buying a car, they are shown to be less likely to use it to pay for something else, even when the money is easily accessible. Later in this report, I will discuss this topic in more detail and provide examples of new fintech propositions that have been built around this specific consumer savings behaviour.

The UK competitor landscape

Much like the rest of the UK retail banking sector, the savings market has long been dominated by the big six – Barclays, HSBC, Lloyds, Nationwide, RBS and Santander. These large personal current account providers have tended to hold an advantage when it comes to attracting savings deposits, as many consumers – driven mainly by a desire for convenience – typically use the same provider for their current and savings accounts. As many as 56% of current account holders also have a savings account with their main bank, according to the FCA.

In recent years, there have been several attempts by smaller providers, such as Virgin Money and Metro Bank, to break into the savings market and challenge the dominance of the major brands. However, their success has been limited, attracting a relatively small number of savers and failing to significantly dilute market concentration.

How is the landscape changing?

More recently, we have seen an increasing willingness amongst consumers to consider newer providers for their personal finance needs - kicking off some diversification in the market. Digital challengers, including Monzo and Starling, have been steadily taking current account customers away from the incumbent banks for a few years, according to recent figures from the Current Account Switching Service. This trend is also starting to present itself in the savings market, where the big banks’ overall market share of savings by value and by new business is falling.

New savings account providers are gaining traction due to their ability to better meet customers’ needs with convenient, digital-first solutions. These challengers are doing particularly well in capturing those customers primarily driven by a desire to increase their wealth. The lack of basic return offered by the major banks has prompted many savers to open accounts with digital providers, such as OakNorth and Marcus, which are typically able to offer better savings rates than the incumbents due to a lower cost base.

Digital challengers are winning customers.

OakNorth consistently offers some of the best personal savings rates in the market and has grown substantially since its launch in 2015. It has proven popular with a more affluent demographic and has established a strong customer base with higher-than-average account balances. Marcus, an online, easy-access, high-interest savings account by Goldman Sachs, is another example of a digital challenger that has successfully penetrated the UK market. Since launching in the UK in September 2018, it has attracted 350k customers and $12bn in deposits.

New product innovation

The competitor landscape is becoming increasingly diversified and the choice of savings products available to customers is growing steadily. A variety of new propositions have recently launched, looking to address key customer savings needs in more innovative ways than the incumbent providers. Rather than rolling out another version of the same savings account with a 0.1% variation in the interest rate, these new entrants offer products that approach saving from a different angle and encourage people to change their attitudes and approaches to saving.

Different innovation themes have emerged across the UK savings market and I’ve selected three to focus on in this report – Automation; Savings Goals & Pots; and Marketplaces. The following section will examine some of the most interesting and inventive savings propositions relevant to each of these themes, with a key focus on how they are better meeting the needs of customers.

What are the key themes?

1. Automation

Automation of processes is well established within financial services, and customers are typically already comfortable with the concept of automated payments such as standing orders, which move a set amount of money from one account to another on a regular basis. By automating elements of their finances, people no longer need to remember to manually make important payments and money will appear in the right places with minimal customer input. Automation is most commonly used in the context of bill payment, but more advanced technology is increasingly allowing automation – powered by customisable rules – to help drive consumer saving.

When it comes to saving, a major problem for many people is that they forget to save or don’t put aside money at the right time (i.e. when they get paid). A common piece of advice is to “pay yourself first”, whereby you transfer money to a savings account every payday, rather than waiting to see what’s left at the end of the month. This theory is logical but constrained in practice; it can be difficult to calculate an affordable amount to save up front, particularly for people with uncertain or irregular incomings and outgoings.

With these common pitfalls in mind, I’ll now go on to explore some of the new propositions using the power of automation to simplify saving for consumers.

Plum is an example of a simple, customer-centric product which uses automation and nudge tactics to change people’s saving habits, estimating it can make users up to £186k better off over their lifetime. Behavioural science principles have been integrated into the product design, meaning that Plum understands how its users might forget to save, find it difficult to work out how much to save or simply lack the willpower to put money away. It is easy-access, so it meets the needs of those who might need to retrieve their savings quickly and also caters well to those on unstable or flexible incomes.

The first step to using Plum is to link it with your bank account via a secure API. Through this connection, Plum monitors your regular spending behaviour and makes a judgement about how much you can “afford” to save; that is, how much you can safely set aside whilst still having enough money to cover essential bills and necessary daily spending. Every few days, funds are transferred from the connected account to a separate savings account so that by the end of the first month, you have a pot that’s been created for you without having to think at all. This “little and often” approach to saving challenges the popular idea that we must set aside a big chunk of money on a monthly basis in order to achieve success.

A potential issue here concerns trust. Not all consumers are going to be comfortable with the uncertainty of not knowing when transfers will be made or how much they’ll be for. Others will be sceptical about Plum’s ability to accurately calculate an amount they can actually afford. To attempt to overcome some of these potential worries, Plum pre-warns users of an upcoming payment prior to the money being taken, giving them the option to cancel it should they feel it could put them in financial difficulty.

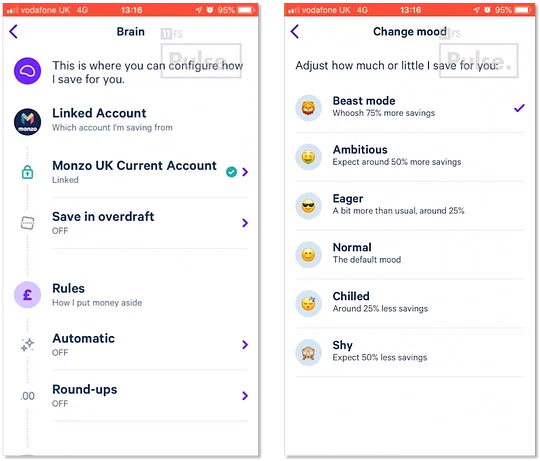

Plum’s “Brain” function allows users to customise rules around how the app saves for them, including the option to pause automatic saving at any time. It’s possible to instantly adjust how much or how little Plum sets aside by selecting a “mood” - this adds a useful element of flexibility for users as it enables them to adapt their savings behaviour based on their current financial circumstances.

Plum's mobile app.

Ultimately, the success of the proposition depends on the user’s willingness to trust Plum’s algorithm and put faith in its ability to accurately assess their financial position. As customers become more comfortable with using new financial providers and digital tools to meet their needs, adoption of solutions such as Plum – which already has an established UK customer base of 650k – is likely to continue to grow. This is supported by the fact that Plum, initially only available on iOS, has recently launched an Android app, which it expects will increase its monthly new users by 40% to help achieve its target of two million total users by the end of 2020.

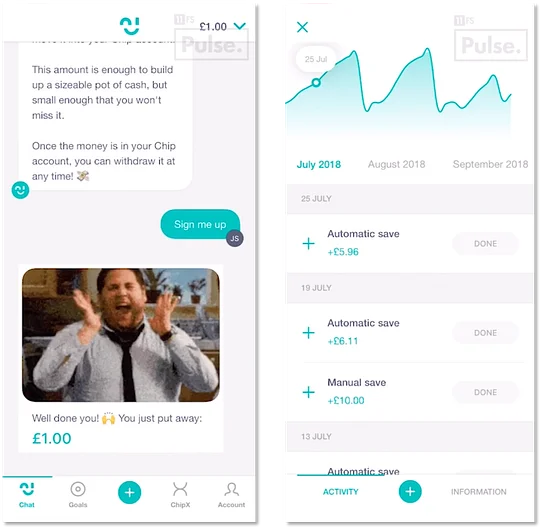

Another app that uses automation to help drive saving behaviour is Chip, which is also well suited to those looking for easy-access savings accounts that serve less regular income patterns. Since its launch in October 2016, Chip has attracted 150k app downloads and helped users achieve more than £85 million in automatic savings. Similarly to Plum, Chip connects directly to your bank account via open banking and uses AI and transaction data to calculate exactly how much you can afford to put aside once bills, rent, daily spending and any other necessary financial commitments have been accounted for. This money is then automatically moved into your Chip savings account every few days.

Chip is built to help people actually do something with their savings, rather than just saving for the sake of it. It does this by enabling users to set savings goals and track their progress towards them via status bars and analytics showing individual monthly spending habits. Savings goals will be discussed in more detail later in this report, but it’s key to call this feature out as a major benefit of Chip’s proposition and a valuable tool in helping customers establish positive savings behaviour. By linking automated saving with savings goals, Chip differentiates itself from other solutions in the market and aims to bridge the gap that exists for many savers between putting aside money and achieving their financial ambitions.

Self-control is a major factor affecting people’s ability to save. Although many understand the importance and benefits of saving money on a regular basis, whether that’s to build up an emergency fund or to achieve future goals, they might still struggle to do so. Chip aims to help overcome this hurdle by communicating with users via an in-app automated chatbot, which provides simple guidance and encouragement to help them focus on saving. The algorithm chats to customers as if it’s their friend and provides motivation, via gifs and emojis, to help drive positive savings behaviour.

Chip's mobile app.

Using the power of automation, these apps enable users to save without having to consciously engage with the subject on a regular basis. Forming a consistent savings habit is tough as it relies upon us repeatedly making the decision to forego instant gratification for longer-term gain, according to behavioural science. This means that making a one-time decision to automate saving is much easier than having to make multiple decisions to manually transfer funds into a savings pot. Another consideration is that people typically make more responsible financial decisions if they are deciding for tomorrow’s self rather than today’s self. Providers are therefore giving customers the ability to set up regular savings rules which (in theory) will make them more likely to sustain good habits and less likely to succumb to the temptation to spend.

Whether these services will survive as stand-alone propositions remains to be seen. While the two examples mentioned above have gained significant traction with savers, it’s important to recognise that there is still likely to be a large proportion of people for whom having another app or service that demands their attention via regular nudges and notifications will simply be perceived as being too much hassle.

Another increasingly popular automation-based service is round-ups, or micro-saving, whereby purchases are rounded up to the nearest pound and the change is automatically diverted into a separate savings pot. Many of the digital-only banks, including Monzo and Starling, give users the option to activate this feature for everyday transactions.

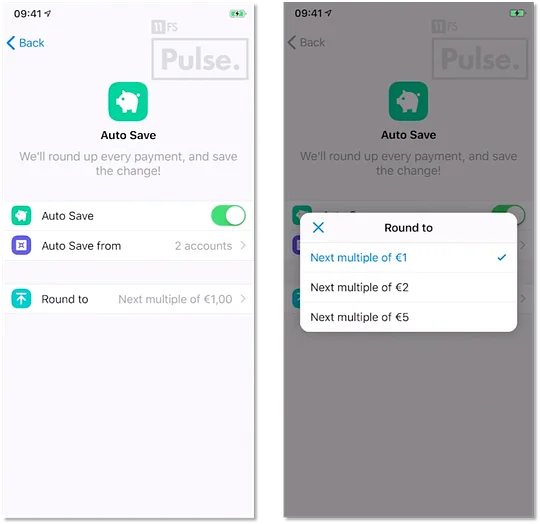

Bunq, which launched in the UK earlier this year, enables its customers to turn on a round-up or ‘Auto Save’ feature within the app, with configurable settings including the ability to save from multiple accounts. Users can also select which default multiple they want to round to, for example, the next multiple of £1, £2 or £5. This allows them to adapt their behaviour depending on their goals and capacity to save.

Bunq's mobile app.

Although it will appear innovative to many, using round-ups alone is unlikely to lead to a substantial savings fund and doesn’t do much to help people reach more ambitious goals. However, automated round-ups can be used in conjunction with other features, such as goals and pots, to drive more effective holistic savings behaviour and boost the amount of money set aside.

2. Savings Goals & Pots

For many people, the hardest part of saving money is balancing their near-term situation versus their longer-term financial commitments and goals. It takes willpower and a certain amount of sacrifice to actively set aside money for tomorrow that could be spent today. Savings accounts are widely used as a separation tool to keep savings away from day-to-day spending, as discussed previously within the ‘customer savings needs’ section of this report. They can help people resist the temptation to spend, particularly when combined with a goals-based savings approach whereby money is set aside for a specific purpose.

A number of providers now offer tools specifically designed to meet these customer needs; in particular, users can create a subsection or ring-fenced area within their main account that can be used for saving. This is a convenient solution for customers looking specifically to isolate their savings funds from their spending, without having to go through the often lengthy process of opening a separate account to start saving.

Starling has recently launched Goals (and shared Goals for joint accounts) which lets you set specific saving goals and contribute money from your current account. Any money added to a goal is protected from daily spending, so you can feel confident that your savings are not being compromised. Starling also pays interest on any money saved in Goals, up to account limits (0.5% AER up to £2,000 and 0.25% up to £85,000). It’s incredibly simple to set up a new goal within the app and does not require an application form or additional documentation - the idea being that it’s far easier than opening a separate savings account.

Users can personalise their Goals by choosing a name (e.g. “New York Trip”) and adding a motivational photo, which encourages them to think about why they are saving and establishes a clear link between saving and reward. This could also encourage people to think twice about frivolous spending, which can disrupt good saving habits and delays the achievement of chosen goals. Ultimately, individuals are more likely to be motivated to save if they can see the end result and easily measure their progress towards it - reframing saving as an aspirational activity rather than a chore.

A potential limitation of Starling’s Goals function is that saved money can be transferred out of a goal and back into your main account at any time in a few taps. Although this journey is very convenient for users, it does means that there is very little positive friction preventing you from closing a goal and using the saved money for spending. Having instant access to savings is a requirement for many when opening a savings account, but the ease at which money can be transferred reduces the effectiveness of the proposition for those savers that lack the willpower to resist the temptation to spend.

N26 offers a similar Spaces function; Revolut has an in-app savings proposition called Vaults, and Monzo enables customers to open interest or non-interest bearing Pots depending on how much they want to deposit. Customer appetite for better rates on their savings, combined with the demand for frictionless digital onboarding processes, is driving strong engagement with many of these alternative providers. The recent customer response to the launch of Monzo’s 1% Savings Pots, for example, were so positive that a temporary block on opening new Pots had to be implemented until Monzo could increase the savings limit that had been agreed with its partner provider Investec.

For more on N26 Spaces, check out this episode of 11:FS Homescreen - 'How N26 UK’s savings goals, transfers and referrals work.'

What Monzo’s Pots proposition does differently to similar offerings is allow you to lock your Pots, meaning that access to the money is restricted until a specified date in the future. This adds a layer of positive friction to drive more effective savings behaviour as it prevents you from withdrawing and spending money that’s been set aside for a specific savings goal. By combining this element with market-beating interest rates and a simple account opening process, Monzo is successfully meeting two major customer needs — increasing wealth and helping customers reach their goals.

Another feature of Monzo Pots is that they can be linked with external apps via automation platform IFTTT (If This Then That) to enable you to save in creative ways. Through IFTTT, you can connect Monzo to other apps on your phone and create customised conditional statements that prompt saving activity when certain conditions are met. The motivational fitness app Fitbit, for example, can be linked with Monzo via a rule that automatically transfers money into a specified Monzo Savings Pot whenever you hit your step goal for the day.

Dozens offers similar functionality, whereby you can select from a long list of savings rules, such as “rainy day funds” which transfer £1 from your current account into savings every time it rains. This links back to the first theme of automation and is a good example of how automation tools can be used in conjunction with goals/pots solutions to boost savings effectiveness.

For more on Dozens, check out this episode of 11:FS Homescreen - 'Saving, budgeting and investing with Dozens.'

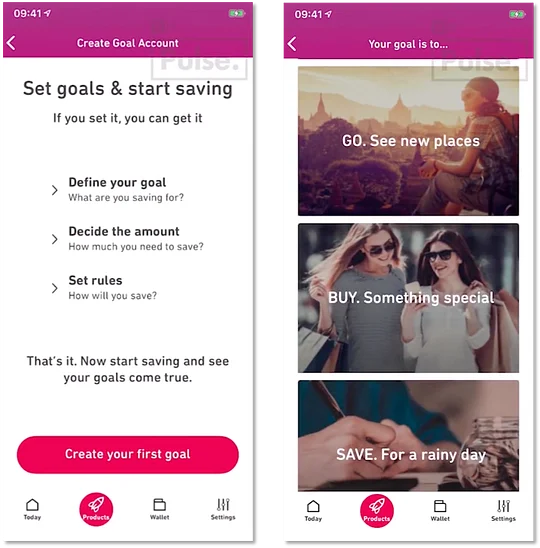

Liv., the largest digital bank in the UAE, allows users to set up savings goals in just a few short stages via the in-app Goal Accounts feature. You are asked to define your goal, decide the amount and then set savings rules - “if you set it, you can get it” - making saving feel simple and achievable. Within the goal definition stage, Liv. suggests some common reasons for wanting to save, such as “GO. See new places” or “BUY. Something special”. This allows you to personalise your savings goals based on your key needs and, similarly to Starling’s Goals tool, promotes saving as an aspirational and rewards-based activity.

As with many of the goals and pots-based savings solutions, Liv. enables its users to set up multiple savings goals via the app to cater to their various savings needs. This enables customers to contribute towards many different pots simultaneously, which is particularly useful if they’re saving for both long-term and short-term goals. Just because you are saving towards buying a house, for example, doesn’t mean that you can’t also be putting aside money to purchase a new laptop in the nearer term. However, some customers may find that having multiple goals limits their ability to focus and reduces motivation to save. To maximise the effectiveness of a goals-based function, providers should encourage customers to create a manageable number of goals that they can work towards at a sustainable rate.

Liv.'s mobile app.

The proliferation of digital savings goals and pots tools in the market offers consumers an alternative way of setting money aside and responds directly to market demand for convenience. These products have been built to enable people to actually make things happen with the money that they’re saving. By getting people to think proactively about why they should be saving and enabling them to automatically put money away, they can actually make progress towards achieving the goals that they have set.

Being able to deposit funds into secure pots which are integrated with an existing bank account is much simpler than having to go through the process of opening a separate savings account with one of the incumbent banks. Creating a tangible link between saving and reward by asking users to assign names and pictures to their different pots of money encourages a mindset shift and prompts people to prioritise their longer-term goals over short-term spending. These factors combined suggest that pots and goals attached to a current account product will be popular with customers and that providers which can implement them well will succeed in keeping users happy whilst also increasing the total value of their own deposits.

3. Marketplaces

The digital marketplace model is becoming increasingly common throughout financial services, with providers from Starling to personal financial management app Yolt offering their customers access to a growing financial ecosystem via connections with various partners. Simply defined, marketplaces are online platforms that enable providers to offer a more diverse set of products by partnering with other companies, fintechs and third parties. For customers, choice and convenience are the key benefits, as well as the potential to access better value products by interacting with digital providers. For providers, the marketplace model enables them to reach new customer segments and service a broader range of needs by leveraging the resources and expertise of key partners. This is particularly relevant to new digital providers which have built up a strong and trusted relationship with their customers, but only provide products that solve for a specific financial need (e.g. saving).

From a savings perspective, there are a growing number of providers offering integrated savings products via a marketplace model. For many, this has enabled them to address a broader spectrum of customer needs by plugging gaps in their product portfolios with third-party offerings.

The following examples of savings marketplaces have all launched relatively recently and are therefore still in the process of expanding their product selection. That means marketplace customers can currently only access a limited product offering. However, we expect to see an increase in choice and availability in the near future as more relationships are established between brands. With that in mind, it is important that marketplace providers select partners and products that represent true value for their customers, or they could risk losing credibility and damaging their trusted relationship.

Monzo has created an in-app savings marketplace, which offers customers a number of easy-access and fixed products from different providers, including OakNorth and Shawbrook Bank. This proposition meets customer demand for ease and convenience, as all products are accessible digitally via the Monzo app, which enables you to manage your money all in one place.

Monzo’s partnership with OakNorth is expected to benefit both parties as it has enabled Monzo to offer a wider choice of products to better meet the needs of its customer base, whilst OakNorth has been able to open up its platform to a wider demographic and attract customers who sit outside of its typical target market.

That said, in terms of the benefit to the customer, the ease and convenience of the marketplace model can come at the cost of receiving less competitive interest rates. OakNorth rates on personal savings products, for example, are higher if customers open an account with them directly rather than going via the Monzo marketplace. This is a big drawback of the model and will likely reduce its appeal for customers, particularly those who prioritise the importance of achieving the best possible rate on their deposits. The fact that this was widely reported in the UK media will further have dampened the potential success of the partnership.

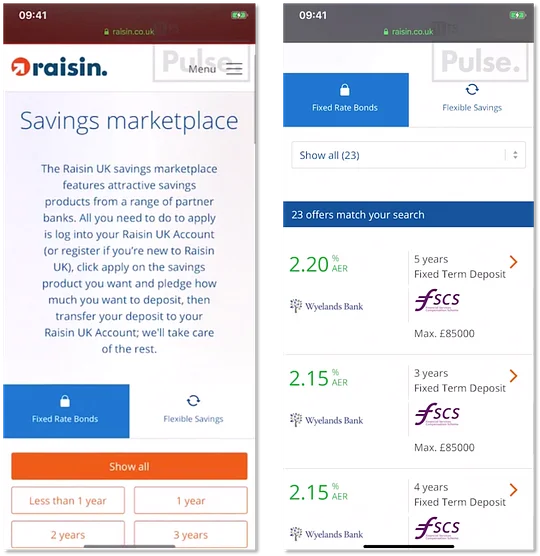

Raisin, which launched in the UK in 2018, offers a marketplace proposition which enables customers to open accounts with providers from across Europe. It has established partnerships with a range of UK challenger banks and European banks to offer fixed-term and notice savings products through its online platform, accessible via a single user log-in.

Raisin gives you access to products that offer a higher rate of return than more well-known providers; for example, 1.75% on a one-year fixed-rate bond from UK-based challenger Axis Bank, compared with a market rate of 0.65% from a similar product at Barclays. This is diversifying the market and attracting a significant number of customers – c.200,000 across Europe – who are looking for better rates on their deposits. As with OakNorth, Raisin typically attracts an older and more affluent audience. However, it hopes to broaden its appeal and open itself up to a younger audience with a recent expansion into notice and easy-access accounts, as well as partnerships with popular fintechs including Yolt and Monese.

Raisin's web platform.

Digital marketplaces have the power to drive significant change in the savings landscape by giving customers access to a wider choice of products from a more varied set of providers. Those customers who believe there would materially be little benefit to moving their money, or are put off by the expected hassle, could be persuaded otherwise if presented with a selection of relatively high-rate and easily accessible products.

The convenience of being able to access multiple products through one login and manage them via a single dashboard is likely to encourage users to take a more active interest in saving and ultimately lead to a behavioural shift amongst consumers. In turn, that should result in providers thinking longer and harder about the savings products they offer, as customers can more easily, and become more willing to, move their funds. Those providers who best meet specific customer needs will ultimately win out in a marketplace environment.

What's next?

The competitor landscape will continue to evolve and diversify as alternative providers gain traction with customers and steadily take market share away from the incumbent providers. The available range of savings products will widen as a variety of new and innovative solutions enter the market, driven by advances in technology and increasingly strong consumer demand for digital-first products.

Consumer attitudes and behaviours towards saving will experience further change and disruption, as alternative providers demonstrate the potential of convenient, competitive, accessible and goals-based solutions designed with key savings needs in mind. The ability of challengers to successfully grow their customer base will depend on the willingness of savers to trust new brands to meet their financial needs. This trust factor is likely to increase as alternative providers become more established and prove the value of their offerings vs incumbent providers.

Over the next few years, it will be interesting to monitor the progress and development of new market entrants and alternative savings solutions, as well as observing how the incumbent banks respond to the ongoing evolution of the UK savings market.

Recommendations

- Understand savers’ needs: In order to create products that will appeal to customers and drive a genuine shift in savings behaviour, it’s essential for providers to understand primary savings needs. Get to the heart of why people open a savings account; what they want to save for, and why they currently struggle to save, to enable the design of customer-centric propositions that are intuitive and fit for purpose.

- Be creative: Inspire and engage customers with innovative solutions that provide something different to those offered by incumbent providers. Experiment with the tone of voice, visual app designs and personalisation to bring saving to life and encourage people to reconsider their existing attitudes towards saving.

- Harness the power of automation: Enable customers to save subconsciously with automated savings rules that put aside sustainable amounts of money on a regular basis. Demonstrate how it’s possible for customers across many different demographics to build up a meaningful savings pot without it having a negative impact on their day-to-day life.

- Focus on reward: Help people actually achieve something with their savings by encouraging them to recognise their motivations for putting money aside. Empower customers to reach their goals with customisable savings pots which are separate from their daily spending and can be locked if preferred.

- Leverage partnerships: Providing solutions that meet the needs of the whole market is unrealistic and resource-heavy. Focus on narrow execution and developing a best-in-class solution that meets the needs of a specific market segment. For areas outside your expertise, partner with whoever is best in the industry to deliver solutions for alternative segments and plug the gaps in your product offering.