Why banks need a new approach to innovation

The labs and accelerators across financial services offer great innovation theatre, but are they getting anything in to the hands of users?

If you had a headache and I offered you a vitamin tablet, you’d be unimpressed. The vitamin didn’t solve your problem. This is my beef with innovation labs and accelerators at banks, insurance companies and generally at corporates.

Those labs have smart people who want to do the right thing, but they don’t have a mandate. What ends up happening is the lab is seen as out of touch by 'the business' and lacks credibility to do anything meaningful.

Have they achieved anything?

Advocates of labs and accelerators will point to the fintech startups that have passed through their program and are now valued above $1bn, the magical ‘unicorn’ status. Or what about those vital fintech partnerships that are now live and with customers? I mean, sure, but a partnership can happen without a lab and a valuation isn’t a measure of ‘value’.

I’d argue the biggest success from labs has been to bring bank staff at little closer to the world of fintech and startups. The value of that cannot and should not be discounted; getting people who were unlikely to be exposed to the firms, ideas and innovation bubbling just under the surface. There are some green shoots of potential in the world of labs, but as a veteran of this world, unless it becomes absolutely core to the bank or FI then they’ll always be a press release or something for marketing.

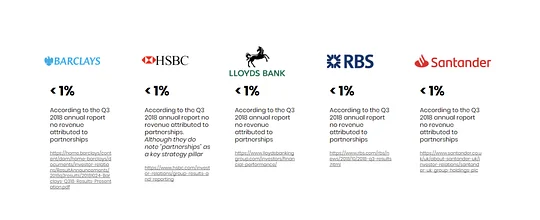

I reviewed the annual reports of five big UK banks and tried to look for evidence of where 'Innovation' or 'labs' or anything partnership-driven had created a material impact on their business. What did I find?

Sweet FA.

What’s holding them back?

The most common criticism of bank innovation labs and accelerators is that they dabble around the edges and don’t make a material difference to the bank or its customers.

While many have processes and programs of work designed to farm 'problem statements' from business areas, to me there’s one killer reason why accelerators especially haven’t worked. The innovation comes from the outside in. If I’m an entrepreneur and I’m building a business, then unless my goal is to be a vendor to a bank, it’s very rare I’m building to solve a banks’ customers problems or the bank itself.

By the time a fintech or startup finds itself in an accelerator a whole stream of activity kicks off to try and fit the fintech into the bank, but this is the very definition of a solution looking for a problem. It’s backwards.

Accelerators were fundamentally designed to create companies and grow valuation. They were never designed to solve problems for an incumbent financial institution. They’re not designed to help institutions grow, or find a way to dramatically reduce operating costs.

Banks need an alternative that’s effective and measured in terms of the value it delivers to customers.

Enter: Venture Building

Also known as a start-up studio. These organisations build entire companies. Unlike a digital agency who can create the experience on glass or screen, or a strategy house that creates a pretty PowerPoint presentation but can’t deliver any technology change, or the delivery consultancy who sell bodies… A bank is a business and growth comes from thinking and acting like a business instead of thinking in projects.

Projects end, your business goes on.

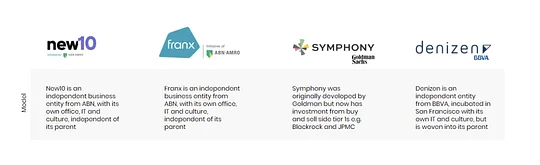

We’ve actually seen some organisations start one-off approaches to this, but it’s yet to scale.

These programs take internal problems, gaps in the value chain and focus on building them out. They’re able to take internal and external staff, build a new company and even create equity positions in those companies for internal founders.

What’s fascinating is how some even hold a job open for their internal staff for 12 months in the parent organisation. This means internal staff who have family commitments or do not have the resources to take the risk of building a company can unleash their entrepreneurial talent.

Doing it vs. doing it well

Building these 'inside out' ventures is just the beginning. How will these businesses grow and become something of scale in the same way a VC backed startup would? In the examples above the internal teams caught lightning in a bottle. An internal advocate was able to get the funding, support and momentum in their organisation to do something new and different.

What would happen if you built the machine that could launch many of these ventures? Banks and FIs could then bring a number of these new ‘child’ businesses to market. Not all will go on to be world beaters, but it’s a great shot at real growth that’s aligned to the business.

How could it work?

The big risk is that you create the right propositions and ideas but can’t execute them inside the big machine. How do you find the talent with the right track record of getting something off the ground, in to the customers hands?

You’d ideally want to have a structure and a start-up making machine stacked with people who have built startups or fintechs before, that know how to operate in large banking environments but also how to get the most out of modern technologies.

The risk is that you take one big bet, and it ends up with a budget that’s too big (yes really), too many people involved, and no momentum. How do you avoid weighing down these fledgling businesses?

You’d want a portfolio and an ability for the machine to run two to four propositions at any one time. They’d start small and they’d earn their way into more funding.

Digital Ventures are 1% Finished

The classic innovator's dilemma is, can the incumbent get innovation before the innovator gets scale? The question can be turned on its head. Can the new innovator made by the incumbent get scale?

Creating a true 'innovator' as a new company requires thinking much bigger than projects; instead, think about building a business or better yet, investing in one. When I was on the founding team of the Barclays Accelerator, I worked closely with a prolific investor there who gave one bit of advice about early stage investing.

It’s all about team - do I believe this team will get it done? If they will, do they have a mission that’s interesting, different and could be big?

So if a bank or FI is looking to grow a true new venture it begs the questions:

- Who are the founding team?

- What’s their track record?

- What’s the problem they’re solving?

Try as they might, the big incumbents struggle to attract the talent a startup would, even with massively inflated salaries. A new business is an opportunity to build a new culture, attract fresh talent and materially grow the business.

Getting that opportunity off the ground, in whatever shape or form, can be difficult. If you’re struggling to figure out where the opportunities lie, get in touch!