How retail Regenerative Financial Institutions can redefine returns

With consumers becoming increasingly conscious of the impact of their lives, and financial services providers, on the environment, how can retail banks look to react to this trend?

In a period characterised by Greta Thunberg, global climate protests and the terrible scenes we’ve all seen from bushfires in Australia, climate conscious consumerism has been discussed with fervour; there is no doubt of its position in the zeitgeist. Customer’s purchase decisions are now swayed more than ever by the environmental impact a product/service has.

A climate conscious approach to retail banking has begun to permeate through the industry. We’ve seen this with the early adoption for retail digital-only regenerative financial institutions (RFIs) such as Aspiration in the US (three million customers) and Triodos in the UK and the Netherlands (1.19 million customers).

The chasm between the zeitgeist and adoption is still significant for RFIs

But unlike choosing to shop at Lush or Patagonia, the decision to join a regenerative finance institution is fraught with far more “ifs” and “buts”. Customers’ choices of fleece jackets are one thing; money carries a particular emotional weight. The chasm between the zeitgeist and adoption is still significant for RFIs.

To cross this chasm, we need to understand a fundamental driver of adoption: human values. In a previous post, I described Edward Bernays’s theory that customers tend to buy a product not because of its characteristics, but because it associates with customers’ deeply held values. Through investigating universal human values, we can gain a more nuanced but powerful understanding of the path to product adoptions.

Human values

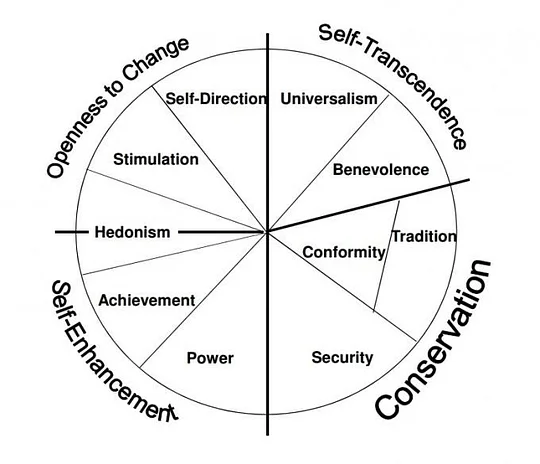

Shalom Schwartz is a social psychologist who created the Theory of Basic Human Values. It poses 10 universal values recognised across all major cultures: self-direction, stimulation, hedonism, achievement, power, security, conformity, tradition, benevolence and universalism. Think of these as our universal internal compass.

Michelle Reidy, "The Schwartz Theory of Basic Values"

In his research, he uncovered concepts about human values that give us a different lens on why customers buy:

- “Values are ordered by importance relative to one another. People’s values form an ordered system of priorities that characterize them as individuals. Do they attribute more importance to achievement or justice, to novelty or tradition? This hierarchical feature also distinguishes values from norms and attitudes.”

- "The relative importance of multiple values guides action. Any attitude or behavior typically has implications for more than one value. For example, attending church might express and promote tradition and conformity values at the expense of hedonism and stimulation values. The tradeoff among relevant, competing values guides attitudes and behaviors. Values influence action when they are relevant in the context (hence likely to be activated) and important to the actor.”

- “Values serve as standards or criteria. Values guide the selection or evaluation of actions, policies, people, and events. People decide what is good or bad, justified or illegitimate, worth doing or avoiding, based on possible consequences for their cherished values. But the impact of values in everyday decisions is rarely conscious. Values enter awareness when the actions or judgments one is considering have conflicting implications for different values one cherishes.”

From this perspective, we can see how adoption for a product/service isn’t driven by a single value, but is a result of a set of competing values. To complex things further, the position of each value on the hierarchy is fluid and continuously changes depending on the context. People are messy.

Money and human values

When we think about money, “self-enhancement” values (achievement, power) and “conservation” values (security, conformity, tradition) tend to dominate. Here’s how Schwartz defined them:

- Achievement: personal success through demonstrating competence according to social standards

- Power: social status and prestige

- Security: safety, harmony, and stability of society, of relationships, and of self

- Conformity: restraint of actions, inclinations, and impulses likely to upset or harm others and violate social expectations or norms

- Tradition: respect, commitment, and acceptance of the customs and ideas that one's culture or religion provides

The “self-enhancement” values lead to the natural desire to maximize returns, and “conservation” values encourage customers to stay with the status quo when it comes to selecting financial services providers. When given the choice, most customers will opt for the 1.5% interest saver account with a well-known bank over the 0.15% interest regular saving account with a regenerative financial institution. The numbers just add up and it is the “right” thing to do.

But the “right” choice has an emotional cost to the customer. During the consideration process, “openness to change” (stimulation, self-direction) and “self-transcendence” values (benevolence, universalism) are considered, but are pushed down in importance in the context of selecting a savings account.

More people will want to bank ethically, and the pull to experiment with new RFIs will increase

Assuming that the customer is climate conscious, they’ll have “openness to change '' and “self-transcendence” values high up as their base value hierarchy. When they opt for the 1.5% interest account, they’ll need to confront a value dissonance as they prioritise “self-enhancement” and “conservation” values (returns and security) over “openness to change” and “self-transcendence” values (divert their capital to new RFIs that fund regenerative enterprises).

As climate change continues to embed deeper into the zeitgeist, “openness to change” and “self-transcendence” values will be positioned higher in the base value hierarchy of customers around the world. More people will want to bank ethically, and the pull to experiment with new RFIs will increase. In this scenario, customers will face an increasing emotional cost as they’re forced to confront a value dissonance when they select traditional banks.

Redefine returns: economics, cultural, and social

Retail RFIs like Triodos and Aspiration shouldn’t focus on beating the high-street banks by providing customers with economic returns. Instead, they should leverage their brand, market, and zeitgeist position to redefine returns. Doing this successfully can help customers remove value dissonance, and RFIs to escape the competition.

Kate Raworth noted in Doughnut Economics that at its core, “regenerative enterprise needs financial partners seeking to invest long term in generating multiple kinds of returns – human, social, ecological, cultural and physical – along with a fair financial return”. For RFIs, sharing these unique returns with customers is an opportunity to differentiate.

Social returns

Social capital is defined by the OECD as “networks together with shared norms, values and understandings that facilitate co-operation within or among groups”. These networks are valuable because they provide support, a sense of identity and opportunities.

RFIs can create and promote meaningful communities for like-minded individuals through facilitating these links. We can take a page from Ian Kar’s Fintech Today here. Fintech Today has a Slack channel for specific members – this is an online, private, interest specific community with real-time communication. This community creates value for its members because it facilitates social links (i.e. creating connection with other members) and creates serendipitous opportunities.

How might RFIs facilitate these social links and create meaningful experiences? Could they create online, private, interest specific channels? What are the offline experiences that it can curate for depositors and lenders? How could they connect the two? RFIs could become a platform to build new connections, a place to discover new experiences, and a place to discuss new ideas.

Cultural returns

Offering customers opportunities to engage with culture is another form of return.Through familiarity with the dominant culture of a certain society/sub-group, one can build better relationships with others who share the same cultural knowledge. Members of this “in-group” can in turn unlock opportunities available only to that cohort. As French sociologist Pierre Bourdieu notes in his essay “The Forms of Capital,” this cultural capital can provide an advantage in achieving a higher social status, and can even be exchanged for an economic return under specific circumstances.

The new model of returns is a more inclusive one that combines economic, social, and cultural capital

If Bourdieu illustrated cultural capital’s external benefits, then the Danish-Icelandic artist Olaffur Eliasson’s view on cultural capital shifts our attention to its internal benefits. He said “Art and culture engage at the emotional level without prescribing particular ways of living or acting. A good book can express things that are emotionally familiar but that you had not yet put in your own language. A painting can give visual form to your not-yet-verbalised need. I like to think of the cultural sector as listening to you...to simplify somewhat, I don’t think culture tells you what to do, but it listens to what you want to do.”

Cultural capital helps us be introspective; to reflect on, adjust, and affirm our value hierarchy. What are the ways that RFIs can partner and engage with the art and culture sector to curate these experiences for its customers?

Building a new model

As the 20th century American inventor Buckminster Fuller once said: "You never change things by fighting the existing reality. To change something, build a new model that makes the existing model obsolete." If the old model of return is purely economic capital, the new model of returns is a more inclusive one that combines economic, social, and cultural capital.

In this new model, RFIs won’t see themselves as just a bank. They’ll provide the banking functionalities and products of a traditional financial institution, but they’ll also position themselves as an organisation that helps customers find their community, understand their value hierarchy, and develop as individuals.