7 reasons Banking as a Service is a game changer

We now live in a world where almost anyone can build and launch innovative, regulated financial products as easily as they can create a Shopify page - that’s the magic of Banking as a Service (BaaS).

We’ve really seen BaaS take off in recent years, with the likes of Stripe, Grab, Apple and Lyft embracing the $3.6 trillion dollar opportunity that it presents. Even Goldman Sachs has put BaaS on its roadmap, launching a developer portal that allows companies to embed finance within their own products.

The best thing is that it’s mutually beneficial for both banks (helping them to create new revenue streams) and brands (allowing them to provide new offerings) as well as creating an opportunity for specialised providers.

Let’s take a look at some of the reasons BaaS is an unmissable opportunity for every player in the banking ecosystem.

1. More revenue streams

Bank licences (or ‘charters’ for those reading in the States) are expensive and hard to get hold of. BaaS means that banks can rent out their licences to brands and providers for a fee.

As a result, banks make more money out of their existing banking licence. And another avenue for additional revenue is through providing various elements of the banking stack to brands and providers.

For example, Evolve lends its banking licence to Synapse and Mercury, whilst also providing treasury and the general ledger services as well as elements of compliance and product.

2. Increased creativity

BaaS enables brands to easily provide financial services, even when that’s not their core product. The modularity of BaaS means a brand can pick and choose the providers they use, depending on what their customers need. This gives brands the flexibility and creativity to build financial services into their existing offering.

Ride-hailing apps like Uber and Grab have embedded financial services into their user interfaces so that banking fits into the user’s everyday lifestyle. Rather than needing a separate app or service to manage the financial side of things, riders can seamlessly connect their bank details once and the app will remember them for future use.

Another great example is Apple. It’s partnered with Goldman Sachs to offer the Apple Card, allowing it to provide financial services but without a banking licence. It’s a signal of Apple’s wish to move from a tech company to an ‘all-in-one’ business. Simple design features allow users to understand their financial ecosystem within one single view, predicting upcoming costs ahead of time as well as showing an overview of their monthly activity and spending analysis.

BaaS presents a huge opportunity for brands to leverage their existing customer relationships and to gain more insight into their customers by bringing their financial habits into their ecosystem. Banks can help brands to use these smart insights to better understand their needs, helping them plan more effectively for the future.

BaaS providers are likely to see strong revenue if they can help brands get to market faster.

3. Faster entry to market

Getting a banking licence is extremely expensive and can take years. The beauty of BaaS is that it lets brands skip the queue. There's a market for BaaS offerings, partly because there's a need for new financial products and services.

So BaaS providers are likely to see strong revenue if they can help brands get to market faster.

One example is Deserve. The student credit card offers a ‘one size fits all’ set of tech capabilities to help brands get to market with a credit card within 90 days. Deserve is able to provide this level of speed by focusing purely on self-serve tools, keeping its team lean and the sales cycle efficient.

4. Better (end-to-end) user journeys

No one wants to be a jack of all trades, master of none. That’s why brands typically cater to one or two customer needs.

Adopting BaaS means that brands can expand their offerings to include financial services that specifically complement their core products, or are of particular relevance to their customers. Embedding financial services in the context of the product allows brands to address a customer’s needs with a seamless experience.

For example, Apple’s credit card allows it to offer a financial service that their users would otherwise source elsewhere, while still maintaining the quality tech and design people know and love.

Grab Financial, for instance, improved the user experience through GrabPay and GrabPay Card, instead of asking them to use a different mobile banking app. It’s now the most popular mobile wallet in SEA’s rapidly growing fintech sector.

Grab also worked with 11:FS to define the product offering and commercial strategy for its super app.

5. Benefit from specialising

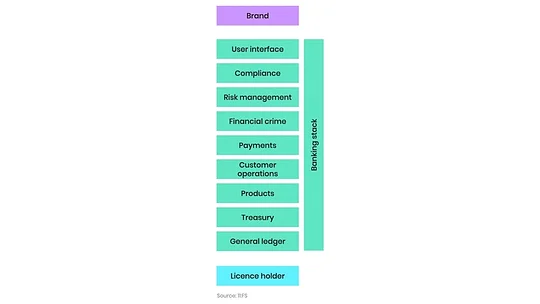

BaaS moves banking from vertical integration to horizontal integration, where instead of one actor covering the whole banking stack, providers can specialise in what they are best at. In turn, collaborations can produce the best results with a combination of specialised actors.

Providers can focus on being good at one or a few elements of the banking stack, rather than having to cover every element. For example, Marqueta have become known for specialising in payments, whilst Stripe started out with a focus on payments and over time has expanded its capabilities to treasury, products and financial crime.

By specialising in one or two areas, providers can carve out a slice of the market that’s unique to them, and brands can take advantage of more choice and flexibility.

11:FS Banking as a Service stack

6. More customer engagement = more revenue

We mentioned how banks can find new revenue streams and optimise through BaaS. Well, brands can too.

Square has seen huge returns from its Cash App. In 2019, Square Cash App generated $1.11 billion in total net revenue, up 157% year over year, and $458 million in gross profit, up 135% year over year. They also attracted 24 million monthly active customers of the Square Cash App in December 2019, achieving 60% year-over-year growth.

Chime has not only reaped the financial rewards, but has attracted a loyal customer base. Arguably the most well known US digital challenger bank in the USA, Chime is known for allowing users to ‘get paid 2 days early’.

Chime enabled BaaS by partnering with Bancorp Bank, which has provided the banking licence capabilities, and Galileo to run the payments side. Thanks to its simple design and execution, over 8 million customers now use Chime - that’s up from 1 million in 2018. And because their customers are so delighted with the service, Chime can also boast an incredibly high referral rate.

BaaS has attracted the world’s largest tech unicorns, global banks and household brands.

7. The world’s best businesses are leading the charge

Since the birth of challenger banks Monzo and Revolut in 2014, BaaS has attracted the world’s largest tech unicorns, global banks and household brands.

Let’s look at Stripe. Since it was founded in 2010, it’s made its way from a payment payment solutions for tech companies with small customer bases, to covering a range of offerings for everyone. Stripe is now valued at $36 billion and the tech companies who adopted Stripe early on have grown with it.

Goldman Sachs, one of the US’ biggest banks, is also putting its best foot forward when it comes to BaaS. It recently launched an API-first developer portal that allows companies to embed finance into their own business models to improve the customer experience. And it’s no doubt that other banks will follow Goldman’s lead.

We've interviewed some of the brightest minds in fintech for our brand-new 6-part video series, Decoding: Banking as a Service. Find out more about the series and sign up for instant updates when new episodes drop!