Subscription trends to watch in 2025

Despite global economic headwinds, rising prices and over half of consumers now precisely tracking their subscription spend, 89% of businesses are optimistic about recurring revenue growth for the year ahead. They predict changing customer demand is the top factor that will impact profitability.

This is according to new research in Subscription Economy: Evolution Not Revolution, a report from subscription management fintech Minna Technologies in partnership with specialist management consultancy FT Strategies and global market research firm Savanta.

The report includes data and analysis of surveys of over 100 US enterprise subscription business executives and more than 2,000 US consumers. The executive sample included Board members, C-Suite executives, managing directors, directors and owners from B2C businesses with an annual turnover ranging from $10 million to over $1 billion, including financial services and fintech, streaming media, software, publishing and retail brands.

Gen Z and millennials have the most subscriptions

Subscription usage decreases with advancing age and lower income. Gen Z and millennials have more subscriptions than older age groups (70% for 18-44 year-olds versus 63% for 45-64 year-olds and 55% for people aged 65+) and prefer to self-serve digitally.

The challenge is keeping these digitally-savvy subscribers engaged, understanding their needs and building a customised, dynamic offering centred around them. Their perception of value extends ‘off-platform’ – beyond a brand’s own products and platforms. They want a personalised, omnichannel customer experience, frictionless payments and the option to manage subscriptions via third-party channels, such as marketplaces and banking apps.

The rise of serial churners

Subscriptions reflect a fundamental shift toward flexibility and exploration. Almost half (47%) of consumers believe that subscriptions give them access to a certain lifestyle, 63% prefer paying monthly to an annual fee, 55% think owning anything they don’t need now is a waste of time and 51% like exploring different brands and services.

"Businesses need to focus on enhancing flexibility, convenience and control for customers."

Amanda Mesler, Chair and CEO of Minna Technologies

Serial churners continue to grow and have become mainstream, with two-thirds of businesses reporting that up to 20% of people who unsubscribe return within six months, lured back by new content or offers. In response, brands are making it simpler to cancel to increase the likelihood of users resubscribing.

New regulations, such as the UK Digital Markets, Competition and Consumers Act 2024 and the US Federal Trade Commission’s proposed “click to cancel” provision, support making it easier and more transparent for consumers to cancel subscriptions.

Top subscriber retention tactics

Enhanced flexibility can entice subscribers to stay. 63% of subscribers are likely to stay for offers, 46% for subscription plan downgrades and 39% for the ability to pause plans.

Despite consumer demand for pause, only half of businesses offer this. The top reason to cancel after cost is “I didn’t use it enough”, highlighting the need to monitor user engagement, track subscriber churn risk using predictive analytics, and adapt plans to suit customers’ changing needs.

Amanda Mesler, Chair and CEO of Minna Technologies, said: “As part of the ongoing value exchange in the subscription economy, businesses need to focus on enhancing flexibility, convenience and control for customers. Customer demand has led to the emergence of new channels to manage subscriptions, such as banking apps and aggregators. By offering subscription management, banks can increase revenue, reduce chargebacks and OPEX, and enhance engagement and trust. Subscription businesses can retain, win back and grow subscribers.”

Consolidation is key in a fragmented digital world

With the average US consumer having 8.2 subscriptions and spending $1,416 per year, and 32% of consumers having ten or more subscriptions, there is growing demand for consolidation. The majority (73%) of subscribers are interested in a consolidated subscription management solution, but only 2% are currently using a single app to manage their subscriptions.

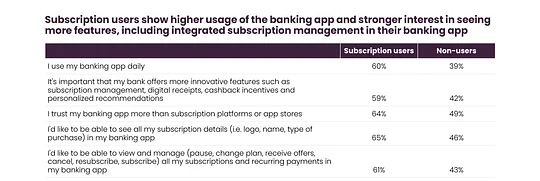

Three in five (61%) consumers use the same card for all their subscriptions, and 61% of subscribers would like to be able to view and manage all their subscriptions in their banking app. This represents a significant opportunity for debit and credit card issuers to be top of wallet by enabling consumers to track and manage their subscription spend in their app.

Gen Z and millennial subscribers are especially interested, with eight in ten 18-44 year-olds wanting this functionality and nearly one in two willing to switch banks for this.

Strengthening the value exchange with diversified offerings

Driving retention and loyalty are key priorities for subscription brands. The average US subscriber has 3.3 streaming subscriptions and values streaming services the most but cancels frequently due to high costs, increased prices, limited value, underutilisation and a bad experience.

Business must convince consumers of the value they offer and diversify their content, channel and product strategy. Gen Z and millennials prefer user-generated content to traditional media and turn to trusted experts, friends, family and communities for product recommendations.

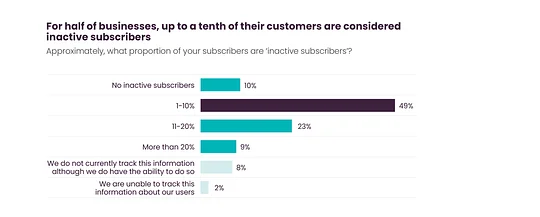

Half of subscription businesses state that up to 10% of their subscriber base is inactive. With brands vying for attention, it’s critical to re-engage subscribers, reinforce the value they’re receiving and offer them control and choice.

Ben Catterall, VP Solution Consulting, Aptitude Software, said: “Exploring product diversification, hybrid paid content models and alternative formats is becoming increasingly important. Bundling and complementary products boost loyalty, brand engagement and ARPU. Flexibility is crucial; refining subscription models to offer more choice and control is essential for developing sustainable revenue strategies.”

Harnessing AI, first-party data and personalisation

First-party data strategies remain a top priority for businesses since consumers expect hyper-personalisation and tailored value propositions. 93% of businesses recognize AI’s crucial role in customer service and retention. There are growing opportunities to leverage AI to enhance subscription products and increase their appeal.

Janine Hirt, CEO of Innovate Finance, said: “Innovators today are helping to provide the best customer experience possible and enable all of us to manage our finances more effectively. This research highlights the importance of using new technologies such as AI to create a more personalised customer experience, and provide insights on our recurrent spending behaviours.”

An evolving subscription economy

As the subscription economy continues to evolve rapidly, the most compelling subscriptions aren’t merely transactional. Successful brands build and sustain powerful relationships, communities and experiences. They cultivate strong associations with trust, value, convenience, lifestyle and personalisation and embed themselves in subscribers’ lives.

Ultimately, consumers will choose – and return to – the brands that empower them, build deep relationships and associations, and provide a flawless, personalised experience.