The digital payments debate: is the future really cashless?

When did you last pay for something in cash? If you can’t remember, you’re not alone.

The payments industry is evolving as consumers all over the world switch cash for digital payment methods such as card and mobile.

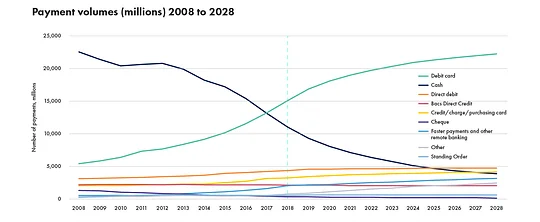

The use of physical money is at an all-time low in the UK, with cash transactions representing only 28% of all payments in 2018, according to UK Finance. If we compare this to a figure of 60% in 2008, it’s evident how much the payments landscape has changed in just a short space of time.

The pace of change doesn’t look set to slow anytime soon either, with current predictions suggesting cash will make up only 9% of total UK transactions by 2028 — we are well on our way to becoming a “cashless society”.

Source: UK Finance

This divisive concept has been discussed at length all over the media, both in this country and abroad. Many see the shift towards cashless as inevitable, highlighting key benefits for both consumers and businesses associated with convenience, cost and physical security.

On the other side of the debate are those campaigning to protect universal access to cash, calling out the disproportionately negative effects that ditching notes and coins would have on the poorest segments of society. Notably in last year’s independent Access to Cash Review, which urges banks, regulators and the government to commit to defending access to cash for the millions in the UK who are still very much reliant on it.

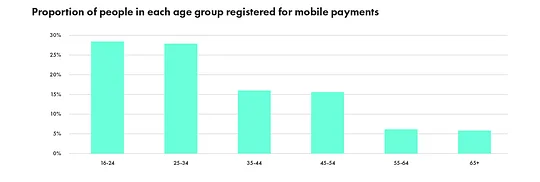

Source: UK Finance

Whether you’re in favour of the idea or not, there’s no denying that Britain is accelerating towards becoming cashless at one of the fastest rates in the world. Debit cards are now firmly established as our preferred payment method, having overtaken cash in 2017, and are predicted to account for 50% of all transactions by 2024.

The relentless growth in popularity of smartphones, contactless payments, mobile and online banking, and digital-only financial providers have all been key drivers of change. Add to these the explosion in payments innovation, from iZettle’s portable, low-cost payment acceptance tools for SMEs to Stripe’s simple e-commerce payment processing platform, and you can see how a cashless future could actually become a reality in the UK.

Scandinavia leads the charge towards cashless societies

One country that’s front and centre of the global cashless revolution is Sweden, which is on track to become the world’s first cashless society by 2023. Cash represents barely 1% of the economy, compared with 10% in Europe and 8% in the US. Electronic payment methods, which are used to make 4 out of every 5 purchases in Sweden, reign supreme and it looks like only a matter of time before the Krona is no longer accepted as legal tender.

Consumers are hooked on the convenience of paying with their smartphones

What’s particularly interesting about the Swedish example is the close link between the decline in cash usage and the rapid growth of mobile payments. Consumers are hooked on the convenience of paying with their smartphones and mobile wallets have seen great success, particularly for shopping online.

The shift towards mobile has been accelerated by the success of fintech payments app Swish, which was set up as a collaborative venture by Sweden’s biggest banks in 2012. The free service enables its users to instantly transfer money by simply entering the mobile number of the recipient. Initially set up as a P2P payments tool, Swish is now used by more than two-thirds of the Swedish population to make individual, consumer-to-business and online payments.

Trends towards cash independence are clearly visible across most of the Nordic countries, with Denmark, Norway and Finland also demonstrating a high and rapidly increasing number of cashless transactions.

Digital wallets now dominate China’s payments landscape

That said, Northern Europe is not the only part of the world where cash payments are fast becoming obsolete. China is also marching towards becoming cashless at a significant pace, again, driven mainly by the widespread adoption of mobile payments services. The smartphone obsession in China is real and digital wallets now dominate China’s payments landscape more so than anywhere else in the world.

Two-thirds of online sales and more than one-third of payments in stores are made through leading mobile wallet operators including Alipay and WeChat Pay, according to Worldpay’s 2018 Global Payments Report.

Why is cashless a good thing?

Regardless of where you are in the world, the cashless trend presents a number of considerable benefits for consumers and businesses alike.

Everyone can appreciate convenience, and it’s certainly true that digital payments make it quicker and easier to pay in most everyday situations. Contactless has made it possible to tap and go - no queues and no faffing with loose change.

Mobile payments mean you don’t even have to carry a wallet with you at all, just your phone. The convenience of using smartphones to transfer money in a matter of seconds is impressive and we can split bills easily with friends and family at the touch of a button.

The crux of the cashless society debate is about the fundamental importance of fairness and inclusivity

For businesses, there are a number of pros associated with going cashless which are hard to ignore. In many areas, the cost of providing cash handling infrastructure is increasingly disproportionate to the number of customers that are actually wanting to use it, meaning that a growing number of retailers are opting not to take cash at all.

Not having cash on the premises can be a major win: reducing the risk of robbery; increasing physical security for staff and eliminating inefficient cashing-up processes at the end of every day.

Banks now charge significant fees for depositing cash which, coupled with the slow demise of local branches in the UK, has turned the whole process into a serious headache for many businesses as they’re forced to make longer journeys to pay more to deposit their money.

Why is cashless a bad thing?

A cashless future looks undeniably appealing on a number of levels. However, we must contextualise the benefits - it’s important to understand the potentially damaging implications a cashless system could have on certain segments of society.

Source: UK Finance

Not everyone is happy with the idea of going cash-free and there will always be those individuals who don’t feel comfortable leaving the house without a wodge of cash in their pocket. These people will defend their right to use cash until the bitter end; stubbornly refusing to adapt to a digital-first payments system.

Nevertheless, the real crux of the cashless society debate is not about personal preference, it’s about the fundamental importance of fairness and inclusivity.

Around 17% of the British adult population - over 8 million people - would struggle in a cashless society, according to the Access to Cash Review. Poverty is highlighted as the biggest indicator of cash dependence, not least because the poorest in society are unlikely to have the means of accessing computers or smartphones to enable them to bank digitally.

We have a social responsibility to ensure...the vulnerable in society are not left behind

Other groups with a high dependence on cash who would be disproportionately affected include charitable organisations; rural communities without access to reliable internet/ mobile coverage; the unbanked; the elderly; those with physical or mental health issues who struggle to handle cash, as well as people with a history of debt problems. For this latter group, who may be particularly reliant on using cash to limit their spending, the lack of friction associated with digital payments could present a considerable problem.

Cash is vital in supporting financial inclusion and we have a social responsibility to ensure that as cash is phased out, the vulnerable in society are not left behind.

What’s next?

As global demand for frictionless commerce increases alongside smartphone ownership, the use of digital payments will continue to grow at the expense of physical cash.

The trend towards cashless is inevitable, but a gradual transition is key to avoid alienating those people who depend on cash as their primary payment method.

Educating the wider population about the benefits of digital banking and payments must continue to be a priority for governments and banks to ensure that people become more comfortable with using less cash in their day-to-day lives.

It will be fascinating to see whether becoming totally cash-free will actually become a reality in those countries, such as Sweden, at the vanguard of the digital payments revolution.

By keeping a close eye on their progress and challenges over the next few years, the UK can strive to plan and prepare properly for its own shift to cashlessness to ensure as few people as possible are left behind.