Vadim Toader - Proportunity: mortgage innovation putting homes within reach

In this guest blog, Vadim Toader, CEO and co-founder of Proportunity, examines how predictive technology and lending innovation can prevent home buying from becoming a fantasy.

Once upon a time, there was a fair lady and her prince charming. They lived in a cramped studio in Elephant & Castle, as that was all they could afford. Doesn’t sound that glamorous, does it? But that's the harsh reality that each first-time buyer faces nowadays.

We don’t imagine Meghan, Harry and baby Archie living in a one bedroom flat, piled on top of each other. Instead, we’re fed images of their lavish Windsor castle, their getaway cottage in Cornwall, and maybe a nice flat on Kings Road for theatre nights. That’s the British homeownership dream young couples grow up with.

But when we plan for our own future, we've stopped believing in our own house with a white picket fence.

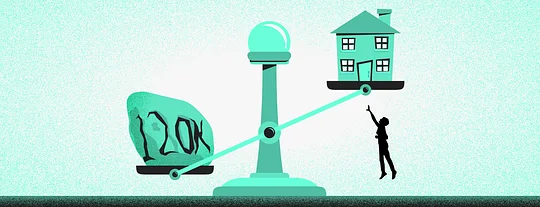

Why did buying become a dream? Deposits.

First Time Buyers are a dying breed. There are 200,000 fewer people per year buying their first home in the UK, compared to 2001. To put this in context, there are currently 370,000 first time buyers each year. Meaning, in just short of two decades, 35% of our species have been eradicated.

Deposits are the main killer: 70% of first time buyers say coming up with the deposit is the biggest roadblock (up from 50% in 2010). According to Halifax, in 2001, the average First Time Buyer in London needed to put down £40K.

In 2019, that soared to an unattainable £110K cash deposit. Young people in their 20s just don’t have enough cash saved up to secure a good mortgage.

If you’re a young professional in London, you know how hard saving even £100 per month is. And that means you’re only saving £1200 per year. To get to £110K, you’ll need approximately 100 years.

So...erm...good luck?! And it’s getting worse, as our income is stagnating, while rent is going up.

70% of first time buyers say coming up with the deposit is the biggest roadblock

Ok, if we can solve deposits, then we can reverse the tide! But how?

The government tried Help to Buy, which lends the deposit upfront as an equity loan - great. But that's ending in 2021! Moreover, it’s limited to new builds under £600k (£200k outside of London).

What’s worse, many new home developers used it as an excuse to push up property prices by as much as 40%, meaning you can only afford a 1 bed flat in London. New builds also tend to see less growth in their first sales cycle, meaning you end up paying more for a home that won’t have the same returns.

Another option is Shared Ownership but that’s clearly the worst of both worlds: you still have to come up with a deposit, you don’t actually own the home, and most of your monthly payments go towards rent on something you don’t own.

So you’re not really saving either. On top of that, you need permission to make any improvements to the home, and they have to approve what price you sell at. So it’s just like renting, but you have to pay an additional £20k+ deposit and you can’t just move out whenever you want.

Young people just don’t have enough cash saved up to secure a good mortgage

But what if there was a Help to Buy for any property?

What if there was a way to use modern technologies to rethink the entire approach? What if in so doing, it unlocked a way for first time buyers to boost their limited deposit with an equity loan and help them own the home they actually want? That's what the Proportunity Loan is all about.

Unlike Help to Buy, the focus is not on the developers, but on the buyers, as Proportunity works for both new and existing properties.

The result is that buyers can, generally, afford more, whether that means getting that second bedroom that seemed out of reach, living a mile closer to work, or within a better school’s catchment area. It could even reduce the overall costs as a larger deposit means better financing rates are unlocked.

How does technology support more loans?

At Proportunity we use advanced machine learning and data analytics technology to find areas that are growing and spot undervalued properties in these areas. We use AI to search for the hidden gems within the housing market, so that you are getting a growing home.

And I’m proof of this; it helped me live out my home buying fairytale.

I was renting a single bedroom in a house with three other people. After marrying my fair lady, we started looking for a flat just for us. Initially, we wanted to rent but when we saw how expensive it would be, I started looking at mortgage rates for a nice 2-bed flat in our neighbourhood.

The rates weren't terrible... if we could come up with a £120k deposit. But two working 20-somethings just don’t have that kind of money.

The rates weren't terrible...if we could come up with a £120k deposit

Proportunity’s forecasting technology led us to a home in Bermondsey, an area close to where we work but that was not on our radar. We not only found a home we could afford, but one that was bigger than we had expected.

Because it was in an up and coming neighborhood, it cost 40% less (literally) than similar sized houses within the same commuting distance to work and we could afford it with the Proportunity Loan. This was great as we now don't have to move and pay stamp duty again when we want to have kids. Moreover, the deposit loan allowed us to keep some of the savings and reinvest them in the house once we bought it, turning it into our dream home.

We’re already able to see the typical price growth indicators, e.g. new coffee shops and artisan pizza places beginning to pop up in the area. We also expect the area to continue to grow once the new Bakerloo tube station is built down the street.

First time buyers have never faced such a steep uphill climb towards home ownership. House prices have gone up and deposits are harder to save for, making buying a home you actually want almost impossible.

However, technology now can not only spot underpriced outliers and get a bigger bang for your buck, but can also help you put down a bigger deposit, meaning you can afford more as well! By combining these two factors, Proportunity is making sure you will be able to afford a charming house, worthy for a Prince or Princess, no matter who you are.

I discussed the use of technology and much more in Episode 322 of Fintech Insider Insights: Are mortgages broken?