Why banks treat transformation like people treat liposuction

When clients come into the 11:FS office, shiny eyed and with an exciting mandate, it gets us super pumped to hear where they want help on their journey.

People who work with us know that it’s as much about that journey and what it establishes as it is about the result. But this isn’t how everyone views it in the industry.

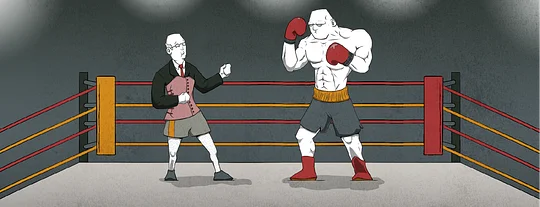

We see it all the time: banks wanting the liposuction approach and people wanting to sell it to them. Quick fixes that don’t address the real issue and create dependency on them.

They don’t want all the effort and time it takes to work through a problem. They want fast results with the greatest impact. Which is understandable but not sustainable.

Effort leads to impact

Would you send your team onto the court in the best kit with the very best sneakers if they didn’t know what the lines on the court mean?

Eating healthy food and getting up to run every morning is a major inconvenience, yes. But when you begin to feel the positive effects that come from it, you realise the fruits of your labour.

You’re stronger. Conditioning yourself over a period of time, you come to realise that there’s no end to the cycle. If you stop, you will inevitably end up back at square one. If you cut corners and go for the lipo approach, you really are in danger of doing even more damage that could be fatal in the future.

Financial services companies need to get this one thing: it’s not what you do, it’s the way you do it.

The reality is that innovation is a mentality. An overhaul of operational efficiency that ensures the longevity of not just a product or service but crucially a business.

True innovation is a top-down concept. Too often, key stakeholders and decision makers adopt a posture of transformation without fundamentally changing the archaic processes that slow the business down.

It takes intensity and consistency

In order to change how change is done within your organisation, you need intensity and consistency in equal measure.

You can intensely clean your teeth once, but unless you do it every day you won’t have good teeth. Same with exercise or healthy eating. There’s no getting it out of the way for the year!!!

If banks want transformation, they can forget buying bean bags and investing in a library full of ‘Agile For Dummies’ books.

Financial services companies need to get this one thing: it’s not what you do, it’s the way you do it.

Fintechs offer no discernable fear factor to the big incumbents in what they do right now but are terrifying in how they do it. How intense they are with their hunger. How much they listen to their customers. How quickly and cheaply they can develop and put things into the market. How proud their staff are to work there. Terrifying.

Quick fixes won’t cut it

If banks want transformation, they can forget buying bean bags, upgrading to Yorkshire tea and investing in a library full of ‘Agile For Dummies’ books. These things are just shadows of success, not success itself.

True transformation is about taking your team on the journey. It’s about educating them about why changes need to be made and getting them to believe super passionately in the thing you collectively want to achieve.

This is why at 11:FS it’s so important for us to lace up our sneakers with our clients rather than providing an answer and stepping away. Like personal trainers, our teams will coach and mentor companies to dial the current state of play up to 11.

Banking is a marathon, not a sprint.

The best clients are not the ones who pay us the most. They’re the ones who are fundamentally better at the end of the process because they think and act differently.

Liposuction consulting, on the other hand, doesn’t make businesses powerful and fit. It doesn’t give them the lung capacity to go further than the competition. They haven’t stretched enough to be flexible or moved enough to be agile. The heart of the organisation is still weak.

The company looks a little leaner and meaner. Alright. But it won’t stay that way unless it has healthy habits.

In finance as in fitness, you’ll only remain in the race if you commit to a program of constant conditioning.

Banking is a marathon, not a sprint.

Need to know where to start your transformation journey? Listen to Fintech Insider episode 242 to learn from the industry’s biggest innovators!