Banks, mergers, and missed opportunities

In the wake of UBS’ takeover of Credit Suisse, we’ve been thinking a lot about the impact that mergers and acquisitions (M&A) have on technology and architecture.

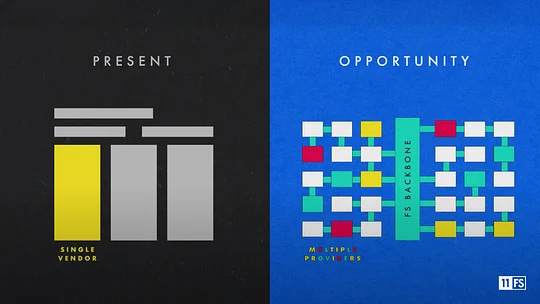

The easy option is to pursue consolidation of IT systems and focus on a single technology platform for each capability. This ostensibly saves money by reducing both the cost and the number of people required to run multiple platforms in parallel.

This sounds perfect from an IT cost model perspective but it’s not without issues. Fundamentally, it follows a systems-centric view of the world and doesn’t actually change anything internally for the business as a whole.

This means that frustrations the business has with any technology or architecture will remain with a lock-in on a solution (vendor or in-house) that will continue to be managed via the same annual cost cycles as things have always been. Is there a better way?

Capability, not technology

M&A is an opportunity to think differently about architecture and take an alternate approach which not only solves the desire to consolidate, but also allows the business to move beyond its traditional IT ways of delivering solutions. Rather than looking at reorganising your technology as a bank, how about considering the ways startups and fintechs would solve this problem?

Fintechs almost never build and run their own stack from end to end. They typically find best-of-breed SaaS-style providers who are offering the capability they need for that part of the value chain. The job of the fintech is then to build on top of those SaaS providers to add their own customer-facing capabilities. A bank’s customer-facing projects are akin to startups so the capabilities they really need are the same as a fintech.

Whales are expensive and slow to change - the very reason why M&A activity is fraught with cost and danger.

At 11:FS, we talk about the difference between whales and schools of fish - whales are the large, monolithic, all-encompassing enterprise solutions that were highly popular in the 1990s and still run a lot of the underlying banking infrastructure around the world. Schools of fish are the new breed of SaaS-style startups that are offering customer friendly API-based solutions that allow fintechs to glue together their proposition from best-of-breed SaaS solutions. Whales are expensive and slow to change - the very reason why M&A activity is fraught with cost and danger. Schools of fish however can be switched out easily and cheaply if a better provider/fish comes along.

Lower-level business capabilities that move away from IT systems create a powerful set of building blocks which essentially act as SaaS offerings. The business can leverage these to rapidly compose customer products and services to take to market. This moves the build of solutions outside of complex core systems and simplifies delivery as well as removing system lock-in.

Taking a capabilities-centric approach allows the business drivers to come from a product-led perspective rather than a technology-restricted one. Capabilities should be focussed around primitive building blocks for the business such as: store of value, cards, payments, KYC, etc.

A product-led approach allows the requirements of the business consuming the capability to be identified both for functionality and other dimensions such as SLA, performance, regulation and so on. The target internal systems can be encapsulated in the capability approach and delivered to the business via a set of business APIs.

To do this effectively, the business needs a product roadmap, which allows future needs to be built out along with a timeline to give the business what it needs next and when. Product prioritisation allows competing parts of the business to be managed and met in parallel.

The paradigm shift here is to run the capability as a business on its own.

Run capabilities like internal fintechs

It makes no sense to take this approach without also changing the operating and budget model too. Otherwise it just leaves the centralised capability as another centralised IT function. The paradigm shift here is to run the capability as a business on its own, within the larger organisation, moving it out to run its own P&L by charging services to its consumers.

This is both a mindset shift and a fundamental change in the way technology is viewed. This is a change in the dynamics of enterprise architecture and how it considers technology. It needs to move up a level from a traditional governance-centric model and apply entrepreneurial approaches to how it is approached. This will enable a move from a cost-based approach to a profit-making fintech model. This profit can then be used to differentiate and innovate in the capabilities for the business.

Like any fintech, the enterprise needs to invest in this capability, give it some seed money and several rounds of investment, and, like any business, it needs to start with a business case and to hit its goals and targets as it grows. If all this happens, the capability will be a success.

Be bold

M&A is a challenging time for any organisation, and technology is often viewed through a simple cost-saving lens as part of the bigger picture. It's too soon to tell what UBS will do from a technological standpoint as a result of the Credit Suisse purchase, amid headlines of cost-cutting and layoffs, but there is a real opportunity for every merger to do something more than just save costs. It is a chance to bring a differentiating approach in the delivery of the underpinning capabilities behind the technology estate and to move to a fintech centric model. Ultimately, the additional cost to make this happen will be small compared to the return on investment it will achieve.

In short, the status quo of system consolidation may bring marginal gains but shaking things up and taking a different approach can be a game changer.

Build digital strategies and loveable products

At 11:FS Ventures, we’ve helped launch more than 15 businesses worldwide. Our global experts have specialties across the board including engineering, embedded finance, web3 and digital transformation. So, whether you’re looking to strategise, design, build or launch, we’ve got the tools to help you accelerate change and win.