DeFi & Stablecoins: Africa's new savings vehicle

Africa is the most worthy market for mainstream adoption of decentralised finance. Why? I could go on and on about the underbanked, underserved populations and fragmented remittance ecosystem - while that’s all valid, the biggest pain point in my mind is currency devaluation. Volatile currencies make it difficult for Africans’ savings to hold their value. Solving for currency devaluation will provide the beachhead for the adoption of Decentralised Finance (DeFi) across Africa.

🕸️ What’s Decentralised finance?

Remember the internet in the 90s? It wasn’t user friendly and there were lots of competing private intranets and people treated it as a digital phonebook. Due to the public nature of the early internet, millions of developers were able to make the internet better, with new innovations built on top. That kind of innovation would not have been possible on private networks because of corporate and government bureaucracy. The same open source movement is happening with money. Money and payments are highly fragmented. Some traditional financial services still maintain costly private networks and pass on these costs to customers. DeFi is a new money and payment system that looks a lot like the internet we have today. Here are some of the characteristics:

Open Source code based

Borderless

Decentralised

Not owned by corporate or government bodies

Transparent

💸 What are Stablecoins?

Some think that cryptocurrencies are an unpredictable new fad: speculative and volatile. But there’s a type of cryptocurrency that’s designed to match the value of a reserve asset (like fiat currency, another cryptocurrency or commodities). This connection brings stability to the coin while utilizing the advantages of crypto like transparency, security, speed, and low fees. Popular examples include: USD Coin (USDC) and Paxos Standard (PAX).

Currency devaluation in Africa

African currencies have seen a lot of volatility in the post-colonial era. Unstable economies, high national debt and political instability are a symptom of neo-colonialism (but that’s a story for another day). Here are a few examples:

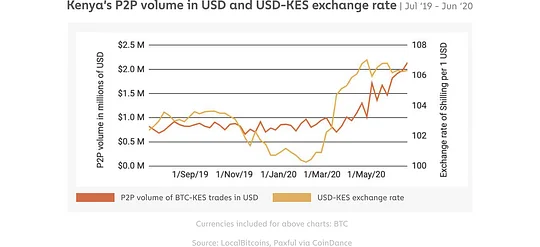

Kenya

When the Kenyan Shilling lost value, P2P trading volumes rose, highlighting users’ strategy of mitigating currency devaluation by shifting to crypto assets for various activities, including savings.

Retail banks have offered foreign currency accounts to help customers mitigate losses from currency fluctuations. These accounts allow customers to hold money in non-volatile currencies like USD, EUR, GBP. Foreign currency accounts are only available to those in the formal banking system and often have high minimum deposits, and offer predatory exchange rates and fees.

Stablecoins would offer accessible savings vehicles to retail consumers

In 2020, the Kenyan Shilling saw a ~6% devaluation while the average retail savings rate for a traditional easy access savings account returned between 2-5% in interest. Stablecoins would offer accessible savings vehicles to retail consumers who may be unbanked by traditional institutions.

Zimbabwe

The Zimbabwean story of currency devaluation is the poster child for the effects of hyperinflation in the modern world. Zimbabweans completely stopped using the currency, which led to the central bank mandating banks to adopt & issue USD for local transactions.

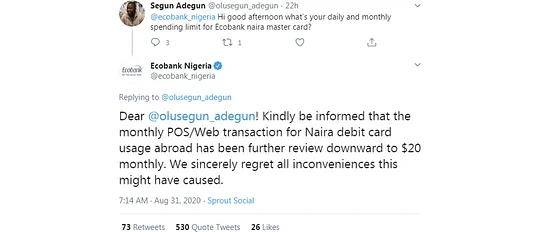

Trust has weakened in banks offering foreign currency accounts

Nigeria

Nigeria’s history of currency volatility has a storied history but the current crisis surrounding a shortage of USD is resulting in Nigerian banks imposing withdrawal limits for their customers using foreign currencies. Trust has weakened in banks offering foreign currency accounts and Nigerians are hungry for alternative stores of value that are immune to the Naira’s devaluation.

Enter: DeFi & Stablecoins

Trust and uptake in traditional savings vehicles across Africa has eroded. DeFi offers control over finances while stablecoins allow consumers to hedge against currency devaluation in their savings.

One stand out example of an organization tackling this problem is Xend Finance. They’re a Binance backed DeFi platform that offers credit unions and cooperatives interest on deposits by converting them to Stablecoins. By building the rails, they’re taking the first step towards mass adoption of DeFi.