Lessons from COVID-19: you need a truly digital strategy, now!

There’s a lot going on right now on personal, business and industry levels. But as I sit here in my home office over the last month talking to senior people in financial services, fintech founders and project teams all over the world, one thing keeps returning to me: “See, we didn’t need more strategy”.

We are living in weird, concerning times on a personal level as well as the ongoing and unpredictable impact the current situation will have on the financial services and fintech firms as this all plays out.

What keeps coming around in my mind is that more progress has been made in large organisations on their remote working practices and policies in the last three months than the preceding 15 years.

How was this so? How did the seemingly immovable beast of change in large organisations, governance, bureaucracy, IT, procurement and control process that create such a Gordian knot of problems get cut so quickly in those who usually are so slow?

What makes change happen?

To answer this, we really need to look at how change really happens in corporates. Companies of all types initiate change. From the C-suite to the front lines, people and teams try to figure out new ways to solve customer problems, improve products, create new revenue streams and reduce costs.

Every change starts with an idea of what could happen to create a measurable benefit for an organization.

Corporates are good with benefits that drive the bottom line but are generally bad with ones where their levers are harder to predict the impact or where the change requires significant investment or effort. Another way to look at it is they are good at doing things that drive direct sales but bad at change that requires culture change.

But ideas are not enough. Change is the process of transforming a vision into a new reality that delivers the promised benefits.

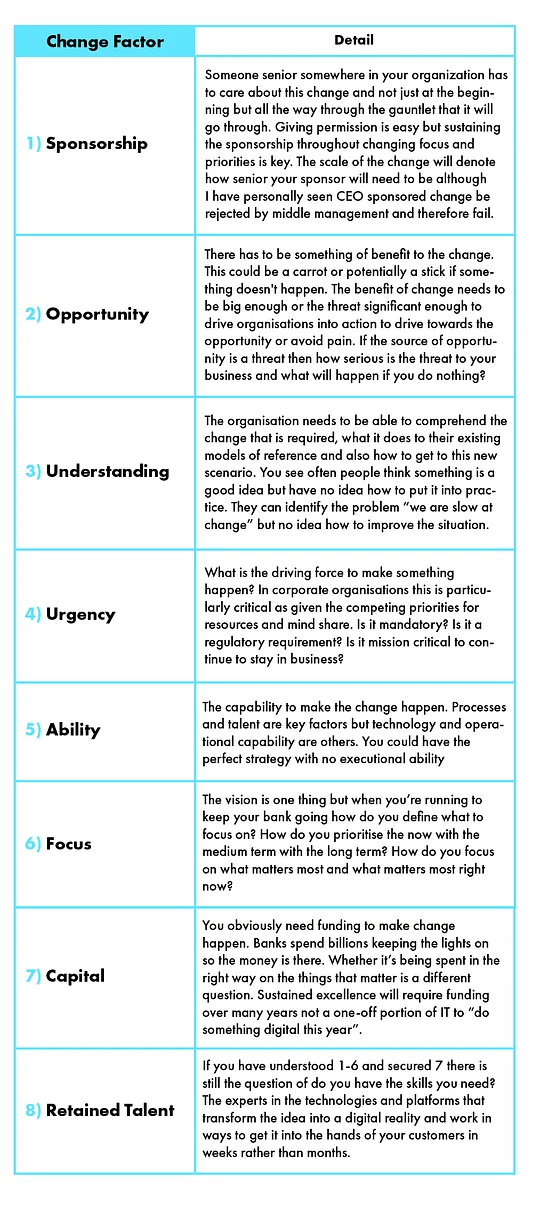

In my mind successful change in a corporate environment requires eight changes factors to be present:

Organisations often find themselves with a lot of these things in place. Some will be able to identify an opportunity but not have the ability. Some might have the ability but not be able to get the sponsorship. Some might have the sponsorship but not the focus. And if they do finally manage to make something happen, some unlucky few don’t have the retained talent to sustain the change put in place.

A Brave New Remote World

As I already said, due to the confluence of change factors, financial service players have progressed their remote working policy more in the last three months than the proceeding 15 years of planning and strategy.

We’ve seen firms go to extraordinary lengths to give their employees the ability to do things that they have never allowed them to do before. Shipping PCs to peoples houses, adopting software they would never have dreamed of before.

Remote working has always been an option. We have always been told of the benefit of it and we’ve seen how it is possible.

So what made this happen so fast?

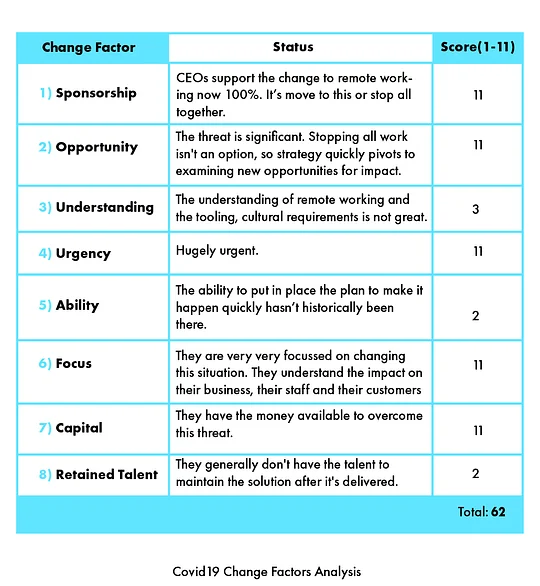

If we take a pretty scoring system we can analyse against those through the lens of the current crisis.

Why haven't other threats accelerated change like this?

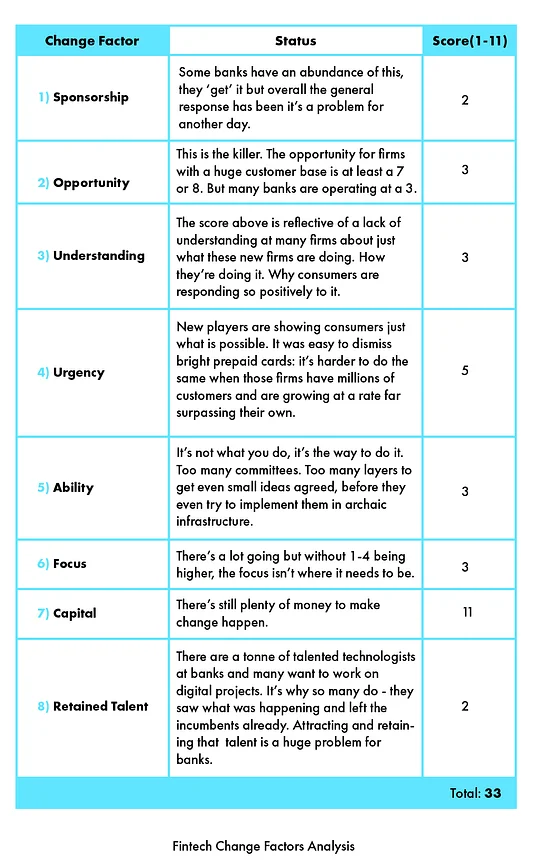

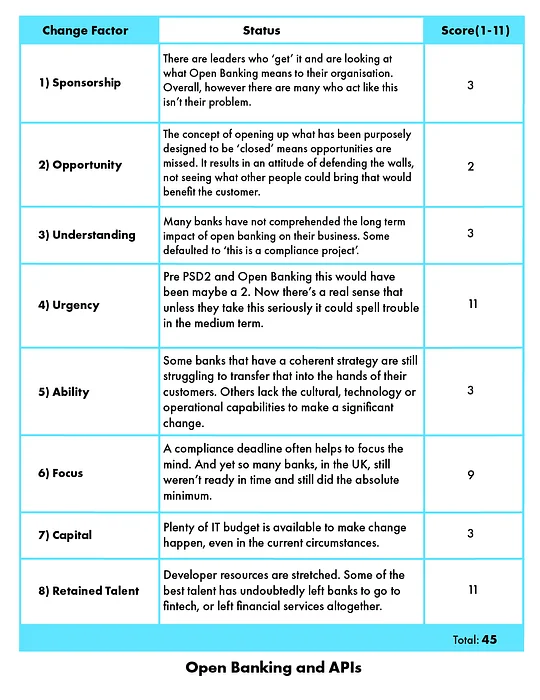

So why do we need an external forcing factor to make something so beneficial happen? If we look at two large driving forces in financial services over the last five years, Fintech and Open Banking, it becomes apparent that for all the ‘strategy’ talk, getting truly digital services customers is lagging.

What can we take from this? We didn’t need more strategy. We needed action to become truly digital

I believe this period of change will accelerate digital financial services. Just look at how the fintech community has already rallied around trying to get government funding into the hands of SMEs and the self-employed.

The last few weeks have shown just how the current digitised approach is isolated and isolating. Banks are still delivering their own products within the walled garden of their own branches, websites, apps, and phone lines, and trying to convince customers to stay within the wall.

Truly digital services have advanced, and this crisis has shown how it’s done. Empathetic design, anticipating needs, tone of voice, and connection with real people – the very best digital services and experiences feel very human at a time when we need it most.

We’ll need much more of it. And we’ll need it yesterday.

Now or never.

Change begins from inside an organisation with key stakeholders and decision makers who are used to working in the same old ways with the same archaic processes that are inevitably slowing the business down.

The reality is that change is a mentality, an overhaul of operational efficiency that ensures longevity of not just a product or service, but fundamentally a business.

It’s not another set of strategy docs or policies with some ‘post COVID-19’ caveats sprinkled over the top.

How we can help

Digital is no longer a nice to have. Becoming truly digital means shifting not just what you do but how you do it across your value chain and operating model. We live and breathe the start-up approach. We have a remote-first approach and can deliver in any circumstances.