Bankenstein: A story of APIs and monoliths

If you create a service that can be put in an app or on a website then it should be an API.

At the moment banking experiences exist in an isolated state. Many banks exist in a monolithic structure. Rigid, siloed, strong. Monoliths may be considered powerful but unfortunately for banks, their foundations are crumbling. No-one knows how to maintain them anymore and the structure itself isolates incumbent banks from the digital advantages neobanks are enjoying.

Internal APIs are particularly important in providing useful microservices to clients. Monoliths provide a complete interconnected service that’s either up or down. APIs perform best in a modular environment. It’s the only environment where they can interact easily. And provide new services.

Monstrous monoliths

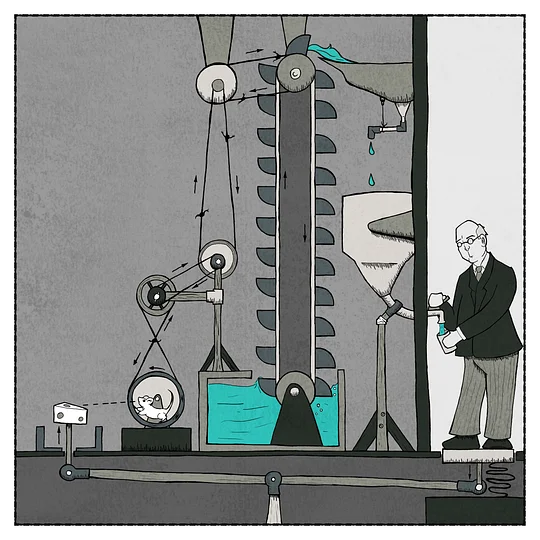

It means that monolithic incumbent banks aren’t extensible. They can’t be extended out with APIs. That’s not quite true. They can be extended out. But bolting APIs on to a monolithic system creates a veritable Bankenstein’s Monster.

Banks need to create a smooth behind the scenes process. One that gently takes the user through a journey without exposing them to the underlying technology limitations. Instead, Bankenstein’s Monster is a crude stuttering hodgepodge of services, and when customers try to engage one a different one fails and the whole service suffers.

It’s an unmanageable game of catch-up. 30 year old technology cannot possibly underpin 5 year old technology. It’s no surprise when the average smartphone today would rank in the top 250 supercomputers worldwide in 1994.

The technology involved when building these banking systems 30 years ago was suitable for the time. But the world’s moved on and bank infrastructures are failing to move with it.

Banks desperately need to escape from the monstrous monolith and move towards a modular technological system. One that can plug in and play with APIs at will. And without crashing other key features in the system if something were to be changed without weeks of manual testing to make sure it doesn’t.

A major issue with monolithic banking architecture is that it’s outlived the administrators. All of the experts who knew how to keep it ticking over are retired. Or they’re charging exorbitant consultancy fees. Either way, the banks are paying a heavy price for its legacy technology.

Neobanks are a step ahead. They didn’t need to adapt from a monolithic system. It’s a rare instance where starting your system from scratch is the better place to be as you can use external APIs more easily. Using a digitally native, API focused, banking system with foundational designs to support the new data age. If they didn’t and chose to build the processor in-house then it would take them at least a year to get off the ground.

Although, while third party APIs are great for getting to market fast, they’re not necessarily sustainable at scale. Uber used Google’s mapping API when it first launched. And after confusion around pricing, increasing costs and switching providers, Uber opted to develop its own API. It’s an internal API and Uber has no plans to offer it out to others. But, thanks to using third party APIs Uber was able to reach that point and maintain first-mover advantage.

For banks to use APIs to the same level of impact they need to move away from ring-fenced monolithic technology. Only that will allow banks to speak to the outside world.

Stand out

But if every bank is doing the same thing how are you going to stand out from the crowd? Those who refuse to shift to an API-focused system will fail. Everyone else will be competing for the same as usual.

Differentiation is key. The true struggle is for the superiority of ideas. Whoever implements their jobs to be done research cycle correctly, whoever creates natively digital services and whoever delivers at speed.

What really matters is providing a true service that treats the individual as a customer of one with evolving needs and requirements, and not just an account number. Whoever achieves that will be the ones to prove their ideas are superior and stand out.

APIs are the way to do it.

If you want to learn more about modular banking, check out 11:FS Foundry.