How messaging is helping banks reconnect with their customers

Messaging has redefined the way we interact with one another. Now, it could do the same with the ways we engage with banks...

In the midst of a global pandemic, it’s more important than ever for banks to offer accessible support to their customers. Messaging should be a significant part of that response; already, institutions like Santander are updating their chatbot capabilities to keep up with customer inquiries, while third-party providers such as Spixii are offering to set up services remotely in under two weeks.

The rush to improve these systems speaks to their value in fostering positive customer relationships. But messaging isn’t just essential in emergencies – it’s bound to be a crucial part of customer support going forward, regardless of the outcomes of coronavirus.

To understand the role messaging has played on the industry, we need to go back to the beginning...

The role of conversation

Conversation has always been a fundamental mode of communication.

For most of human history, these discussions were voice-based, face-to-face affairs. Time and location were primary concerns. Unlike written media, from letters up through email, chit-chat tends to happen in real-time: I say something, you respond almost immediately.

Then SMS messaging happened. And just like that, everyday conversation has never been the same.

How messaging has changed the conversation

For one thing, you no longer have to be in the same room with someone to have a tete-a-tete with them. If I want to wish a mate in California a happy birthday, I can shoot him a message and he’ll receive it almost instantly. He can then respond immediately, and we can start communicating in a way that feels an awful lot like a face-to-face conversation.

Or he could choose to respond a few hours later, which gets at another fundamental shift that messaging has wrought: conversation no longer takes place in real time.

Messaging as a form of communication has changed the way we behave and interact with each other

With SMS, communication has also become asynchronous. I can fire off a message, but I don’t necessarily expect a response right away. Because texting is so easy and embedded in daily life, though, people often respond fairly quickly. And SMS has evolved. In 2011 Apple introduced iMessage. Whilst iMessages can only be written and sent on an Apple device, they can be delivered to any brand of device across data or WiFI. Now you can send and receive all kinds of content including images and video.

Messaging as a form of communication has changed the way we behave and interact with each other. We’re more comfortable with asynchronous communication; in fact, it’s become more and more useful as people fall under increased time pressures. You don’t need to set a mutually agreed-upon time to have a conversation over text. Instead, you can proceed at your own leisure.

That last point is important, as it offers an incredible advantage that banks and other financial institutions can capitalise upon.

How banks can harness messaging

When I worked at a bank, we wanted to understand why customers were reaching out to us. We wanted to get a better understanding of what job they were trying to get done.

So we analysed thousands of customer service calls to understand the underlying reasons why customers were calling. We discovered that a high percentage of these calls were non-urgent. Customers didn’t need to solve a problem right then and there; they were calling because they had a general issue and that was the only 15-minute period available in their day.

All banks have mobile and internet banking services, yet apart from some FAQ pages, they only offer customer service over the phone and this is forcing many customers to take an action they don’t necessarily want to perform. Messaging fixes that problem.

Before messaging, customer service could be obtrusive. If customers had problems, they either had to visit a branch or make a long, drawn-out call to solve it. And a lot of the time they were calling out of frustration because they couldn’t find the help and support they needed on the bank’s website or mobile app.

For some banks, messaging has provided customers with an alternative channel to communicate with their bank that avoids the long phone conversations. And while it may take a number of messages to complete an inquiry, the process is often faster than calling up, waiting on hold and then finally discussing their issue. And more importantly it’s much more convenient for the customer.

... Everything still feels like a one-on-one, personal conversation, putting the customer at ease

Because customers can interact asynchronously with representatives, they can initiate and respond to inquiries at their own pace, giving them greater control over their own time. We all know that no product or service is perfect. What’s key is that we can provide customers with a positive experience when they do need help and support.

But it’s not just consumers who benefit. Banks carry a massive chunk of cost from servicing customers. With phone-based customer service, representatives can only handle one caller at a time. Messaging allows each agent to assist multiple users at once, creating efficiencies and therefore cost savings.

And all of this happens while preserving users’ privacy. A representative may be talking to other people simultaneously, but there’s little risk of exposing sensitive information. Rather than reading their details out loud on, say, a crowded bus, callers can silently type them. Best of all, everything still feels like a one-on-one, personal conversation, putting the customer at ease.

Repairing customer relationships

While messaging offers a host of benefits to banks, it also gives them something more valuable: the opportunity to rebuild their relationships with customers.

Think about how you connect with your bank. It’s usually a one-way interaction – consumers use mobile apps and self-service features until they encounter major problems, at which point they contact customer service.

When financial institutions do reach out to their users, bad news is often on the way. If my bank gives me a call, it’s probably because an error or fraud is involved. Is it any wonder why customers tend to dread these interactions?

The bottom line is that banks need to rekindle their relationships with their customers. And messaging is a great way to do that.

[Messaging] systems can make customer service more beneficial to both banks and their users

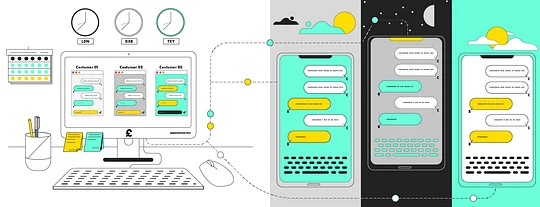

A two-way messaging interface opens up new lines of communication that banks didn’t have before. Some institutions are already using natural language chatbots, software that mimics human speech patterns, that can handle about 30 percent of customer inquiries.

Others have adopted synchronous messaging systems that retain human operators. As with helplines, customers are placed in a queue until a representative can respond to their needs. From there, the conversation becomes asynchronous: customers can go about their day, pausing only when they need to respond to their representative.

These systems can make customer service more beneficial to both banks and their users. Consumers with non-urgent inquiries can find sufficient help quickly through a messaging system, while those with complex inquiries can still walk through their problems on a call.

That latter point also minimizes a significant problem for banks: customer service retention rates. By reducing the number of repetitive calls, representatives can focus on completing more creative, value-added work. In turn, this would lead to greater job satisfaction and reduce turnover.

The future is already here

It would be a misnomer to call messaging the future of customer service at banks. After all, the technology is already here and in use at major financial services institutions.

But through wider adoption and development of both chatbots and synchronous messaging systems, the industry can enrich its relationship with customers all while using resources more effectively. And that’s only the beginning...

How we can help

Digital is no longer a nice to have. Becoming truly digital means shifting not just what you do but how you do it across your value chain and operating model. We live and breathe the start-up approach. We have a remote-first approach and can deliver in any circumstances.