The Race for the Remedies Fund

Metro Bank, Starling and Clearbank in partnership with Tide were announced as the recipients of Pool A of the Remedies Fund this morning. They pipped the big banks which were looking, maybe even expecting, to get a piece of the action to the post.

So what is the Remedies Fund? Why does it exist? How much money is still left to be handed out? And who is in the running for it? The races are on.

What’s it all about?

The small business banking sector is considered the lifeblood of any economy. Yet for decades it has been one of the most underserved and over-charged sectors of banking services — a subject I go into more depth in my research report here.

That could be about to change. Post financial crisis one of the UK’s largest banks, Royal Bank of Scotland (RBS), had more than 80% of its shares purchased by the UK Government. In return, it had to gradually split up its business to help the UK have a more competitive banking market — at the time of the financial crisis the top 4 banks had a more than 90% share of the market.

It thought it could achieve this by making an old brand called Williams & Glyn independent once again, creating two banks where there were previously one. Needless to say, like all giant transformation projects, this didn’t go so well and became a cautionary tale.

RBS State Aid - Alternative Remedies Package (“Remedies”)

So RBS had to go back to the drawing board – there was no getting out of this one. The result was the creation of a Remedies Package, a lump sum of funding RBS handed over to an independent body which would give it out as grants to other firms. Aside from serving the purpose of RBS meeting its obligations, the Remedies Package would also drive competition in the UK banking market for small businesses.

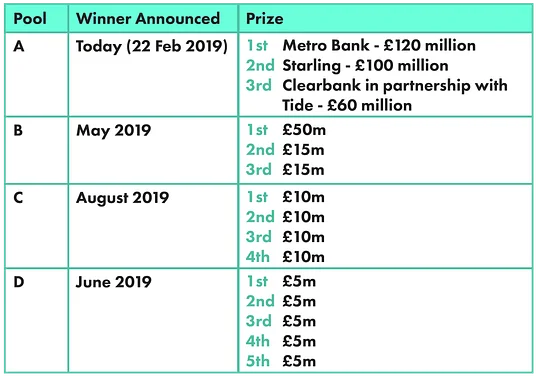

There are two main elements to the funding: A Capability and Innovation Fund of £425 million, and an Incentivised Switching Fund of £275 million. This blog will focus on the former, with insight into the latter to follow.

Capability and Innovation Fund

The funding has been divided into pools which banks and non-banks have been invited to apply for, depending on their maturity in the market and what it is they’re trying to build.

Given the vast amount of news there has been around applicants, withdrawn applications and the occasional snarky remark, I thought positioning these pools as races would be a good way to explain what’s been going on out there.

Race - Pool A

How the organisers describe it:

“To facilitate the development of more advanced business current account offerings and ancillary products for SMEs in the UK giving preference to beneficiaries with an established business current account offering.”

What that means:

This funding was fought for by incumbents and startups that have proven their credentials in the business banking market and are looking to offer next-level products. That meant newer entrants to the market were thought to be at a disadvantage here.

Who entered the race?

This race has some real controversy around it as some very large banks entered and there were a couple of surprises. Santander entered and then withdrew, while Virgin Money was absorbed by CYBG, reducing the field by two. That said, the race remained wide open with some feisty newcomers looking in excellent shape as well.

Riders included:

- Tide and ClearBank paired up to make the most of each others’ strengths.

- One of the most well-known of the new banks, Starling Bank was also in the running.

- “Challenger brands” TSB, Metro Bank, Nationwide, Co-operative Bank and CYBG entered the fray.

- And a few outsiders in the form of Hampden & Co (a less widely known newcomer), Sweden’s Handelsbanken and private bank Arbuthnot Latham & Co. provided further healthy competition.

The winners:

1st - Metro Bank

2nd - Starling

3rd - Clearbank in partnership with Tide

Race - Pool B

How the organisers describe it:

“To facilitate the modernisation of existing business current account offerings or the development of new business current accounts or ancillary product propositions for SMEs in the UK.”

What that means:

The contenders in this race are looking to either launch a business banking proposition, or bring a legacy one up to date. Startups and incumbents have pretty much equal chances on paper.

Who entered the race?

We don’t know yet, the window for applications only opened at the beginning of February and closes in March. That said, there is no rule that says those who missed out on Pool A cannot also apply to Pool B.

Race - Pool C

How the organisers describe it:

“To facilitate the expansion of business offerings to include, lending or payments services to SMEs in the United Kingdom or international payments services to SMEs in the United Kingdom.”

What that means:

Pretty much does what it says on the tin, this pool is open to entrants looking to make the currently very painful and expensive processes of getting credit and making payments easier and cheaper for SMEs.

Who entered the race?

The application window doesn’t open til May but the specialist SME lenders such as Funding Circle and iwoca seem likely candidates. It’s possible some of the big banks that have recently launched SME lending operations, for examples Natwest’s ESME could also decide they want a piece of the action.

Race - Pool D

How the organisers describe it:

“To facilitate the commercialisation of financial technology that is relevant to SMEs.”

What that means:

Pretty much anything goes, the scope for this pool is very broad given that the definition of a service that is “usable by SME” and competes with bank accounts very tough to quantify. That explains why the organisation in charge of handling the Remedies (BCR) started generating awareness back in May 2018. The application window is also much longer for this pool, it opened in November 2018 and closes in April 2019.

Who entered the race?

As yet we don’t know, but given how big the UK’s fintech ecosystem is and how broad the scope for potential applicants appears, this could be the race with the most entrants and the toughest to win.

What’s next?

The hope is that the result of the remedies fund will be increased competition and a greater variety of more suitable products in SME banking market. Some industry commentators and participants feared that if the bigger banks won the big prizes that smaller, newer players would fall by the wayside and the opposite would happen. Thus far these fears have been proven wrong and the challengers have won the first round, but it remains to be seen what they will do with their winnings.

It’s worth noting that we’ve already seen huge growth in the number providers of SME financial services in the UK, without the help of remedies fund, which means there is already more competition than in 2008. And if a big bank does win one of the big prizes and uses it to create outstanding financial products for this previously unloved market, then that’s no bad thing either.