How building societies can own the homebuying space

Building societies are ubiquitous in the UK with 43 currently operating across the country. They are however, often conflated with banks. The key difference between building societies and banks though, is a big one: a building society is owned entirely by its members rather than shareholders, to whom they pay dividends every year.

And the differences don’t stop there. Building societies traditionally focus on real estate, helping individuals through the homebuying journey or helping businesses who specialise in construction.

But most importantly, it’s how they look after their customers that sets them apart from banks. Building societies tend to cover much smaller geographical areas, with a heavy emphasis on building in-person relationships and serving the local community.

Typically, they don’t have the size or scale to compete with the big banks when it comes to providing the mod-cons we’ve come to expect from our financial services providers. The exception to that is Nationwide, which is in the CMA9 (the nine largest banks in the UK), with just shy of 10% of the UK savings market.

Where do they stand in the current market?

A lack of individual scale or sophistication doesn’t stop building societies from being competitive, particularly in the homebuying space. In 2023, 25% of all mortgages in the UK originated from a building society.

Among the top five building societies by group asset size, the first half of 2024 was equally promising. Leeds Building Society had their busiest day ever for mortgage completions, while Skipton Building Society grew their mortgage balances by 10% year-on-year.

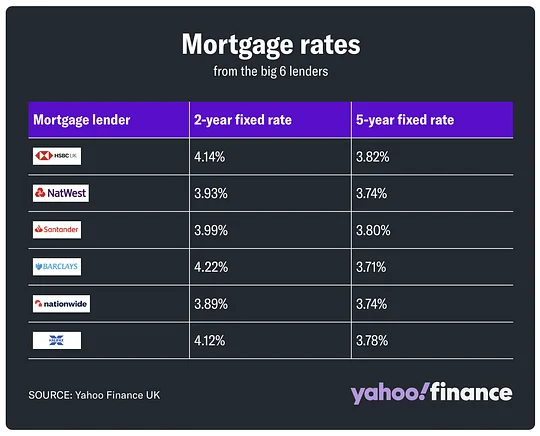

Being competitive on rates is increasingly important for building societies as interest rates continue to revert to their higher long-term trend, but they are also where building societies face stiff competition from big banks who are starting to offer lower rates and higher Loan-to-Value (LTV) ratios.

The Bank of England’s rate cut to 5% earlier this year triggered a race to provide mortgages at sub-4%. Nationwide was the first to lower their rates, going to 4%, but ultimately it was big banks like HSBC, that dipped below 4%.

This competitive rates landscape is forcing building societies to find new ways to compete in the homebuying space.

Why do they need to change what they’re doing?

The homebuying journey hasn’t seen the kind of modernisation that we’ve seen in other areas of financial services and building societies haven’t traditionally had the incentive to drive that change. The status quo has been too stable.

In 2023, the top 10 players in the mortgage space had over 83% market share, with Lloyds, Barclays, NatWest and Satander taking 4 of the top 7 spots, showing the power of the incumbents.

This status quo and lack of innovation has forced building societies to pull the only lever they have available to keep up with banks - pricing. Skipton Building Society as an example is currently offering a 100% LTV mortgage. When you’re offering 100% LTV, you’re competing on a commodotised product.

High LTV mortgages are aimed at aspiring homeowners who would struggle to be accepted into a lower LTV scheme. This reflects a key point reiterated in most of the big building societies’ H1 financial results - there is a large focus on first-time buyers and people who are struggling to find a more traditional mortgage.

Skipton has only been able to accept the risk of providing a 100% LTV by using open banking to verify the last 12-months of rental payments customers have made. This is a case of a catalyst (competition to offer ever increasing LTV) creating an innovation (using open banking to verify rent).

"Fintechs are solving some really important, niche problems in the homebuying space, which is the perfect place to start for building societies looking for inspiration."

Where else building societies can innovate

If the banks aren’t innovating and building societies are only just scratching the surface, then there is one group building societies can look to for inspiration on how to compete beyond pricing and that’s fintechs.

Fintechs have generally stayed away from homebuying due to the barriers to entry around secured lending making it hard to provide mortgages on the same scale as incumbents do. But this hasn’t stopped them innovating around the edges.

At the moment, fintechs are solving some really important, niche problems in the homebuying space, which is the perfect place to start for building societies looking for inspiration:

- Strideup provides Shariah-compliant mortgages using innovative loan structures to address a (USD 7.25bn) share of the market that existing mortgage offerings ignore. Helping minority communities who would otherwise struggle to get on the property ladder is mission aligned with what building societies are trying to achieve.

- Coadjute connects all parties involved in the homeownership journey using Blockchain to make the process smoother and more secure. They’ve already received funding from major banks and building societies like Lloyds and Nationwide. Getting involved in initiatives like this and leveraging the local networks building societies have is a really powerful way to strengthen the communities they serve.

- Generation Home provides innovative products to make it easier for first-time buyers. Its ‘Income Booster’ feature allows you to add additional people’s income to your mortgage to improve your affordability, with a lot of flexibility on how you split payments and home equity between all parties.

- Lendinvest competes in the commercial mortgage space, with over £6bn lent to date. By focusing specifically on commercial mortgages in the UK, they’ve been able to solve key problems for a hyper-localised subset that speaks to one of the original aims of the traditional building society.

- Habito is the poster child of modern mortgage applications, using open banking to streamline the process and reduce the time taken to actually get a mortgage. Some building societies are already using open banking but the level of integration hasn’t been taken to this level - a quick win to reduce the hassle of getting a mortgage.

The way these fintechs are getting right to the crux of real customer problems with a digital-first approach can’t be ignored by building societies. In other areas of finance, incumbents are already being threatened and dethroned and homebuying could well be next.

"The biggest strength of building societies, though, remains their customer and broker satisfaction."

What should they keep doing?

This isn’t to say that building societies need to rip up the playbook and start again. Some of the things they do clearly resonate with their customers.

Building societies are working hard to help first-time buyers. Skipton’s 100% LTV mortgage stands out but it’s not alone. Leeds Building Society is also using open banking in partnership with Experian to boost applicants’ credit score while Yorkshire Building Society has a mortgage that only requires a £5,000 deposit.

Additionally, for the types of mortgages that first-time buyers typically choose, building societies price lower than the market averages (albeit the most competitively priced mortgages remain those of the biggest banks), showing their commitment to their target markets.

These products are actively serving those who wouldn’t be able to afford a mortgage without them. It’s no wonder then that building societies have captured a third of the first-time buyer market.

The biggest strength of building societies, though, remains their customer and broker satisfaction. In the first half of 2024, Smart Money People ranked building societies highest for both customer and broker satisfaction. This is the cornerstone of what differentiates them from banks - H1 2024 was the 12th time in a row they’ve shaded banks in customer and broker satisfaction. It’s not surprising that building societies are able to successfully major in satisfaction as they are more deeply embedded in local communities, with in-person customer service at the heart of their business model.

While the number of bank branches fell by 5,050 (44%) between 2012 and 2022, building societies saw a much smaller decrease of just 235 (12%) in the same period, taking the overall share of branches owned by building societies from 17% to 38% between 2014 and 2023. This exemplifies a less hardline approach from building societies to the digital-first model that has become the de facto standard in the last decade, and customers are responding to that.

It's time to double down on innovation

It’s simply not enough for building societies to compete on rates while disruption in the mortgage space is picking up speed.

The push to modernise is undeniable and without a digital offering to match the success of their in-person service, they will ultimately lose out to fintechs tugging on the edges of underserved communities.

Doubling down on innovations to help key demographics like first-time buyers is worth the investment, dovetailing with their already high customer satisfaction can cement the space building societies occupy in the UK.

Ready to Venture?

At 11:FS Ventures, we’ve helped launch more than 15 businesses worldwide. Our global experts have specialties across the board including engineering, embedded finance, customer experience, and digital transformation.

So, whether you’re looking to strategise, design, build or launch, we’ve got the tools to help you accelerate change and win, wherever you are in the world.

Let's talk