Why big banks are creating challengers: Leaving a legacy

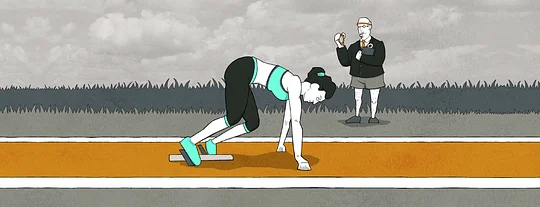

Incumbent banks’ approach to becoming modern digital beasts is like a 60-year-old athlete trying to compete in the Olympics.

All the AI and mobile front-end work in the world isn’t going to help the body work faster, but the knowledge of that older athlete? Now that’s valuable. A 60-year-old athlete when working with a younger athlete, with newer technology, well, that could be magic.

When Goldman launched Marcus, the immediate reaction of most bankers I spoke to was to miss the point. I heard “This isn’t new, it’s just buying customers with a big savings rate”. Of course they bought customers with a savings rate; Marcus by Goldman launched in the UK with the best savings rate on the market for an immediate access account, but that missed the point for me.

What many missed is that Marcus by Goldman was completely greenfield. The brand had evolved for consumers, the banking and data knowledge Goldman has built for generations was baked in, but the body of the athlete, the tech, that was fresh and that’s exciting.

I think we have an epidemic of senior bankers who are accountants and can’t help but look at the market and the business model as if the game hasn’t changed. To look at a market in which billion-dollar fintechs and big technology companies are being built and say “nothing is new under the sun” is dangerous.

Legacy tech forces legacy operating models

The phrase that makes me want to scream into a pillow is 'Agile at Scale'. It’s a phrase used by banks who are applying the principles of Agile on top of 40- to 50-year-old tech and 100-year-old business processes.

Some banks and FIs are doing amazing things with legacy technology and banks continue to be the backbone of the global economy, but taking legacy technology and legacy business processes into the 21st century is like trying to jump while your feet are cemented to the floor.

If your mainframe requires an outage to push code releases and all of your systems are hardwired into that mainframe, guess what? Proper DevOps will remain elusive and no amount of 'McLego Bricks' are going to help. The importance of this shift is completely missing from mainstream strategy discourse.

From digitized to digital

11:FS Deputy CEO Jason Bates has been using the terms 'Digitized' and 'Digital' to help explain this shift. Newspapers illustrate it best.

Remember when the iPad first launched and you could get newspapers on it? Bright shiny digitized newspapers? It sounded great, until you realised you had a newspaper that ran out of battery and cost a lot more if you dropped it. The only winner from the 'digitized' newspaper was the publisher. The customer didn’t win, the customer didn’t get anything new.

Now consider Netflix or Spotify. They could have shifted from DVD sales to selling feature length movies through an online portal (in fact, Netflix sort of did let you rent movies in the mail as an interim step). What customers got instead is an online platform of more movies than they could ever watch. This only happened because they used the digital powers of new technology. They didn’t try to integrate a revolutionary service back into a pre-existing business.

New tech forces new operating models*

* If you’re digital all the way down.

Being born digital is fundamentally different. When something is built for the first time, it is rarely expected to support millions of customers and be regulated. The first, test bit of code really only needs to give the organisation some learning. Much like a human child, we don’t expect it to be 'at scale' yet, but it’s pretty agile.

If this is the child of an athlete, that athlete can pass on wisdom. If the tech is the greenfield efforts of a banking organisation, it can benefit from past successes with the added benefit of an entirely new operating model.

The huge benefit of new technology is it doesn’t have to wait for a weekend outage, battle to get on the roadmap or the complexity of business processes that are over 100 years old. A blank sheet of paper can be an unfair advantage. When combined with the legacy of knowledge and experience of a big bank, it’s a huge unfair advantage. It’s why we see Yolt by ING taking personal finance by storm, or Mettle by Natwest. To compete with big techs and fintechs, more organisations will build their own challenger.

Building your challenger

There is no game plan for raising a child to be a successful athlete, and similarly, there is no process map to becoming a successful challenger. However, when you look at things that succeed and things that fail you can identify some trends.

When things fail, some patterns emerge. Banks look for the 'top down' strategy (e.g. bring in big McStratHouse) to come up with a comprehensive five-year plan. Now, imagine the comprehensive five-year plan to raising a child, or even a dog. It’s not effective for challengers and not what startups do. Other symptoms include comprehensive org charts, program offices, and more than five vendors involved. Heavy upfront spending commitments is another thing to look out for because it’s almost as if a big budget is the same as success, when in reality it is absolutely not!

There are also patterns when bank challengers succeed. Yolt by ING started with less than five people, and when 11:FS started Mettle the team was less than five people too. You see a focus on two things: 1) Talking to customers and 2) Writing code.

The interesting thing with this type of project is they get seen as a sort of 'moonshot' like Google’s self-driving cars efforts. In reality, everything starts simply. Begin with a customer problem, and work from the bottom up to strategy.

How well do you really know the customer problem? And how is that shaping the product you're building?