How brands can evolve for the new financial services landscape

Leveraging consumer trust is an important tool for all brands. Businesses are starting to take note and realising that in today’s all encompassing landscape, one product offering simply isn’t enough anymore.

This is why we’re starting to see everyday household brands, such as Apple and Facebook, move into financial services. From the Apple Card to Razer Pay to Stripe partnering with brands across the world, Financial Services is quickly becoming more intelligent and tailored to consumers and their lifestyles.

The data says it all: 62% of people said they would consider banking with an established tech company. And things look even more promising as the Gen Zs and Gen Xs start to choose their banks of the future, with 75% of respondents aged 18 to 34 saying they’d buy a financial product from an established tech company.

We’re beginning to choose brands we already use and love for non-financial purposes to be our financial providers of tomorrow. So how can incumbents adjust to this new landscape?

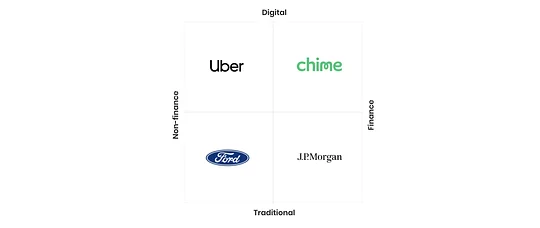

Look at what's happening in the market

So far, we’ve seen tech brands, ride hailing companies and social media providers moving into financial services, but there’s room for all kinds of brands to get involved.

Big brands like Amazon and WeChat have a loyal customer base and an existing, successful product offering; factors that make them a good fit for moving into financial services. For example, 54% of people trust at least one tech company more than banks in general, and 29% trust at least one tech company more than their own current primary bank.

In 2020, we saw gaming company Razer move into financial services with a prepaid card. It hasn’t just gamified financial services, but embedded FS into its existing brand with the intention to “make a game out of everyday life” by offering customers gamified rewards through its app.

The Razer logo glows with RBG lighting after a contactless payment

Razer has further tapped into its iconic legacy of physical gaming hardware by lighting up the logo on its cards when a customer uses it. Small touches like this help to make transactions fun and interactive, keeping users engaged.

Asian tech giant Grab has added to its bank of product features with the launch of financial products. Taking the time to understand its customer behaviours means the brand can reward them financially for every transaction they make using Grab services.

GrabInvest is an example of how Grab is leveraging its household name to get customers into investing by making the process less daunting for users, or, in its own words, “taking the ‘sting’ out of investing.”

By observing what tech businesses are doing in this space, all kinds of brands can think of creative ways to address their customer needs and provide financial services in non-traditional ways. As a16z’s Angela Strange said, “in the not-too-distant future, nearly every company will derive a significant portion of its revenue from financial services.”

Source: 11:FS

What do your customers want?

There’s only one thing for it: speak to your users and work out what they really need.

Maybe they want to use their favourite gaming app to send and request money from friends, or perhaps they want a social media brand to help them improve their understanding of their own behaviours for better financial wellbeing.

At 11:FS, we often talk about Jobs To Be Done, which is how we identify what customers' needs really are. Large companies have the added advantage of a loyal customer base who already uses and loves the brand for specific reasons. By tapping into their customers’ Jobs to Be Done, brands can understand what customers want from a financial perspective and extend their current product offering to address this.

Plus, connecting with your user base makes sense in other ways. When you design a user journey that addresses common pain points and you happen to incorporate a financial element, that’s where the magic of embedded finance happens.

Bringing us onto my next point...

Embedding finance is hot right now 🔥

Embedding finance, as Simon Torrance puts it, is about “enabling any business to manage and sell innovative financial services; seamlessly integrating creative forms of payment, debit, credit, insurance or even investment into their end user experiences.”

Sounds ideal, right?

Embedded finance can take various forms. Apple, for example, has taken its iPhone and Apple app and embedded financial services into its existing proposition in the form of a wallet, payments and a virtual card (accompanied by a physical one.) Making payments embedded into the physical buttons on the iPhone, and financial analysis integrated into the Apple wallet, fits perfectly with the brand’s clean and simple ethos.

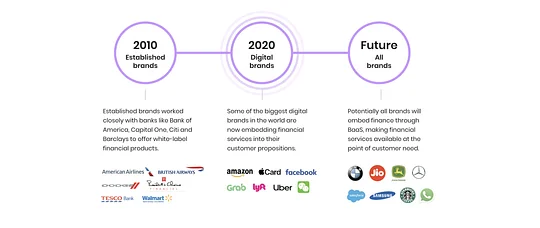

Embedded finance has become much easier with the advent of Banking as a Service (BaaS), which enables brands to provide financial services by partnering with banks and capability providers.

Since brands need a banking license and the right infrastructure to provide financial services, BaaS can help them to partner with banks to ‘borrow’ their licenses and team up with providers - like Marqeta and Synapse - to harness specific elements of the banking stack.

“The headache of getting, and maintaining, a banking license would likely be considered too big a risk for these companies. Instead, they will continue to operate with licensed partners.”

Sarah Kocianski for CNBC

More importantly, embedding finance brings tangible returns for brands. It offers a very large addressable market opportunity that could be worth over $7 trillion in 10 years' time - that’s twice the combined value of the world’s top 30 banks today!

In order to do this, brands need to think about which providers and banks they can leverage. For example, Goldman Sachs and Apple have built an effective partnership to create the Apple Card by playing on each other's specialisms and expertise. Goldman provided the banking license, general ledger and multiple elements of the banking stack (from compliance and financial crime to risk management) while Apple brought its existing user interface and customer operations to the table.

When it comes to BaaS providers, some can provide specialist, focused capabilities, whereas others - like Stripe - cover multiple elements of a stack. It depends on what the brand already offers and how other providers can compliment that in order to to embed finance seamlessly.

Ultimately, it’s survival of the fittest

With more and more brands set to branch into financial services, and super apps who already have huge, loyal customer bases on the rise, incumbent banks can learn a lot from their newer counterparts.

Making sure you understand the current battlefield in your market, establishing what your customers really want,and embedding finance effectively, will be key to creating world-class services and keeping up in the financial services race. 💪