Digital Banking is only 1% Finished, Seriously

Digital Banking is only 1% Finished. That’s our motto at 11:FS. You can see it plastered across everything we do, we talk about it at events, and it’s in all of our client work. Taking a paper statement to the telephone, to a website and then a mobile app isn’t where digital banking ends; it’s where it begins. Digital Banking having 99% to go is a statement of optimism, of opportunity and its how you differentiate, as consumer expectations will only grow in the coming years.

With so much powerful technology now available it’s time to get started on the mountain of work ahead of all of us to make banking truly digital.

Digital Banking Without the Digital

The transistor was invented in 1947 and 71 years on we’re still not done exploring its full capability. All it does is amplify and switch electrical power and electronic signals, but even today we’re still finding new applications for it. So, when we say that Digital Banking is only 1% Finished, that isn’t a criticism or anything negative about the industry. It just means that, after 28 years of investment in digital banking, we’ve only begun to scratch the surface of what’s possible.

There’s so much more to do. That’s why it’s painful to see that incumbents are repeatedly being mis-sold what it means to be truly digital. And that’s not a small issue, approximately £250 billion has been spent on “digitising” banking, and it’s resulted in very little transformative progress. Net promoter scores are still weak, and customers are still left without help for their jobs to be done.

Banking apps are a perfect example of forays into supposedly digital banking, but they aren’t an expression of a truly digital journey. What they’ve done is spend two years creating an app that compresses the banking experience from in-branch to in-phone. It’s digitising the customer journey rather than being truly digital. When you walked into a branch you had a human, who knew your context (where you lived, your life goals) and could relate to you and empathise with you. When we “digitised” banking, we created a service gap. The service-gap lengthens the distance between customers and banks.

Your service gap is a challenger bank, fintech or tech companies’ opportunity to disrupt you.

Thoughtless Innovation

Every incumbent bank has created an innovation centre to combat traditional thinking, but many are missing actual innovation. That’s because banks are ignoring what customers need in favour of what they think customers need. As a result, the products stay the same: checking, savings, loans, mortgages. When you try and push these products that have been available in-branch for centuries through “digital” as a channel, it makes no sense! 11:FS CEO, David M. Brear said it best:

That’s like Apple creating the iPad, the iPhone, iTunes […] and then seriously trying to sell vinyl

Every incumbent bank has created an innovation centre to combat traditional thinking, but many are missing actual innovation. That’s because banks are ignoring what customers need in favour of what they think customers need. As a result, the products stay the same: checking, savings, loans, mortgages. When you try and push these products that have been available in-branch for centuries through “digital” as a channel, it makes no sense! 11:FS CEO, David M. Brear said it best:

That’s like Apple creating the iPad, the iPhone, iTunes […] and then seriously trying to sell vinyl

Fall in love with your customers problems

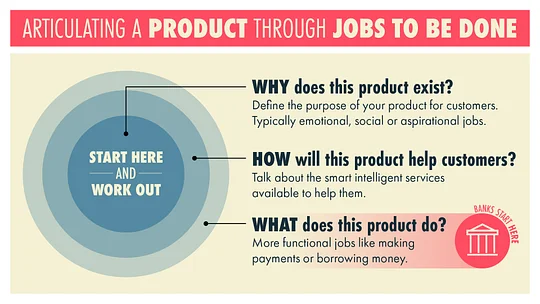

Banks need to change how they think about customers. Jobs to be done is a brilliant framework for this, encouraging research into customer journeys instead of designing an app that’s dead on arrival with products that just aren’t useful to customers. Banks should instead be combining multiple jobs to be done to create a minimum loveable product (MLP) which provides a useful and powerful service to customers.

There are many examples of these MLPs from the fintech space, such as Transferwise’s multi currency account, which is allowing SMBs to have one account which serves many needs. A multi currency account product is useful because it serves multiple needs in one location, but more importantly it makes life easier. That’s the goal of truly digital banking, solving for those underserved and overcharged customers. Those customers are your opportunity, they’re how you differentiate in digital.

Starting Afresh

We recently released the Banking Battlefield, a guide to how difficult it is to progress as a bank today. The truth is there are existing processes, culture and mindset that hold you back. If you want to truly stand out from the crowd of available services to customers, then seeing the world as commodity products pushed through channels may be what’s holding you back. The future is intelligent digital services.

What is an intelligent digital service? It’s digital’s superpower, Digital RICHES. Understanding the virtues of being digital is the pathway to delivering truly differentiated services and real digital banking. Building real time, intelligent, contextual services that are human and extendable - that solve for a job to be done - for a customer who is underserved and overcharged. That is how you differentiate, and that’s how you move forwards on digital.

There's so much left to do. That's why Digital Banking is only 1% finished.

We’re building propositions for organisations big and small to take advantage of all of this opportunity. Join us, or get in touch at hello@11fs.com.